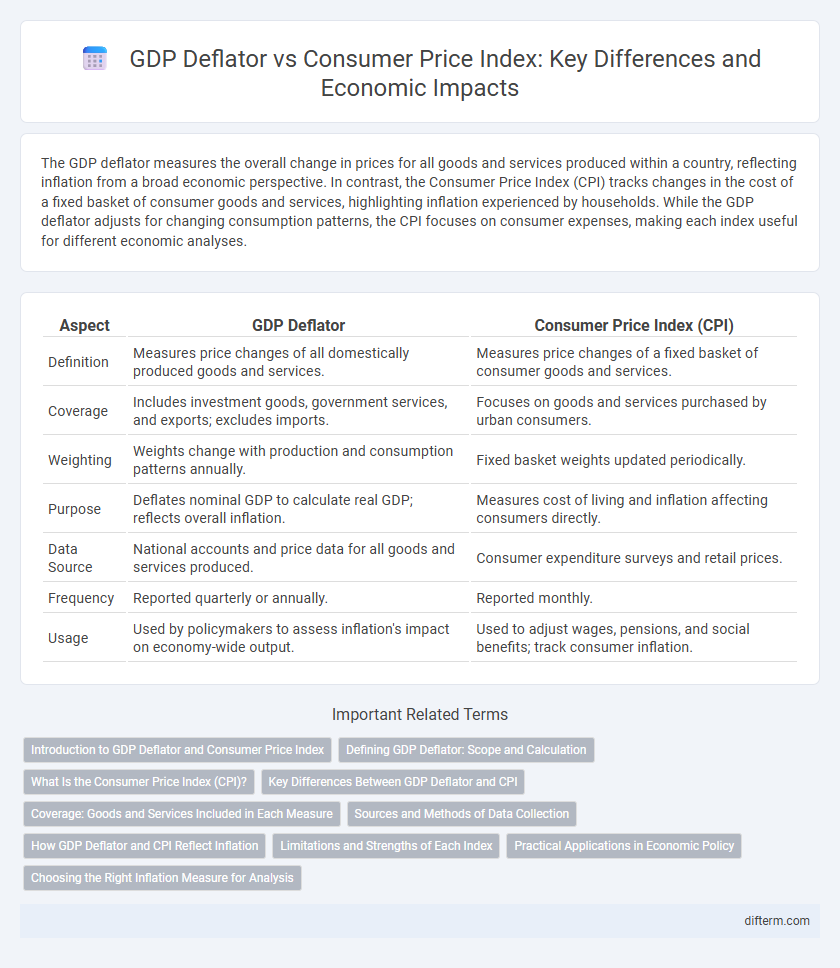

The GDP deflator measures the overall change in prices for all goods and services produced within a country, reflecting inflation from a broad economic perspective. In contrast, the Consumer Price Index (CPI) tracks changes in the cost of a fixed basket of consumer goods and services, highlighting inflation experienced by households. While the GDP deflator adjusts for changing consumption patterns, the CPI focuses on consumer expenses, making each index useful for different economic analyses.

Table of Comparison

| Aspect | GDP Deflator | Consumer Price Index (CPI) |

|---|---|---|

| Definition | Measures price changes of all domestically produced goods and services. | Measures price changes of a fixed basket of consumer goods and services. |

| Coverage | Includes investment goods, government services, and exports; excludes imports. | Focuses on goods and services purchased by urban consumers. |

| Weighting | Weights change with production and consumption patterns annually. | Fixed basket weights updated periodically. |

| Purpose | Deflates nominal GDP to calculate real GDP; reflects overall inflation. | Measures cost of living and inflation affecting consumers directly. |

| Data Source | National accounts and price data for all goods and services produced. | Consumer expenditure surveys and retail prices. |

| Frequency | Reported quarterly or annually. | Reported monthly. |

| Usage | Used by policymakers to assess inflation's impact on economy-wide output. | Used to adjust wages, pensions, and social benefits; track consumer inflation. |

Introduction to GDP Deflator and Consumer Price Index

The GDP deflator measures the price level of all domestically produced final goods and services, reflecting changes in the overall economy's inflation. The Consumer Price Index (CPI) tracks the average change in prices paid by urban consumers for a fixed basket of goods and services, focusing on consumer expenses. Both indicators provide vital insights into inflation but differ in scope and components, with GDP deflator covering all production and CPI emphasizing consumer prices.

Defining GDP Deflator: Scope and Calculation

The GDP deflator measures the overall price level of all domestically produced goods and services within an economy, reflecting inflation by comparing current nominal GDP to real GDP. Its scope includes investment, government spending, and exports but excludes imports, providing a broad inflation gauge across the entire economy. Calculation involves dividing nominal GDP by real GDP and multiplying by 100, enabling insights into price changes over time without the fixed basket limitations of the Consumer Price Index (CPI).

What Is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services, reflecting inflation at the retail level. Unlike the GDP deflator, which includes all domestically produced goods and services, the CPI focuses specifically on out-of-pocket expenditures by households, capturing changes in the cost of living. Economists and policymakers use the CPI to adjust income payments, assess inflation trends, and guide monetary policy decisions.

Key Differences Between GDP Deflator and CPI

The GDP deflator measures the price changes of all domestically produced goods and services, reflecting the overall inflation within an economy, while the Consumer Price Index (CPI) tracks the price changes of a fixed basket of consumer goods and services purchased by households. Unlike the CPI, which uses a fixed basket updated periodically, the GDP deflator uses a variable basket based on current production, capturing changes in consumption and investment patterns. The GDP deflator includes prices of capital goods and government services, excluded from the CPI, making it a broader measure of inflation in the economy.

Coverage: Goods and Services Included in Each Measure

The GDP deflator measures the prices of all domestically produced final goods and services, encompassing investment, government spending, and exports, while excluding imports. The Consumer Price Index (CPI) focuses on a fixed basket of goods and services consumed by urban households, including imported items. This difference in coverage reflects how the GDP deflator captures broader economic price changes, whereas the CPI emphasizes consumer-specific inflation.

Sources and Methods of Data Collection

The GDP deflator measures price changes for all domestically produced goods and services, relying on national accounts data derived from comprehensive production and expenditure records. In contrast, the Consumer Price Index (CPI) focuses on the price changes of a fixed basket of consumer goods and services, using household surveys and retail price sampling to collect data. While the GDP deflator utilizes aggregated output data from producers, the CPI directly gathers prices from retail outlets and service providers to reflect consumer-level inflation.

How GDP Deflator and CPI Reflect Inflation

The GDP deflator measures inflation by comparing the current price of all domestically produced goods and services to prices in a base year, capturing changes in the overall economy's price level. The Consumer Price Index (CPI) reflects inflation by tracking changes in the cost of a fixed basket of consumer goods and services, highlighting the impact on household expenses. While the GDP deflator provides a broader inflation measure including investment and government spending, the CPI focuses specifically on consumer price changes affecting cost of living.

Limitations and Strengths of Each Index

The GDP deflator measures price changes for all domestically produced goods and services, providing a broad view of inflation but excluding imported goods, which limits its scope. The Consumer Price Index (CPI) focuses on a fixed basket of consumer goods and services, offering detailed insight into household inflation but may overstate inflation due to substitution bias and fixed weights. While the GDP deflator adjusts for changing consumption patterns, the CPI better reflects the cost of living for urban consumers, making each index useful for different economic analyses.

Practical Applications in Economic Policy

The GDP deflator reflects the prices of all domestically produced goods and services, making it a comprehensive measure for assessing inflation within an economy, while the Consumer Price Index (CPI) focuses on the cost changes of a fixed basket of consumer goods and services, highlighting household inflation experience. Policymakers use the GDP deflator to gauge overall economic inflation and adjust monetary policy accordingly, whereas the CPI guides adjustments in social security payments, wage contracts, and cost-of-living allowances to protect consumer purchasing power. Differences in coverage and weighting between the two indices influence decisions on inflation targeting, fiscal policy, and indexing mechanisms.

Choosing the Right Inflation Measure for Analysis

The GDP deflator provides a broad measure of inflation by capturing price changes across all domestically produced goods and services, making it ideal for analyzing overall economic inflation. The Consumer Price Index (CPI) focuses on the price changes of a fixed basket of consumer goods and services, offering a more direct gauge of the cost of living for households. Selecting the appropriate measure depends on whether the analysis targets general economic inflation trends or household-level purchasing power.

GDP deflator vs Consumer Price Index Infographic

difterm.com

difterm.com