Gross Fixed Capital Formation (GFCF) measures the total value of a country's investments in fixed assets such as buildings, machinery, and infrastructure during a specific period, reflecting the overall investment activity. Net Capital Formation adjusts GFCF by subtracting depreciation, indicating the actual increase in the productive capacity of an economy. Understanding the difference between these metrics is crucial for evaluating sustainable economic growth and the true expansion of capital stock.

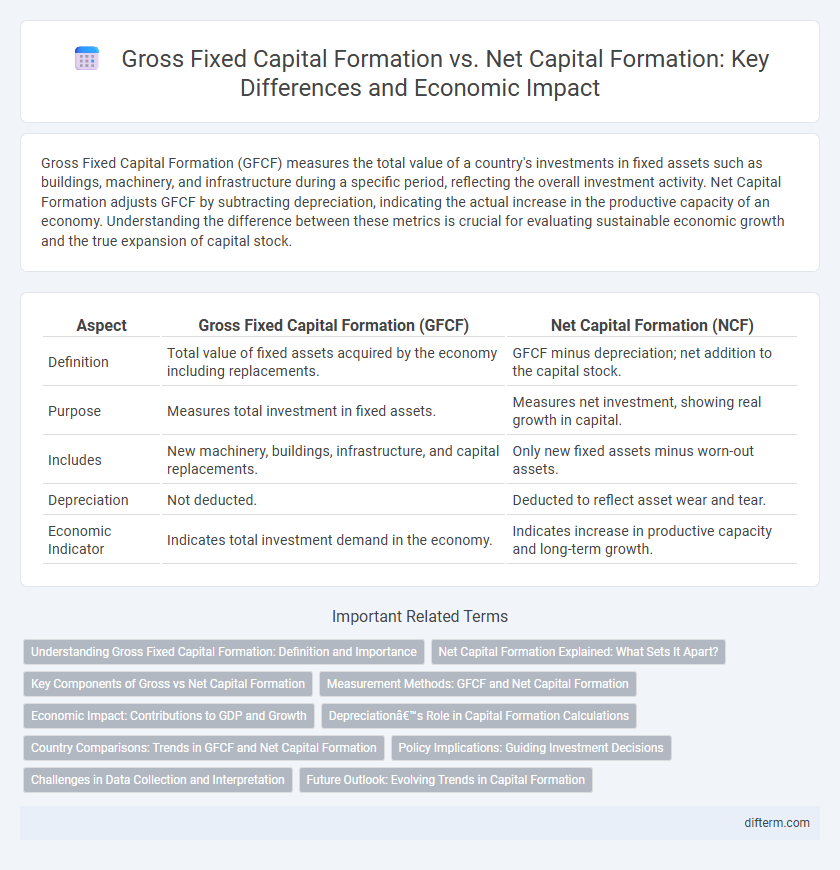

Table of Comparison

| Aspect | Gross Fixed Capital Formation (GFCF) | Net Capital Formation (NCF) |

|---|---|---|

| Definition | Total value of fixed assets acquired by the economy including replacements. | GFCF minus depreciation; net addition to the capital stock. |

| Purpose | Measures total investment in fixed assets. | Measures net investment, showing real growth in capital. |

| Includes | New machinery, buildings, infrastructure, and capital replacements. | Only new fixed assets minus worn-out assets. |

| Depreciation | Not deducted. | Deducted to reflect asset wear and tear. |

| Economic Indicator | Indicates total investment demand in the economy. | Indicates increase in productive capacity and long-term growth. |

Understanding Gross Fixed Capital Formation: Definition and Importance

Gross Fixed Capital Formation (GFCF) represents the net investment in physical assets such as machinery, buildings, and infrastructure, excluding depreciation. It measures the economy's total spending on fixed assets that contribute to productive capacity and economic growth. Understanding GFCF is crucial for assessing investment trends and forecasting future economic performance.

Net Capital Formation Explained: What Sets It Apart?

Net Capital Formation represents the actual increase in an economy's fixed assets after accounting for depreciation, distinguishing it from Gross Fixed Capital Formation which measures total investment without deductions. It provides a clearer indication of the net addition to productive capacity, reflecting asset renewal and expansion more accurately. Understanding Net Capital Formation is essential for assessing sustainable economic growth and long-term investment effectiveness.

Key Components of Gross vs Net Capital Formation

Gross Fixed Capital Formation (GFCF) includes the total value of a country's investments in fixed assets such as machinery, infrastructure, and buildings before accounting for depreciation. Net Capital Formation represents GFCF adjusted for the consumption of fixed capital, reflecting the actual addition to the capital stock after subtracting asset wear and tear. Key components of GFCF are new investments in physical assets, while Net Capital Formation emphasizes sustainable growth by considering asset deterioration.

Measurement Methods: GFCF and Net Capital Formation

Gross Fixed Capital Formation (GFCF) measures total investment in fixed assets before accounting for depreciation, capturing the full value of acquisitions like machinery, buildings, and infrastructure within a period. Net Capital Formation adjusts GFCF by subtracting capital consumption (depreciation), reflecting the actual increase in capital stock available for productive use in the economy. Accurate measurement of GFCF and Net Capital Formation is essential for assessing economic growth potential and capital accumulation dynamics in national accounts.

Economic Impact: Contributions to GDP and Growth

Gross Fixed Capital Formation (GFCF) represents total investments in fixed assets, driving immediate economic expansion by increasing productive capacity and contributing significantly to GDP growth. Net Capital Formation, which accounts for depreciation, reflects the actual increase in capital stock, offering a more precise indicator of sustainable economic growth and long-term productivity improvements. High levels of both GFCF and Net Capital Formation correlate with robust economic performance, signaling healthy investment trends that support innovation, infrastructure development, and enhanced competitiveness.

Depreciation’s Role in Capital Formation Calculations

Gross Fixed Capital Formation (GFCF) measures total investment in physical assets before accounting for depreciation, reflecting the overall addition to an economy's capital stock. Net Capital Formation deducts depreciation, or capital consumption, thereby providing a more accurate indicator of the actual increase in productive capacity. Depreciation's role is critical in distinguishing between gross investments and the net renewal or expansion of an economy's capital assets.

Country Comparisons: Trends in GFCF and Net Capital Formation

Gross Fixed Capital Formation (GFCF) measures a country's total investment in fixed assets, reflecting infrastructure expansion and business growth, while Net Capital Formation adjusts GFCF by depreciation, indicating actual net additions to capital stock. Countries with high GFCF but low Net Capital Formation often face accelerated capital depreciation or asset obsolescence, signaling potential inefficiencies in investment sustainability. Comparative trends reveal that emerging economies typically exhibit rapid growth in GFCF, whereas developed nations show steadier Net Capital Formation due to better maintenance and technological upgrading of capital assets.

Policy Implications: Guiding Investment Decisions

Gross Fixed Capital Formation (GFCF) measures total investment in fixed assets before depreciation, while Net Capital Formation accounts for asset wear and tear, reflecting true capital stock growth. Policymakers should emphasize Net Capital Formation for more accurate guidance on sustainable investment levels and economic resilience. Prioritizing Net Capital Formation data enables better allocation of resources toward effective infrastructure development and long-term productivity improvements.

Challenges in Data Collection and Interpretation

Gross Fixed Capital Formation (GFCF) data faces challenges such as distinguishing between asset replacements and new investments, causing inconsistencies in measuring economic growth accurately. Net Capital Formation requires depreciation adjustments, complicating data collection due to varying asset lifespan estimations and maintenance records. Both indicators struggle with informal sector coverage and asset valuation discrepancies, hindering precise economic analysis and policy formulation.

Future Outlook: Evolving Trends in Capital Formation

Gross Fixed Capital Formation (GFCF) captures total investment in fixed assets, while Net Capital Formation considers depreciation, providing a clearer measure of net asset growth. Emerging technologies, sustainable infrastructure, and digital transformation are driving shifts in capital allocation, influencing both gross and net formation metrics. Future trends emphasize increased investment efficiency and asset longevity, reshaping how economies measure productive capacity and long-term growth potential.

Gross Fixed Capital Formation vs Net Capital Formation Infographic

difterm.com

difterm.com