Oligopoly markets feature a few dominant firms that influence prices and output through strategic interactions, whereas monopoly markets are controlled by a single firm with significant price-setting power. In an oligopoly, firms often face interdependent decision-making, which can lead to collusion or competitive behavior, while monopolies face no direct competition, allowing them to maximize profits by restricting supply. Both market structures result in reduced consumer choice compared to perfect competition, but oligopolies often exhibit more dynamic pricing and innovation due to competitive pressures within the group.

Table of Comparison

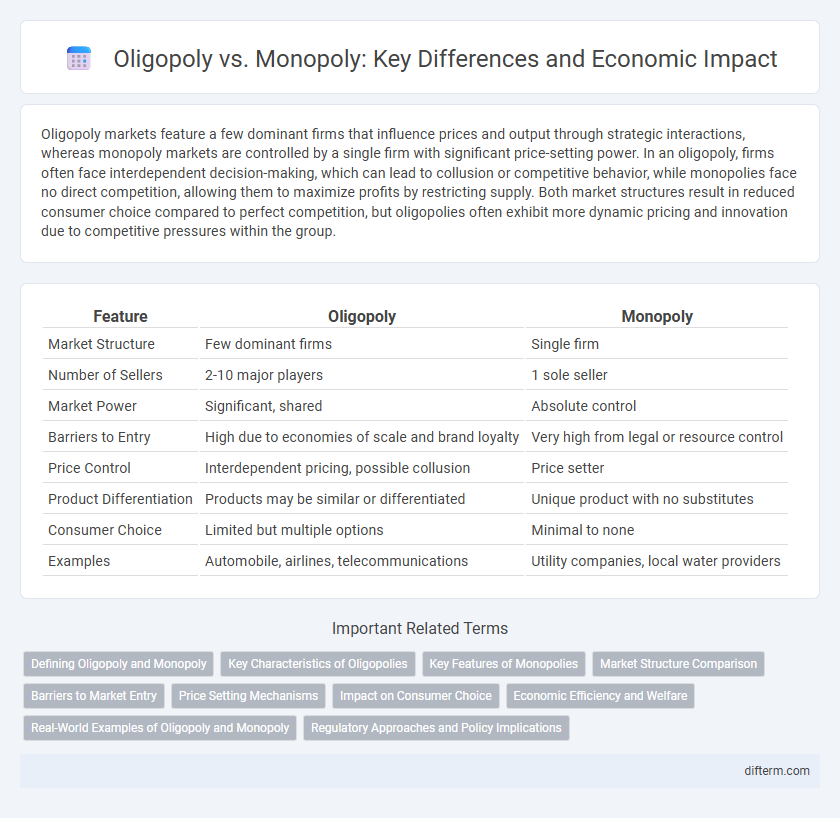

| Feature | Oligopoly | Monopoly |

|---|---|---|

| Market Structure | Few dominant firms | Single firm |

| Number of Sellers | 2-10 major players | 1 sole seller |

| Market Power | Significant, shared | Absolute control |

| Barriers to Entry | High due to economies of scale and brand loyalty | Very high from legal or resource control |

| Price Control | Interdependent pricing, possible collusion | Price setter |

| Product Differentiation | Products may be similar or differentiated | Unique product with no substitutes |

| Consumer Choice | Limited but multiple options | Minimal to none |

| Examples | Automobile, airlines, telecommunications | Utility companies, local water providers |

Defining Oligopoly and Monopoly

An oligopoly is a market structure characterized by a few large firms that dominate the industry, leading to limited competition and potential collusion. In contrast, a monopoly exists when a single firm controls the entire market, setting prices and output without competitive pressure. Both structures impact market efficiency and consumer choice differently, with oligopolies sometimes allowing for competitive dynamics, unlike monopolies.

Key Characteristics of Oligopolies

Oligopolies are characterized by a market dominated by a few large firms, each holding significant market power and influencing prices through strategic interactions. High barriers to entry prevent new competitors, maintaining the dominance of existing companies. Firms in oligopolies often engage in non-price competition, such as advertising and product differentiation, to achieve competitive advantages.

Key Features of Monopolies

Monopolies are characterized by a single firm dominating the entire market, allowing it to control prices and exclude competition effectively. They face high barriers to entry, such as significant capital requirements, legal restrictions, or control over essential resources. Monopolistic firms often exhibit price-setting power, leading to reduced consumer choice and potential inefficiencies in the allocation of resources.

Market Structure Comparison

Oligopoly consists of a few dominant firms that hold significant market power, often leading to interdependent pricing and output decisions, while monopoly features a single firm with exclusive control over the entire market. Barriers to entry in oligopolies are high but less insurmountable than monopolies, which typically enjoy absolute market dominance and price-setting ability. Both structures influence consumer choice and market efficiency differently, with oligopolies potentially fostering innovation through competition, whereas monopolies may reduce output and increase prices due to lack of competition.

Barriers to Market Entry

Oligopolies feature high entry barriers due to economies of scale, capital requirements, and control over essential resources, which restrict new competitors from easily entering the market. Monopolies impose even more stringent barriers through exclusive ownership of key patents, government regulations, or technological superiority, effectively maintaining sole market control. These barriers protect dominant firms' market power and limit competitive pressures.

Price Setting Mechanisms

Oligopoly price-setting mechanisms involve interdependent firms that consider competitors' potential reactions, often leading to price rigidity or tacit collusion to maintain higher market prices. In contrast, a monopoly price setter faces no direct competition, allowing it to maximize profits by determining output levels where marginal cost equals marginal revenue. Both market structures influence market efficiency and consumer welfare differently due to their distinct strategic pricing behaviors.

Impact on Consumer Choice

Oligopoly markets feature a limited number of firms, creating moderate competition that allows consumers some variety in products and prices while still limiting overall choice. Monopoly markets consist of a single firm dominating the market, resulting in restricted consumer options and often higher prices due to the lack of competitive pressure. The reduced competition in monopolies typically leads to inefficiencies and less innovation compared to oligopolies, where a few competing firms can still drive product differentiation.

Economic Efficiency and Welfare

Oligopoly markets often exhibit limited economic efficiency due to strategic behavior among few dominant firms leading to higher prices and restricted output compared to perfect competition. Monopolies further reduce welfare by producing below socially optimal output and charging prices above marginal cost, causing deadweight loss and consumer surplus reduction. Both market structures tend to allocate resources inefficiently, but oligopolies may foster innovation through competition, partially mitigating welfare losses.

Real-World Examples of Oligopoly and Monopoly

Oligopolies dominate industries such as telecommunications, with companies like AT&T and Verizon controlling a significant market share and limiting competition. Monopolies often arise in utilities, exemplified by local electric companies like Pacific Gas and Electric, which operate as sole providers within specific regions. These market structures influence pricing, innovation, and consumer choice, shaping economic outcomes in their respective sectors.

Regulatory Approaches and Policy Implications

Regulatory approaches in oligopolies focus on promoting competition through antitrust laws and preventing collusion among dominant firms, ensuring market efficiency and consumer protection. Monopoly regulation often involves price controls, public ownership, or breaking up monopolistic entities to prevent abuse of market power and protect public interests. Policymakers must balance fostering innovation with maintaining fair market conditions to minimize economic inefficiencies and promote long-term growth.

Oligopoly vs Monopoly Infographic

difterm.com

difterm.com