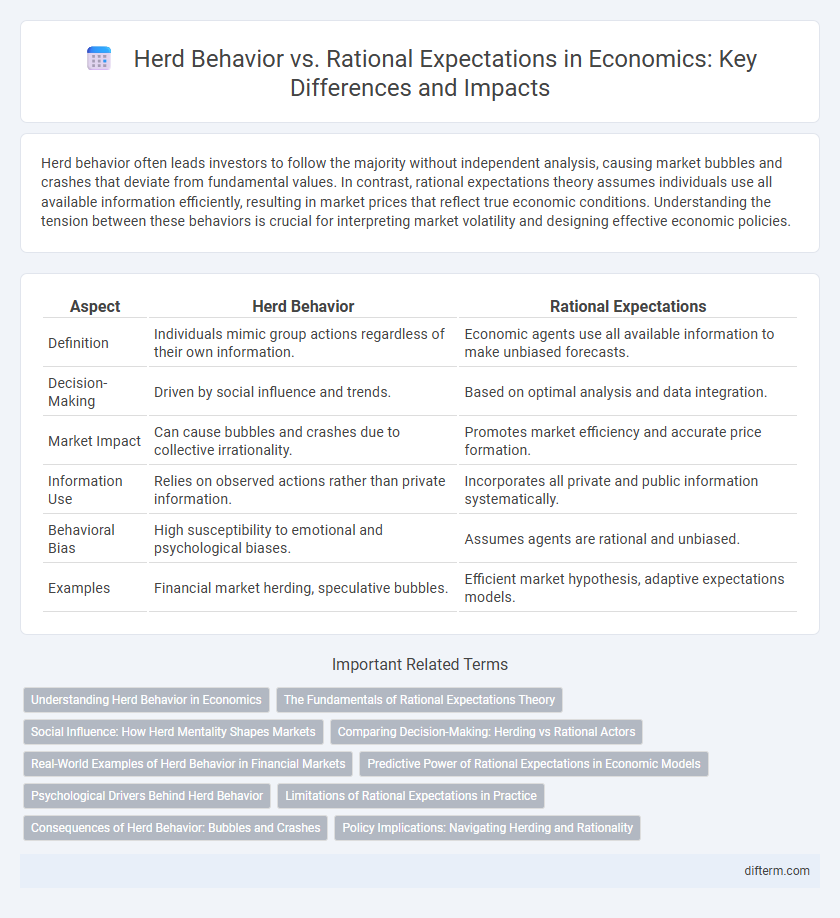

Herd behavior often leads investors to follow the majority without independent analysis, causing market bubbles and crashes that deviate from fundamental values. In contrast, rational expectations theory assumes individuals use all available information efficiently, resulting in market prices that reflect true economic conditions. Understanding the tension between these behaviors is crucial for interpreting market volatility and designing effective economic policies.

Table of Comparison

| Aspect | Herd Behavior | Rational Expectations |

|---|---|---|

| Definition | Individuals mimic group actions regardless of their own information. | Economic agents use all available information to make unbiased forecasts. |

| Decision-Making | Driven by social influence and trends. | Based on optimal analysis and data integration. |

| Market Impact | Can cause bubbles and crashes due to collective irrationality. | Promotes market efficiency and accurate price formation. |

| Information Use | Relies on observed actions rather than private information. | Incorporates all private and public information systematically. |

| Behavioral Bias | High susceptibility to emotional and psychological biases. | Assumes agents are rational and unbiased. |

| Examples | Financial market herding, speculative bubbles. | Efficient market hypothesis, adaptive expectations models. |

Understanding Herd Behavior in Economics

Herd behavior in economics refers to individuals mimicking the actions of a larger group, often leading to market bubbles or crashes without underlying fundamental changes. This phenomenon contrasts with rational expectations theory, which assumes that agents use all available information to make optimal decisions. Understanding herd behavior is crucial for predicting market trends and mitigating systemic risks caused by collective irrationality.

The Fundamentals of Rational Expectations Theory

Rational expectations theory asserts that individuals use all available information efficiently to forecast future economic variables, minimizing systematic errors in predictions. Unlike herd behavior, where decisions are driven by social influence and trend-following, rational expectations emphasize adaptive learning and the incorporation of underlying economic fundamentals. This theory underpins many modern macroeconomic models, assuming that agents form expectations consistent with the actual structure of the economy over time.

Social Influence: How Herd Mentality Shapes Markets

Herd behavior significantly impacts financial markets by driving investors to mimic the actions of the majority, often disregarding their own information or analysis. This social influence intensifies market volatility and can lead to asset bubbles or crashes as individual rationality is overshadowed by collective psychology. Understanding the contrast between herd mentality and rational expectations is essential for predicting market dynamics and improving regulatory frameworks.

Comparing Decision-Making: Herding vs Rational Actors

Herd behavior in economic decision-making often leads individuals to mimic the actions of a larger group, prioritizing social conformity over independent analysis, which can result in market bubbles or crashes. In contrast, rational expectations theory assumes that actors make decisions based on all available information, optimizing outcomes by anticipating future economic conditions accurately. While herding can amplify market volatility, rational actors contribute to market efficiency by incorporating diverse knowledge and minimizing systematic errors.

Real-World Examples of Herd Behavior in Financial Markets

Herd behavior in financial markets often manifests during asset bubbles and crashes, such as the dot-com bubble of the late 1990s and the 2008 global financial crisis, where investors collectively ignored fundamental valuations. This irrational mimicry leads to excessive price volatility and market inefficiencies, diverging from the predictions of rational expectations theory. Empirical data from stock market trading volumes and price movements illustrate how psychological factors override individual analysis, amplifying systemic risk.

Predictive Power of Rational Expectations in Economic Models

Rational expectations significantly enhance the predictive power of economic models by assuming agents use all available information efficiently to forecast future variables, reducing systematic errors in predictions. Unlike herd behavior, which leads to market inefficiencies and bubbles due to imitation without analysis, rational expectations provide more accurate predictions of market outcomes and policy impacts. Empirical studies confirm models incorporating rational expectations better anticipate inflation rates, asset prices, and output fluctuations compared to models dominated by herd behavior dynamics.

Psychological Drivers Behind Herd Behavior

Herd behavior in economics stems from psychological drivers such as social conformity, fear of missing out, and reliance on collective wisdom over individual analysis. Investors often mimic the actions of a group to reduce uncertainty, leading to market trends fueled more by emotion than by fundamental data. This contrasts with rational expectations, where decisions are based on objective information and calculated forecasts rather than social influence.

Limitations of Rational Expectations in Practice

Rational expectations often assume that all economic agents have access to complete information and can process it without error, a condition seldom met in real markets. In contrast, herd behavior emerges as individuals mimic the actions of others, leading to market inefficiencies and bubbles despite rational models predicting equilibrium. Limitations of rational expectations include cognitive biases, information asymmetry, and the dynamic complexity of markets that prevent perfect foresight and decision-making.

Consequences of Herd Behavior: Bubbles and Crashes

Herd behavior in financial markets often leads to asset bubbles as investors collectively drive prices beyond intrinsic values, fueled by imitation rather than fundamental analysis. This irrational exuberance inflates market valuations unsustainably, increasing vulnerability to sudden crashes when sentiment shifts. Such volatility disrupts economic stability, erodes investor confidence, and can trigger widespread financial crises.

Policy Implications: Navigating Herding and Rationality

Herd behavior in financial markets can amplify economic volatility, necessitating policy measures that encourage transparency and reduce information asymmetry to mitigate systemic risks. Rational expectations suggest that individuals base decisions on all available information, guiding policymakers to design frameworks that promote accurate information dissemination and credible economic signals. Balancing interventions to curb irrational herding while reinforcing rational decision-making enhances market efficiency and stability.

Herd Behavior vs Rational Expectations Infographic

difterm.com

difterm.com