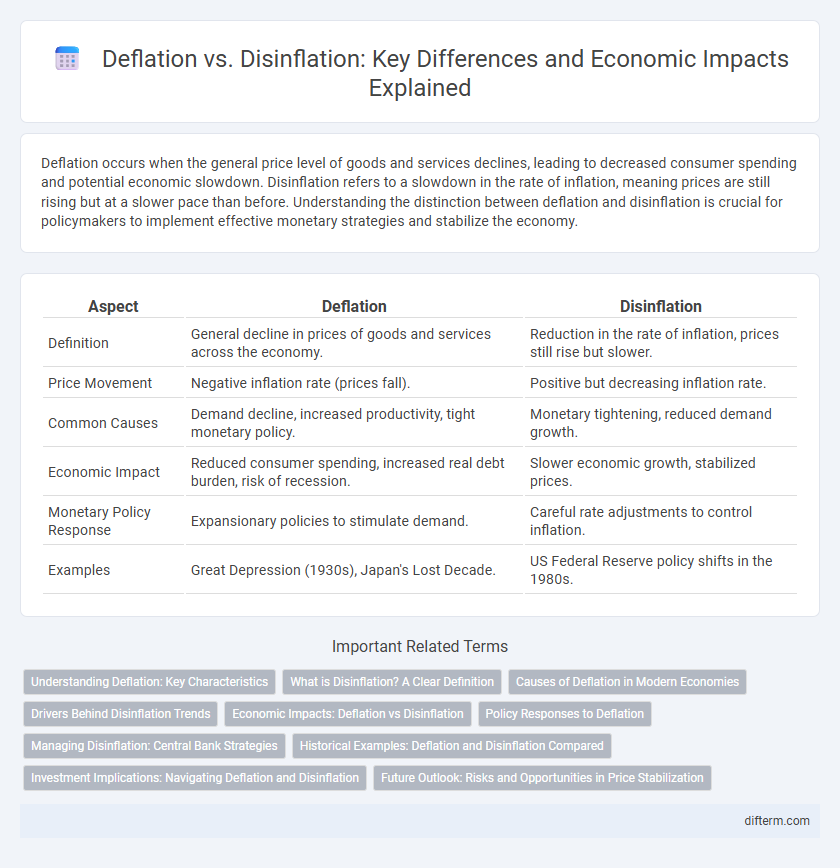

Deflation occurs when the general price level of goods and services declines, leading to decreased consumer spending and potential economic slowdown. Disinflation refers to a slowdown in the rate of inflation, meaning prices are still rising but at a slower pace than before. Understanding the distinction between deflation and disinflation is crucial for policymakers to implement effective monetary strategies and stabilize the economy.

Table of Comparison

| Aspect | Deflation | Disinflation |

|---|---|---|

| Definition | General decline in prices of goods and services across the economy. | Reduction in the rate of inflation, prices still rise but slower. |

| Price Movement | Negative inflation rate (prices fall). | Positive but decreasing inflation rate. |

| Common Causes | Demand decline, increased productivity, tight monetary policy. | Monetary tightening, reduced demand growth. |

| Economic Impact | Reduced consumer spending, increased real debt burden, risk of recession. | Slower economic growth, stabilized prices. |

| Monetary Policy Response | Expansionary policies to stimulate demand. | Careful rate adjustments to control inflation. |

| Examples | Great Depression (1930s), Japan's Lost Decade. | US Federal Reserve policy shifts in the 1980s. |

Understanding Deflation: Key Characteristics

Deflation is characterized by a sustained decrease in the general price level of goods and services, leading to increased purchasing power and reduced consumer spending. Unlike disinflation, which refers to a slowdown in the rate of inflation, deflation signals a negative inflation rate, often linked to declining demand, surplus supply, and lower wages. Key economic indicators of deflation include falling consumer price indices (CPI), reduced investment, and rising unemployment rates.

What is Disinflation? A Clear Definition

Disinflation refers to a slowdown in the rate of inflation, where prices continue to rise but at a decreasing pace. Unlike deflation, which denotes a general decline in price levels, disinflation indicates a reduction in the speed of inflationary growth. Central banks monitor disinflation closely as it can signal stabilizing prices without leading to negative economic impacts associated with deflation.

Causes of Deflation in Modern Economies

Deflation in modern economies is primarily caused by a sustained decrease in aggregate demand, often triggered by reduced consumer spending and business investment. Excessive debt burdens and tightening credit conditions contribute to falling prices as businesses lower costs to stimulate demand. Technological advancements and productivity gains can also lead to supply outpacing demand, intensifying deflationary pressures across various sectors.

Drivers Behind Disinflation Trends

Disinflation occurs when the inflation rate slows down but remains positive, driven primarily by factors such as improved supply chain efficiencies, technological advancements, and stabilized commodity prices. Central banks' monetary policies aimed at tempering demand without triggering a recession also play a crucial role in moderating inflation rates. Consumer expectations adapting to a stable economic environment further contribute to the gradual deceleration of price increases.

Economic Impacts: Deflation vs Disinflation

Deflation leads to a sustained decrease in general price levels, causing reduced consumer spending and increased real debt burdens, which can trigger economic recessions and higher unemployment rates. Disinflation, characterized by a slower rate of inflation rather than a price decline, often results in more stable economic growth and manageable cost adjustments without the severe contraction linked to deflation. Central banks typically view disinflation as a sign of successful monetary policy tightening, whereas deflation poses significant challenges for economic recovery and financial stability.

Policy Responses to Deflation

Policy responses to deflation primarily involve expansionary monetary measures such as lowering interest rates to stimulate borrowing and spending, alongside quantitative easing to increase money supply. Fiscal policies include increased government spending and tax cuts designed to boost demand and counteract falling prices. Central banks and governments must coordinate efforts to restore inflation expectations and prevent a deflationary spiral that can hamper economic growth.

Managing Disinflation: Central Bank Strategies

Central banks manage disinflation by adjusting monetary policies, primarily through interest rate modulation and open market operations to control money supply without triggering deflation. They carefully monitor inflation expectations and labor market dynamics to avoid economic slowdown while gradually guiding prices toward more stable growth. Strategies often include forward guidance to influence market behavior and maintain credible commitment to inflation targets.

Historical Examples: Deflation and Disinflation Compared

Deflation, marked by a sustained decrease in the general price level, severely impacted the global economy during the Great Depression of the 1930s, leading to widespread unemployment and economic contraction. Disinflation, a slowdown in the rate of inflation, was evident during the 1980s in the United States when Federal Reserve policies successfully reduced inflation rates from double digits to single digits without triggering a recession. Historical analysis shows deflation typically causes more severe economic distress compared to the more controlled and often policy-driven phenomenon of disinflation.

Investment Implications: Navigating Deflation and Disinflation

Deflation leads to falling prices and reduced consumer spending, causing lower corporate profits and increased risk for investors. Disinflation, characterized by a slowdown in inflation rates, often signals a stabilizing economy, which can support steady returns on investments like bonds and blue-chip stocks. Understanding these dynamics helps investors adjust portfolios to minimize risk during deflation and capitalize on gradual price adjustments during disinflation.

Future Outlook: Risks and Opportunities in Price Stabilization

Deflation presents risks such as reduced consumer spending and increased debt burdens, potentially leading to prolonged economic stagnation, while disinflation signals a slowdown in price increases that can stabilize markets without triggering recession. Emerging technologies and monetary policies offer opportunities to manage price levels effectively, minimizing volatility and encouraging sustainable growth. Future outlooks emphasize vigilant policy adjustments to balance risks of deflation spirals against stagnant inflation, promoting resilient economic recovery.

Deflation vs Disinflation Infographic

difterm.com

difterm.com