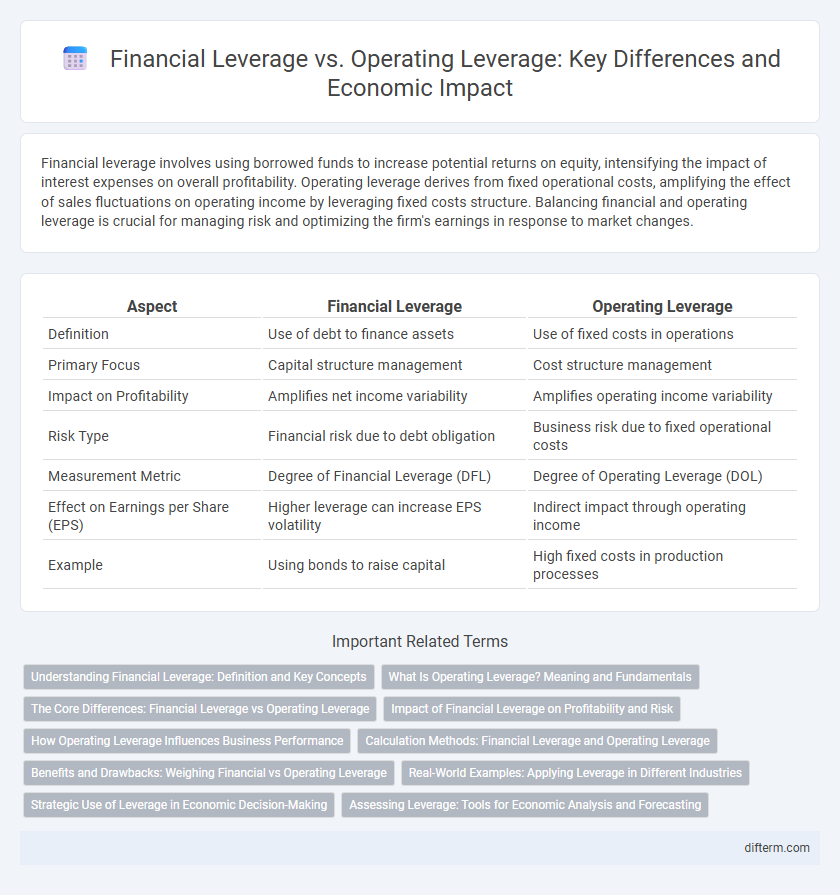

Financial leverage involves using borrowed funds to increase potential returns on equity, intensifying the impact of interest expenses on overall profitability. Operating leverage derives from fixed operational costs, amplifying the effect of sales fluctuations on operating income by leveraging fixed costs structure. Balancing financial and operating leverage is crucial for managing risk and optimizing the firm's earnings in response to market changes.

Table of Comparison

| Aspect | Financial Leverage | Operating Leverage |

|---|---|---|

| Definition | Use of debt to finance assets | Use of fixed costs in operations |

| Primary Focus | Capital structure management | Cost structure management |

| Impact on Profitability | Amplifies net income variability | Amplifies operating income variability |

| Risk Type | Financial risk due to debt obligation | Business risk due to fixed operational costs |

| Measurement Metric | Degree of Financial Leverage (DFL) | Degree of Operating Leverage (DOL) |

| Effect on Earnings per Share (EPS) | Higher leverage can increase EPS volatility | Indirect impact through operating income |

| Example | Using bonds to raise capital | High fixed costs in production processes |

Understanding Financial Leverage: Definition and Key Concepts

Financial leverage refers to the use of borrowed funds to increase a company's potential return on equity, amplifying both gains and losses. It is measured by the debt-to-equity ratio and influences the firm's risk profile by increasing fixed financial obligations. Understanding financial leverage involves analyzing how debt impacts earnings volatility and the overall cost of capital.

What Is Operating Leverage? Meaning and Fundamentals

Operating leverage measures how fixed operating costs impact a company's earnings before interest and taxes (EBIT) relative to changes in sales revenue. High operating leverage indicates a greater proportion of fixed costs in the cost structure, causing EBIT to be more sensitive to fluctuations in sales volume. Understanding operating leverage is fundamental for assessing business risk and planning cost structures to optimize profitability during sales variability.

The Core Differences: Financial Leverage vs Operating Leverage

Financial leverage measures the extent to which a company uses debt to finance its assets, impacting net income through interest obligations. Operating leverage evaluates the proportion of fixed costs in a company's cost structure, influencing operating income volatility relative to sales changes. The core difference lies in financial leverage affecting earnings after interest, while operating leverage impacts earnings before interest and taxes (EBIT).

Impact of Financial Leverage on Profitability and Risk

Financial leverage magnifies both profitability and risk by using debt to finance assets, thereby increasing the potential return on equity when earnings exceed borrowing costs. However, higher financial leverage elevates the risk of insolvency due to obligatory interest payments and fixed financial commitments during downturns. Companies with excessive financial leverage face amplified earnings volatility, which can adversely affect stockholder value and credit ratings.

How Operating Leverage Influences Business Performance

Operating leverage impacts business performance by amplifying the effects of sales fluctuations on operating income, as firms with high fixed costs experience greater profit variability. High operating leverage means a larger proportion of fixed costs relative to variable costs, intensifying risks during sales downturns but boosting profitability when sales rise. Companies with strong operating leverage must carefully manage cost structure to optimize margins and sustain competitive advantage.

Calculation Methods: Financial Leverage and Operating Leverage

Financial leverage is calculated by dividing total debt by total equity, indicating the proportion of debt used to finance assets, while operating leverage is determined by the ratio of fixed costs to variable costs, reflecting the sensitivity of operating income to changes in sales volume. The degree of financial leverage (DFL) can also be derived by comparing the percentage change in earnings per share (EPS) to the percentage change in operating income (EBIT). The degree of operating leverage (DOL) is measured by dividing the percentage change in EBIT by the percentage change in sales revenue, quantifying how fixed operating costs impact profitability.

Benefits and Drawbacks: Weighing Financial vs Operating Leverage

Financial leverage amplifies returns through debt financing but increases the risk of insolvency during downturns due to fixed interest obligations. Operating leverage magnifies profits by utilizing fixed operating costs, enhancing earnings variability with sales fluctuations but can lead to higher breakeven points and vulnerability in low-demand periods. Balancing financial and operating leverage is crucial for optimizing profitability while managing risk exposure in a dynamic economic environment.

Real-World Examples: Applying Leverage in Different Industries

Financial leverage is prominently used in real estate, where companies like Blackstone deploy significant debt to amplify returns on property investments, while operating leverage is critical in manufacturing firms such as Toyota, where fixed costs are high relative to variable costs, intensifying the impact of sales fluctuations on profitability. In technology sectors like Apple, operating leverage plays a key role, as high initial development costs are spread over substantial sales volume, enhancing margins without corresponding increases in variable expenses. Companies in capital-intensive utilities industries often combine both leverage types, using financial leverage to fund infrastructure while relying on operating leverage to maximize efficiency, exemplified by firms like Duke Energy.

Strategic Use of Leverage in Economic Decision-Making

Strategic use of financial and operating leverage significantly impacts a firm's risk and return profile, guiding economic decision-making by balancing debt levels and fixed costs to optimize profitability. Financial leverage involves using debt to increase potential returns, amplifying earnings variability, while operating leverage hinges on fixed operational costs impacting sensitivity to sales fluctuations. Effective leverage management requires analyzing cost structure and capital mix to align financial risk with strategic growth objectives, enhancing value creation in dynamic market environments.

Assessing Leverage: Tools for Economic Analysis and Forecasting

Financial leverage measures the extent to which a company uses debt to finance its operations, impacting net income volatility and return on equity. Operating leverage quantifies the proportion of fixed costs in a company's cost structure, influencing the sensitivity of operating income to changes in sales volume. Assessing leverage involves analyzing ratios such as the degree of financial leverage (DFL) and degree of operating leverage (DOL), which are essential tools for economic forecasting and risk management in financial analysis.

Financial leverage vs Operating leverage Infographic

difterm.com

difterm.com