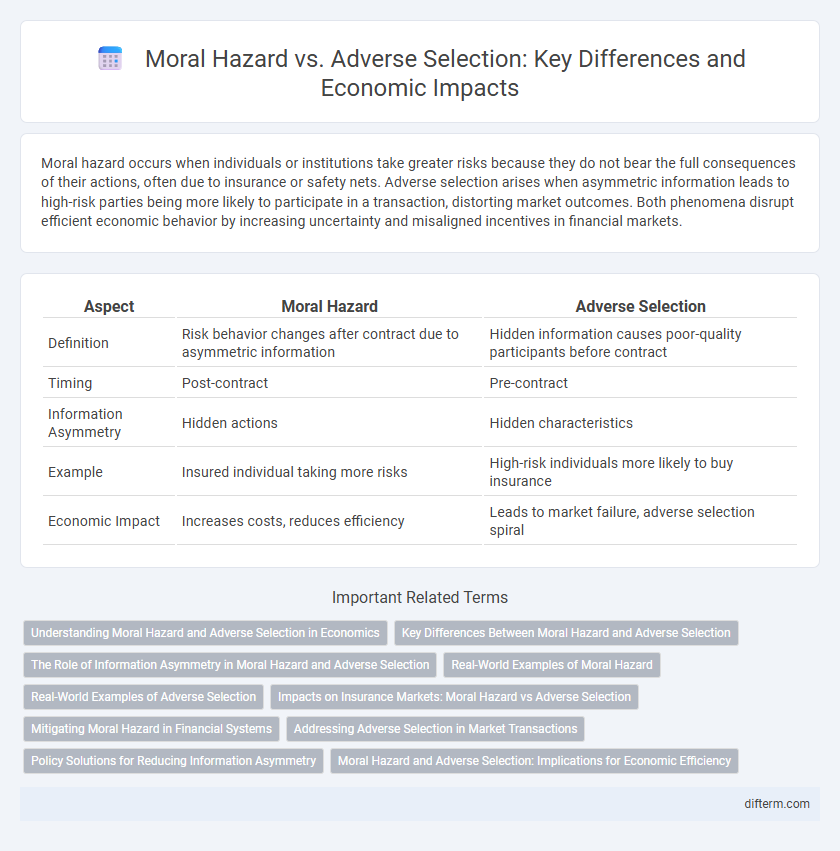

Moral hazard occurs when individuals or institutions take greater risks because they do not bear the full consequences of their actions, often due to insurance or safety nets. Adverse selection arises when asymmetric information leads to high-risk parties being more likely to participate in a transaction, distorting market outcomes. Both phenomena disrupt efficient economic behavior by increasing uncertainty and misaligned incentives in financial markets.

Table of Comparison

| Aspect | Moral Hazard | Adverse Selection |

|---|---|---|

| Definition | Risk behavior changes after contract due to asymmetric information | Hidden information causes poor-quality participants before contract |

| Timing | Post-contract | Pre-contract |

| Information Asymmetry | Hidden actions | Hidden characteristics |

| Example | Insured individual taking more risks | High-risk individuals more likely to buy insurance |

| Economic Impact | Increases costs, reduces efficiency | Leads to market failure, adverse selection spiral |

Understanding Moral Hazard and Adverse Selection in Economics

Moral hazard occurs when one party takes more risks because they do not bear the full consequences, commonly seen in insurance markets where insured individuals may engage in riskier behavior. Adverse selection arises when asymmetrical information leads to high-risk individuals being more likely to purchase insurance, skewing the risk pool and potentially causing market failure. Both concepts highlight critical challenges in contract design and risk management in asymmetric information environments.

Key Differences Between Moral Hazard and Adverse Selection

Moral hazard occurs when one party takes more risks because they do not bear the full consequences, often after a contract is signed, while adverse selection happens before a contract is formed, driven by asymmetric information where one party has more knowledge about risks. Key differences include timing--moral hazard arises post-contract, whereas adverse selection exists pre-contract--and behavior focus, with moral hazard linked to hidden actions and adverse selection to hidden information. These phenomena critically impact insurance markets, influencing policy pricing, risk assessment, and market efficiency.

The Role of Information Asymmetry in Moral Hazard and Adverse Selection

Information asymmetry plays a crucial role in both moral hazard and adverse selection by creating imbalances where one party possesses more or better information than the other. In moral hazard, this asymmetry leads to riskier behavior after a contract is signed, as the insured party exploits hidden actions. In adverse selection, it causes high-risk individuals to disproportionately participate in insurance markets, driven by private knowledge unavailable to insurers.

Real-World Examples of Moral Hazard

In the economy, moral hazard occurs when insured individuals engage in riskier behavior because they do not bear the full consequences, such as homeowners neglecting maintenance after obtaining comprehensive property insurance. Banks taking excessive financial risks post government bailouts illustrate moral hazard by relying on state rescues to mitigate potential losses. Employee absenteeism increases moral hazard risks when companies offer generous sick leave without proper monitoring, encouraging misuse of benefits.

Real-World Examples of Adverse Selection

Adverse selection occurs when asymmetric information leads to high-risk individuals disproportionately participating in markets, such as in health insurance where unhealthy individuals are more likely to purchase coverage, driving up premiums. A classic real-world example is the used car market, where sellers have more information about vehicle defects than buyers, causing buyers to be wary and potentially offering lower prices. This imbalance often results in market inefficiencies and reduced overall welfare.

Impacts on Insurance Markets: Moral Hazard vs Adverse Selection

Moral hazard in insurance markets leads to increased risk-taking behavior by insured individuals, raising overall claim costs and premiums. Adverse selection occurs when high-risk individuals are more likely to purchase insurance, skewing the risk pool and causing market inefficiencies. Both phenomena disrupt optimal pricing and coverage allocation, challenging insurers to implement strategies like screening and monitoring to mitigate financial losses.

Mitigating Moral Hazard in Financial Systems

Mitigating moral hazard in financial systems involves implementing strict regulatory frameworks, such as capital requirements and transparency mandates, to align incentives between financial institutions and stakeholders. Risk-based supervision and incentive-compatible contracts reduce reckless behavior by ensuring that parties bear appropriate consequences for their actions. Enhanced monitoring through advanced data analytics also plays a crucial role in identifying and preventing opportunistic risks before they materialize.

Addressing Adverse Selection in Market Transactions

Adverse selection occurs when buyers or sellers possess asymmetric information, leading to high-risk participants dominating market transactions and causing market inefficiency. To address adverse selection, mechanisms like signaling, screening, and warranties are implemented to improve information transparency between parties. These tools help align incentives and reduce the chances of hidden information distorting market outcomes.

Policy Solutions for Reducing Information Asymmetry

Policy solutions for reducing information asymmetry focus on enhancing transparency and accountability to mitigate moral hazard and adverse selection. Regulatory frameworks such as mandatory disclosure requirements, performance monitoring, and incentive-compatible contracts align the interests of parties and reduce opportunistic behavior. Implementing screening mechanisms, signaling practices, and third-party certifications further help to differentiate high-quality participants, lowering the risks associated with hidden information.

Moral Hazard and Adverse Selection: Implications for Economic Efficiency

Moral hazard arises when individuals or firms alter their behavior after securing insurance or protection, leading to increased risk-taking and inefficiencies in resource allocation. Adverse selection occurs when asymmetric information causes high-risk entities to participate more frequently, thereby distorting markets and raising costs for all participants. Both phenomena undermine economic efficiency by causing misallocation of resources, increasing transaction costs, and necessitating regulatory or contractual interventions to restore optimal market functioning.

Moral hazard vs Adverse selection Infographic

difterm.com

difterm.com