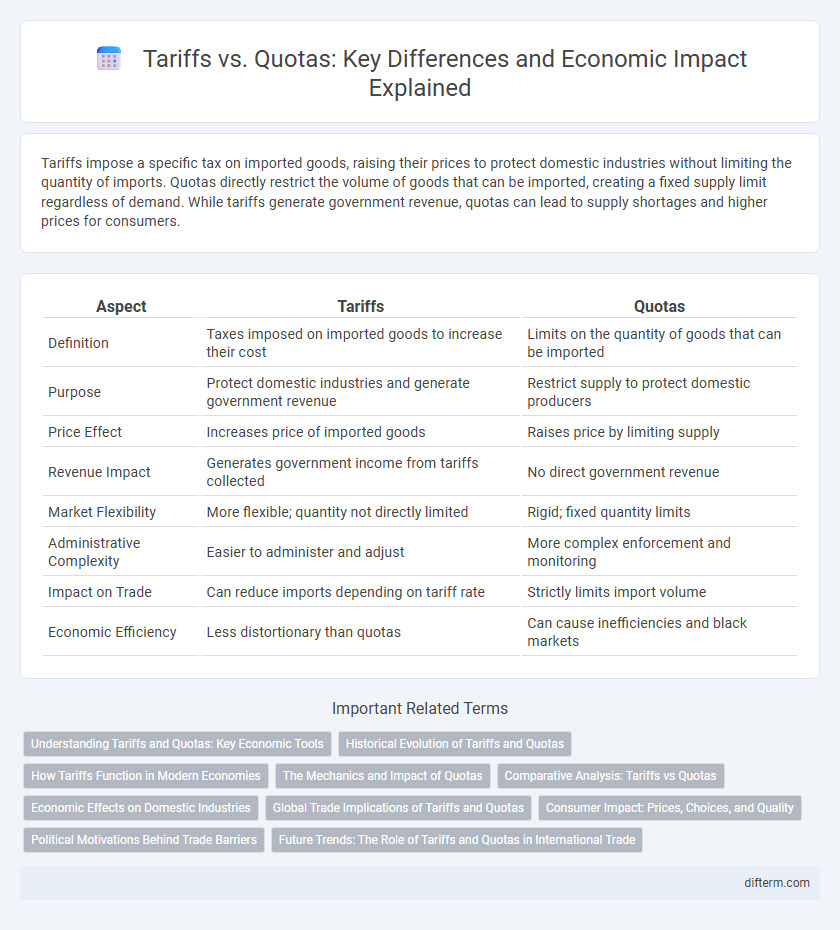

Tariffs impose a specific tax on imported goods, raising their prices to protect domestic industries without limiting the quantity of imports. Quotas directly restrict the volume of goods that can be imported, creating a fixed supply limit regardless of demand. While tariffs generate government revenue, quotas can lead to supply shortages and higher prices for consumers.

Table of Comparison

| Aspect | Tariffs | Quotas |

|---|---|---|

| Definition | Taxes imposed on imported goods to increase their cost | Limits on the quantity of goods that can be imported |

| Purpose | Protect domestic industries and generate government revenue | Restrict supply to protect domestic producers |

| Price Effect | Increases price of imported goods | Raises price by limiting supply |

| Revenue Impact | Generates government income from tariffs collected | No direct government revenue |

| Market Flexibility | More flexible; quantity not directly limited | Rigid; fixed quantity limits |

| Administrative Complexity | Easier to administer and adjust | More complex enforcement and monitoring |

| Impact on Trade | Can reduce imports depending on tariff rate | Strictly limits import volume |

| Economic Efficiency | Less distortionary than quotas | Can cause inefficiencies and black markets |

Understanding Tariffs and Quotas: Key Economic Tools

Tariffs impose a tax on imported goods, raising their prices to protect domestic industries and generate government revenue. Quotas set a physical limit on the quantity of goods that can be imported, directly restricting supply to maintain higher domestic prices. Both tools influence trade balances and market competition, but tariffs provide revenue while quotas primarily control quantity.

Historical Evolution of Tariffs and Quotas

Tariffs have historically served as a primary tool for governments to protect domestic industries and generate revenue, with their use dating back to ancient civilizations and becoming formalized during the Mercantilist era. Quotas emerged more prominently in the 20th century as a direct method to limit the quantity of imports, gaining traction during periods of trade restriction such as the Great Depression and post-World War II protectionism. Over time, international trade agreements like GATT and WTO have aimed to reduce both tariffs and quotas, promoting freer trade while allowing some flexibility through negotiated tariff-rate quotas and safeguard measures.

How Tariffs Function in Modern Economies

Tariffs function as taxes imposed on imported goods, raising their cost to protect domestic industries and generate government revenue. They influence trade balances by making foreign products less competitive compared to local alternatives, thereby encouraging consumers to buy domestically produced items. Modern economies use tariffs strategically to negotiate trade agreements and safeguard key sectors without completely restricting market access.

The Mechanics and Impact of Quotas

Quotas restrict the quantity of a specific good that can be imported, creating a direct limit on supply in the domestic market, often resulting in higher prices due to reduced competition. Unlike tariffs, quotas do not generate government revenue but can lead to allocation inefficiencies and potential rent-seeking behavior as import licenses become valuable assets. The impact of quotas tends to distort market equilibrium more severely than tariffs by constraining product availability and potentially inciting trade disputes.

Comparative Analysis: Tariffs vs Quotas

Tariffs impose a fixed tax on imported goods, generating government revenue while raising domestic prices, whereas quotas set a physical limit on the quantity of imports, directly restricting supply without producing public funds. Tariffs allow more market flexibility by enabling importers to adjust quantities according to price changes, whereas quotas create rigid supply constraints that can lead to black markets and supply distortions. Economic efficiency favors tariffs due to their transparency and revenue benefits, whereas quotas often trigger rent-seeking behavior and greater market inefficiencies.

Economic Effects on Domestic Industries

Tariffs increase domestic industry protection by raising import costs, encouraging consumers to buy locally produced goods, which can lead to higher revenues and job preservation. Quotas limit the quantity of foreign goods allowed, creating scarcity that often results in higher prices and greater market control for domestic producers. Both measures can reduce competition, potentially causing inefficiencies and higher prices for consumers, but tariffs generate government revenue while quotas do not.

Global Trade Implications of Tariffs and Quotas

Tariffs increase the cost of imported goods, leading to higher prices for consumers and potential retaliatory measures from trade partners, which can disrupt global supply chains and reduce trade volumes. Quotas directly limit the quantity of goods entering a market, creating scarcity that often drives up prices and distorts international market equilibrium. Both trade barriers can provoke trade wars, reduce market efficiency, and impact global economic growth by restricting the free flow of goods and services.

Consumer Impact: Prices, Choices, and Quality

Tariffs increase the cost of imported goods, leading consumers to face higher prices but often maintain a broader selection and product quality due to market competition. Quotas limit the quantity of imports, which can significantly reduce consumer choices and may result in higher prices and lower quality as supply constraints reduce competitive pressure. Both trade barriers can negatively impact consumer welfare, but quotas tend to restrict access more severely, affecting variety and potentially quality in domestic markets.

Political Motivations Behind Trade Barriers

Political motivations behind trade barriers such as tariffs and quotas often stem from protecting domestic industries and preserving jobs in key sectors like manufacturing and agriculture. Governments use tariffs to generate revenue and retaliate against unfair trade practices, while quotas serve to limit foreign competition and maintain market stability. These measures reflect strategic economic policies balancing national interests with global trade pressures.

Future Trends: The Role of Tariffs and Quotas in International Trade

Tariffs and quotas will continue to shape the dynamics of international trade as nations navigate economic recovery and supply chain diversification. Emerging trends suggest an increased reliance on tariffs to protect domestic industries while quotas may be strategically employed to manage import volumes and maintain market stability. Trade policies are likely to evolve with a focus on balancing protectionism and globalization, influenced by geopolitical tensions and technological advancements in trade regulation.

Tariffs vs Quotas Infographic

difterm.com

difterm.com