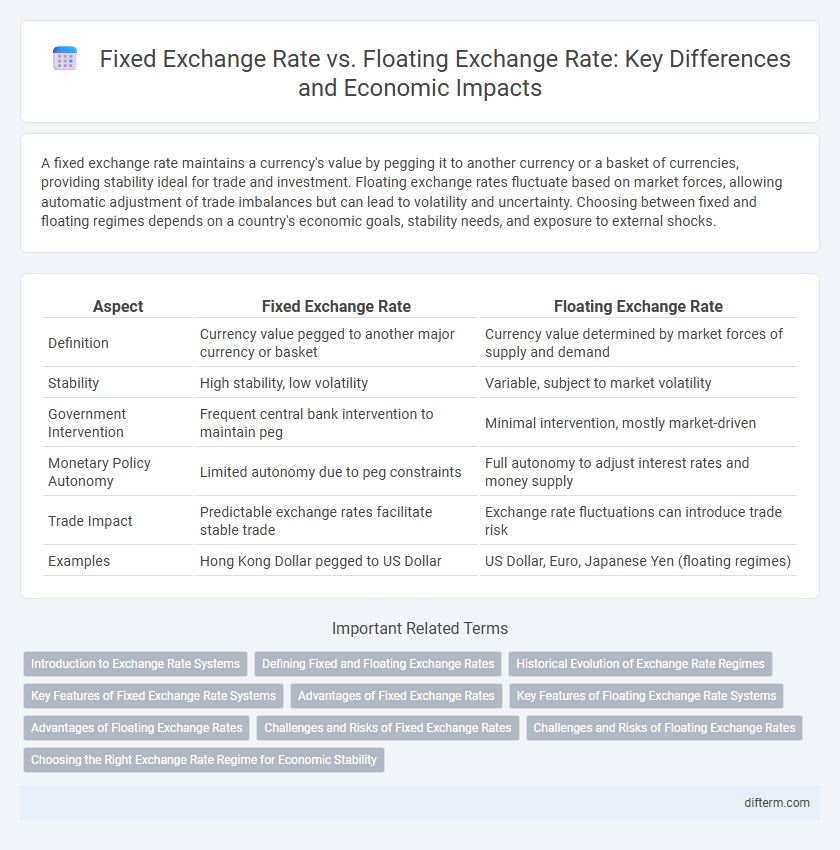

A fixed exchange rate maintains a currency's value by pegging it to another currency or a basket of currencies, providing stability ideal for trade and investment. Floating exchange rates fluctuate based on market forces, allowing automatic adjustment of trade imbalances but can lead to volatility and uncertainty. Choosing between fixed and floating regimes depends on a country's economic goals, stability needs, and exposure to external shocks.

Table of Comparison

| Aspect | Fixed Exchange Rate | Floating Exchange Rate |

|---|---|---|

| Definition | Currency value pegged to another major currency or basket | Currency value determined by market forces of supply and demand |

| Stability | High stability, low volatility | Variable, subject to market volatility |

| Government Intervention | Frequent central bank intervention to maintain peg | Minimal intervention, mostly market-driven |

| Monetary Policy Autonomy | Limited autonomy due to peg constraints | Full autonomy to adjust interest rates and money supply |

| Trade Impact | Predictable exchange rates facilitate stable trade | Exchange rate fluctuations can introduce trade risk |

| Examples | Hong Kong Dollar pegged to US Dollar | US Dollar, Euro, Japanese Yen (floating regimes) |

Introduction to Exchange Rate Systems

Fixed exchange rate systems maintain a currency's value by pegging it to another stable currency or a basket of currencies, providing predictability in international trade and investment. Floating exchange rate systems allow currency values to fluctuate based on market supply and demand dynamics, promoting automatic adjustment of trade imbalances. Central banks play a crucial role in managing exchange rates through interventions and monetary policies to stabilize their economies under each system.

Defining Fixed and Floating Exchange Rates

Fixed exchange rates anchor a country's currency value to another major currency or a basket of currencies, providing stability and predictability in international trade. Floating exchange rates fluctuate according to supply and demand dynamics in the foreign exchange market, reflecting economic indicators, interest rates, and geopolitical events. Central banks intervene less frequently in floating regimes, allowing market forces to determine currency valuation.

Historical Evolution of Exchange Rate Regimes

The historical evolution of exchange rate regimes reveals a shift from fixed exchange rates, exemplified by the Bretton Woods system established in 1944, to the predominance of floating exchange rates after its collapse in the early 1970s. Fixed exchange rates provided currency stability by pegging national currencies to gold or the US dollar, facilitating international trade and investment during the post-World War II reconstruction era. Floating exchange rates, adopted widely since the 1970s, allow currencies to fluctuate based on market forces, offering greater flexibility for monetary policy but introducing increased exchange rate volatility.

Key Features of Fixed Exchange Rate Systems

Fixed exchange rate systems maintain a country's currency value by pegging it to a major currency or a basket of currencies, ensuring stability in international trade and investment. Central banks intervene regularly in foreign exchange markets to uphold the fixed parity, using foreign reserves to buy or sell the domestic currency. This system reduces exchange rate volatility but requires substantial reserves and limits a nation's monetary policy flexibility.

Advantages of Fixed Exchange Rates

Fixed exchange rates provide stability and predictability in international trade by minimizing currency risk and fluctuations, which encourages long-term investment and economic planning. They help control inflation by anchoring domestic prices to a stable foreign currency, fostering confidence among investors and consumers. Governments can also reduce speculative attacks on their currency, promoting economic stability and steady growth.

Key Features of Floating Exchange Rate Systems

Floating exchange rate systems are characterized by currency values determined by market forces of supply and demand without direct government or central bank intervention. Exchange rates fluctuate continuously, reflecting changes in economic indicators, interest rates, and geopolitical events. This flexibility allows automatic adjustment to economic shocks but may introduce higher volatility in international trade and investment.

Advantages of Floating Exchange Rates

Floating exchange rates provide automatic adjustment of currency values in response to market forces, enhancing economic flexibility and stability. They help countries absorb external shocks without depleting foreign reserves, supporting independent monetary policy decisions. Market-driven exchange rates also reduce the risk of currency crises associated with maintaining fixed pegs.

Challenges and Risks of Fixed Exchange Rates

Fixed exchange rates pose significant challenges such as maintaining large foreign currency reserves to defend the peg and limited monetary policy flexibility, which can hinder a country's ability to respond to economic shocks. Persistent misalignment between the fixed rate and market conditions may lead to black market currency trading and speculative attacks that threaten currency stability. Prolonged commitment to a fixed exchange rate can cause balance of payments crises if the exchange rate is perceived as unsustainable by investors and traders.

Challenges and Risks of Floating Exchange Rates

Floating exchange rates expose economies to significant exchange rate volatility, increasing uncertainty for exporters and importers and complicating international trade and investment decisions. Sudden currency depreciation can trigger inflationary pressures, eroding purchasing power and destabilizing domestic markets. Central banks may face challenges in maintaining monetary policy credibility amid speculative attacks and sharp capital flow fluctuations.

Choosing the Right Exchange Rate Regime for Economic Stability

Selecting the appropriate exchange rate regime significantly impacts economic stability, with fixed exchange rates providing predictable currency values that reduce inflation risks and attract foreign investment. Floating exchange rates offer flexibility to adjust to external shocks and maintain monetary policy autonomy, helping economies respond to global market fluctuations. Policymakers must evaluate factors like trade openness, capital mobility, and economic volatility to balance the benefits of exchange rate predictability against the need for adjustment mechanisms.

Fixed exchange rate vs Floating exchange rate Infographic

difterm.com

difterm.com