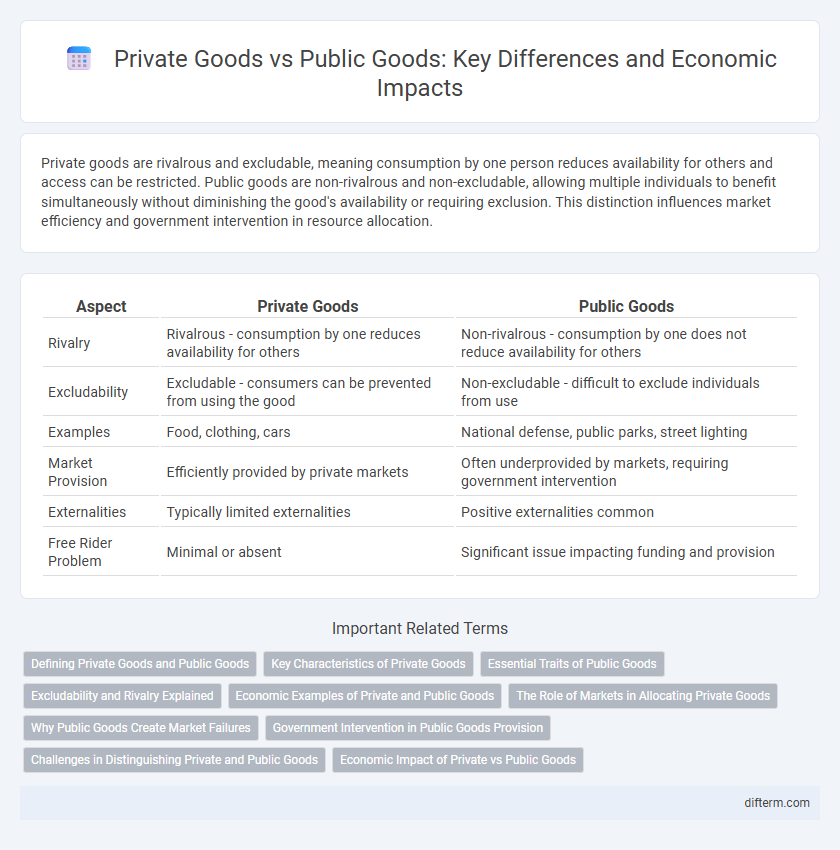

Private goods are rivalrous and excludable, meaning consumption by one person reduces availability for others and access can be restricted. Public goods are non-rivalrous and non-excludable, allowing multiple individuals to benefit simultaneously without diminishing the good's availability or requiring exclusion. This distinction influences market efficiency and government intervention in resource allocation.

Table of Comparison

| Aspect | Private Goods | Public Goods |

|---|---|---|

| Rivalry | Rivalrous - consumption by one reduces availability for others | Non-rivalrous - consumption by one does not reduce availability for others |

| Excludability | Excludable - consumers can be prevented from using the good | Non-excludable - difficult to exclude individuals from use |

| Examples | Food, clothing, cars | National defense, public parks, street lighting |

| Market Provision | Efficiently provided by private markets | Often underprovided by markets, requiring government intervention |

| Externalities | Typically limited externalities | Positive externalities common |

| Free Rider Problem | Minimal or absent | Significant issue impacting funding and provision |

Defining Private Goods and Public Goods

Private goods are commodities characterized by excludability and rivalrous consumption, meaning individuals can prevent others from using them and one person's use reduces availability for others. Public goods exhibit non-excludability and non-rivalry, allowing unrestricted access without diminishing supply to others, exemplified by national defense and clean air. Understanding these fundamental distinctions is crucial for economic policy and resource allocation.

Key Characteristics of Private Goods

Private goods are characterized by excludability and rivalry, meaning consumers can be prevented from using them and one person's consumption reduces availability for others. These goods are typically allocated through market mechanisms where price signals regulate demand and supply efficiently. Examples include food, clothing, and personal electronics, all requiring consumer payment for access and consumption.

Essential Traits of Public Goods

Public goods are characterized by non-excludability, meaning no individual can be effectively excluded from their use, and non-rivalry, where one person's consumption does not reduce availability to others. These essential traits differentiate public goods from private goods, which are both excludable and rivalrous. Examples of public goods include national defense, clean air, and public parks, which require government provision or regulation due to market failure in private sectors.

Excludability and Rivalry Explained

Private goods are characterized by high excludability and rivalry, meaning individuals can be prevented from using them, and one person's use reduces availability for others. Public goods exhibit low excludability and non-rivalry, allowing multiple people to consume them simultaneously without diminishing supply. Understanding these distinctions is crucial for effective resource allocation and policy-making in economic systems.

Economic Examples of Private and Public Goods

Private goods include items like smartphones and clothing, which are rivalrous and excludable, meaning consumption by one individual reduces availability for others and access can be restricted. Public goods, such as national defense and public parks, are non-rivalrous and non-excludable, providing benefits to all without diminishing availability or excluding anyone from use. These distinctions impact economic policies on resource allocation and market regulation.

The Role of Markets in Allocating Private Goods

Markets efficiently allocate private goods by utilizing price mechanisms that balance supply and demand, ensuring resources flow to their most valued uses. Private goods, characterized by excludability and rivalry, rely on competitive markets to determine production quantities and pricing strategies that reflect consumer preferences. This market-driven allocation promotes innovation, productivity, and consumer choice, distinguishing private goods from public goods that require alternative allocation methods.

Why Public Goods Create Market Failures

Public goods, characterized by non-excludability and non-rivalry, create market failures because private firms lack incentives to produce them due to the free-rider problem. Since individuals can benefit without paying, private markets underprovide these goods, leading to inefficient resource allocation. Government intervention or collective funding is often required to ensure optimal production and availability of public goods.

Government Intervention in Public Goods Provision

Government intervention is essential in the provision of public goods due to their non-excludable and non-rivalrous nature, which leads to market failure if left solely to private entities. Public goods, such as national defense and public parks, are typically underprovided by the market because individuals have little incentive to pay voluntarily, resulting in free-rider problems. By funding and regulating these goods, governments ensure efficient allocation and access, promoting overall social welfare and economic stability.

Challenges in Distinguishing Private and Public Goods

Distinguishing private goods from public goods involves challenges such as defining clear boundaries due to non-excludability and non-rivalry characteristics in public goods like national defense and clean air, which complicate market allocation. The free-rider problem arises when individuals consume public goods without paying, leading to under-provision in private markets. Evaluating mixed goods, which exhibit both private and public good features, further obscures classification and complicates effective policy design.

Economic Impact of Private vs Public Goods

Private goods, characterized by excludability and rivalry, drive economic growth through market efficiency and consumer choice, leading to innovation and competitive pricing. Public goods, non-excludable and non-rivalrous, often require government provision to address market failures and ensure equitable access, supporting social welfare and infrastructure development. The economic impact hinges on the balance between private incentives and public benefits, influencing resource allocation and overall societal well-being.

Private goods vs Public goods Infographic

difterm.com

difterm.com