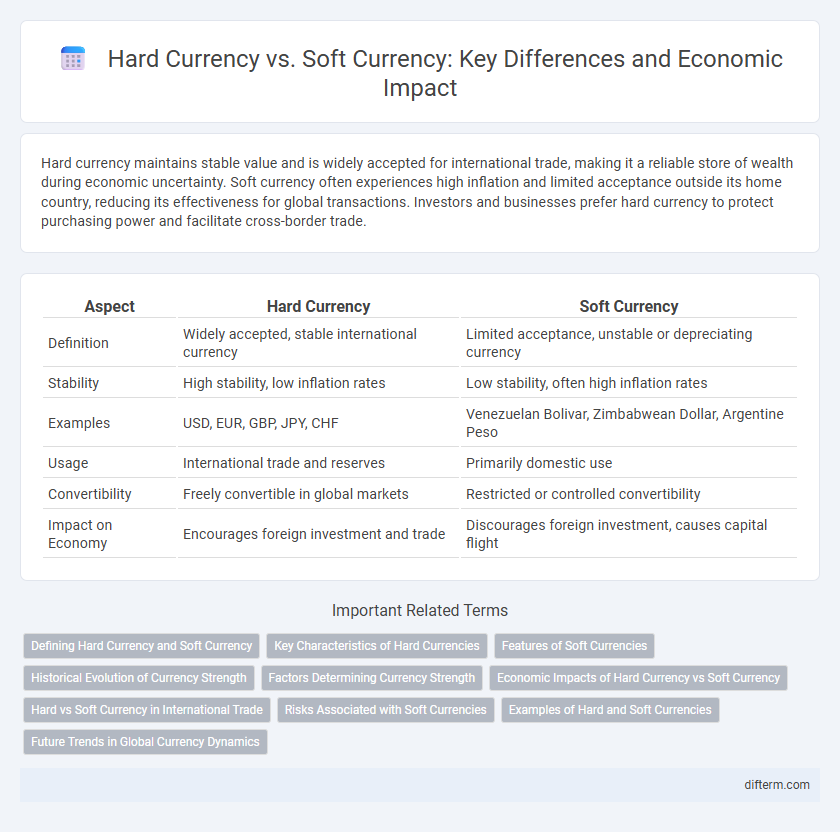

Hard currency maintains stable value and is widely accepted for international trade, making it a reliable store of wealth during economic uncertainty. Soft currency often experiences high inflation and limited acceptance outside its home country, reducing its effectiveness for global transactions. Investors and businesses prefer hard currency to protect purchasing power and facilitate cross-border trade.

Table of Comparison

| Aspect | Hard Currency | Soft Currency |

|---|---|---|

| Definition | Widely accepted, stable international currency | Limited acceptance, unstable or depreciating currency |

| Stability | High stability, low inflation rates | Low stability, often high inflation rates |

| Examples | USD, EUR, GBP, JPY, CHF | Venezuelan Bolivar, Zimbabwean Dollar, Argentine Peso |

| Usage | International trade and reserves | Primarily domestic use |

| Convertibility | Freely convertible in global markets | Restricted or controlled convertibility |

| Impact on Economy | Encourages foreign investment and trade | Discourages foreign investment, causes capital flight |

Defining Hard Currency and Soft Currency

Hard currency refers to a globally accepted and stable currency that maintains its value over time, often backed by strong economic fundamentals and low inflation rates, such as the US dollar, Euro, and Swiss franc. Soft currency, by contrast, is characterized by its volatility, limited acceptance in international trade, and susceptibility to depreciation due to weaker economic conditions or political instability, examples include currencies from emerging markets like the Venezuelan bolivar or Zimbabwean dollar. The distinction between hard and soft currencies significantly impacts foreign exchange markets, international trade, and investment decisions.

Key Characteristics of Hard Currencies

Hard currencies exhibit high liquidity, stability, and widespread acceptance in international markets, often backed by strong economic fundamentals and low inflation rates. They maintain consistent value over time, making them reliable for global trade, foreign exchange reserves, and investment transactions. Examples of hard currencies include the US dollar, Euro, Japanese yen, and Swiss franc, which are favored due to their durability and trustworthiness in fluctuating economic conditions.

Features of Soft Currencies

Soft currencies exhibit high volatility and limited acceptance in international trade due to weak economic fundamentals or political instability. They often experience rapid depreciation, making them less reliable for long-term value storage or foreign exchange reserves. These currencies are typically subject to capital controls and lack widespread convertibility compared to hard currencies like the US dollar or euro.

Historical Evolution of Currency Strength

Historical evolution of currency strength reveals that hard currencies, such as the US dollar and Swiss franc, have consistently maintained stability due to strong economic fundamentals and low inflation rates. In contrast, soft currencies often emerge from countries with high inflation and political instability, causing volatility and diminished international trust. The shift from the gold standard to fiat money further influenced the dynamic between hard and soft currencies, reshaping global trade and reserve preferences.

Factors Determining Currency Strength

Hard currency strength is driven by factors such as political stability, low inflation rates, robust economic performance, and strong foreign exchange reserves. In contrast, soft currencies often suffer from high inflation, political instability, and limited convertibility, reducing their global acceptance. Exchange rate regimes and market confidence further influence the international demand and value of a currency.

Economic Impacts of Hard Currency vs Soft Currency

Hard currency, such as the US dollar or euro, fosters economic stability by attracting foreign investment and facilitating international trade due to its reliability and widespread acceptance. Soft currency, often characterized by high inflation and low demand, can hinder economic growth by discouraging foreign investors and complicating cross-border transactions. Countries with hard currency typically experience greater economic resilience and stronger purchasing power compared to those reliant on soft currency.

Hard vs Soft Currency in International Trade

Hard currency, such as the US dollar and euro, is widely accepted and stable, making it preferred for international trade settlements and foreign exchange reserves. Soft currency, typically from developing economies, faces volatility and limited convertibility, increasing risks in cross-border transactions. Traders and investors prioritize hard currencies to ensure liquidity, reduce exchange rate risk, and facilitate smoother global commerce.

Risks Associated with Soft Currencies

Soft currencies face higher risks such as rapid depreciation due to inflation, political instability, and weak economic fundamentals. These currencies often exhibit volatility, making them less reliable for international trade and investment. Investors typically avoid soft currencies to mitigate potential losses linked to exchange rate fluctuations and capital flight.

Examples of Hard and Soft Currencies

Hard currencies include the US Dollar (USD), Euro (EUR), Japanese Yen (JPY), and Swiss Franc (CHF), known for their stability, wide acceptance, and strong purchasing power in global markets. Soft currencies, such as the Venezuelan Bolivar (VES), Zimbabwean Dollar (ZWL), and Argentine Peso (ARS), often experience high inflation, limited international acceptance, and volatile exchange rates. Investors and businesses prefer hard currencies for international trade and reserves due to their reliability and low risk of depreciation.

Future Trends in Global Currency Dynamics

Hard currencies like the US dollar and euro maintain dominance due to their stability, wide acceptance, and liquidity in international trade. Emerging digital currencies and blockchain technology are reshaping future global currency dynamics by challenging traditional fiat currencies and enabling faster, borderless transactions. Central banks' exploration of digital currencies (CBDCs) signals a shift towards more decentralized yet regulated monetary systems, potentially altering the balance between hard and soft currencies.

Hard currency vs Soft currency Infographic

difterm.com

difterm.com