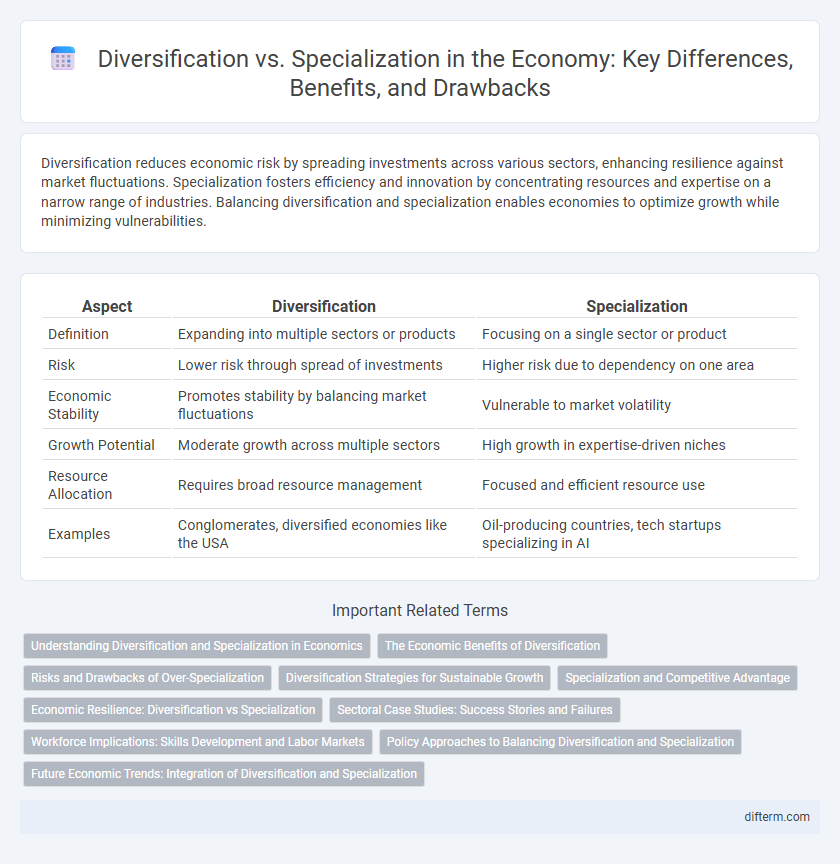

Diversification reduces economic risk by spreading investments across various sectors, enhancing resilience against market fluctuations. Specialization fosters efficiency and innovation by concentrating resources and expertise on a narrow range of industries. Balancing diversification and specialization enables economies to optimize growth while minimizing vulnerabilities.

Table of Comparison

| Aspect | Diversification | Specialization |

|---|---|---|

| Definition | Expanding into multiple sectors or products | Focusing on a single sector or product |

| Risk | Lower risk through spread of investments | Higher risk due to dependency on one area |

| Economic Stability | Promotes stability by balancing market fluctuations | Vulnerable to market volatility |

| Growth Potential | Moderate growth across multiple sectors | High growth in expertise-driven niches |

| Resource Allocation | Requires broad resource management | Focused and efficient resource use |

| Examples | Conglomerates, diversified economies like the USA | Oil-producing countries, tech startups specializing in AI |

Understanding Diversification and Specialization in Economics

Diversification in economics refers to the strategy of spreading investments or production across various sectors to reduce risk and enhance stability. Specialization involves concentrating resources on the production of specific goods or services to achieve higher efficiency and expertise. Understanding these concepts helps policymakers and businesses balance risk management with maximizing productivity for sustainable economic growth.

The Economic Benefits of Diversification

Economic diversification reduces dependency on a single industry, mitigating risks associated with market fluctuations and improving overall economic stability. Diverse economies can better absorb shocks from sector-specific downturns, fostering sustainable growth through multiple revenue streams. This approach attracts varied investments and creates a broader range of employment opportunities, enhancing resilience and long-term prosperity.

Risks and Drawbacks of Over-Specialization

Over-specialization in an economy increases vulnerability to market fluctuations and sector-specific shocks, which can lead to significant job losses and economic instability. Dependence on a narrow range of industries limits adaptive capacity and hampers innovation, reducing long-term growth prospects. Diversification mitigates these risks by spreading economic activities across multiple sectors, enhancing resilience and sustainable development.

Diversification Strategies for Sustainable Growth

Diversification strategies enhance economic resilience by spreading investments across various sectors, reducing dependency on a single industry and mitigating risks from market fluctuations. Incorporating diverse revenue streams fosters sustainable growth through innovation, access to new markets, and improved adaptability to changing economic conditions. Empirical data shows economies with higher diversification indices experience more stable GDP growth and lower volatility during global economic downturns.

Specialization and Competitive Advantage

Specialization enhances a country's competitive advantage by enabling it to focus resources on industries where it has the highest efficiency and skill. This concentration leads to economies of scale, increased productivity, and innovation in specialized sectors. As a result, specialized economies can dominate specific global markets and attract foreign investment.

Economic Resilience: Diversification vs Specialization

Economic resilience is strengthened through diversification, as a varied portfolio of industries reduces vulnerability to sector-specific shocks and global market fluctuations. Specialization can lead to higher short-term efficiency and innovation within niche markets but may increase risk exposure if demand or prices decline sharply. Studies show economies with diversified sectors recover faster from recessions, highlighting diversification's role in stabilizing employment and sustaining growth during economic downturns.

Sectoral Case Studies: Success Stories and Failures

Sectoral case studies reveal that economies embracing diversification, such as South Korea and the United Arab Emirates, have achieved sustained growth by reducing dependence on a single industry. Conversely, regions specializing heavily in one sector, like Venezuela with oil, face significant vulnerabilities during market downturns, leading to economic instability. Success in diversification hinges on strategic investment in emerging industries and infrastructure to foster resilience against sector-specific shocks.

Workforce Implications: Skills Development and Labor Markets

Diversification in economies fosters a broad range of skills development, enhancing workforce adaptability and resilience in shifting labor markets. Specialization drives deep expertise and efficiency within specific industries, but may increase vulnerability to sectoral downturns and reduce labor market flexibility. Balancing these approaches influences employment patterns, wage structures, and long-term economic stability.

Policy Approaches to Balancing Diversification and Specialization

Effective policy approaches to balancing diversification and specialization involve crafting strategies that promote innovation and resilience while maintaining competitive advantages in key sectors. Implementing targeted investments in emerging industries alongside support for established sectors enhances economic stability and growth potential. Policymakers prioritize adaptive frameworks enabling dynamic resource allocation based on market demands and technological advancements.

Future Economic Trends: Integration of Diversification and Specialization

Future economic trends emphasize the integration of diversification and specialization to enhance resilience and competitiveness. Companies adopting sector-specific expertise while diversifying markets and products can better navigate volatility and technological shifts. Balanced strategies leveraging core competencies alongside broad portfolio expansion will shape sustainable growth in dynamic global economies.

Diversification vs Specialization Infographic

difterm.com

difterm.com