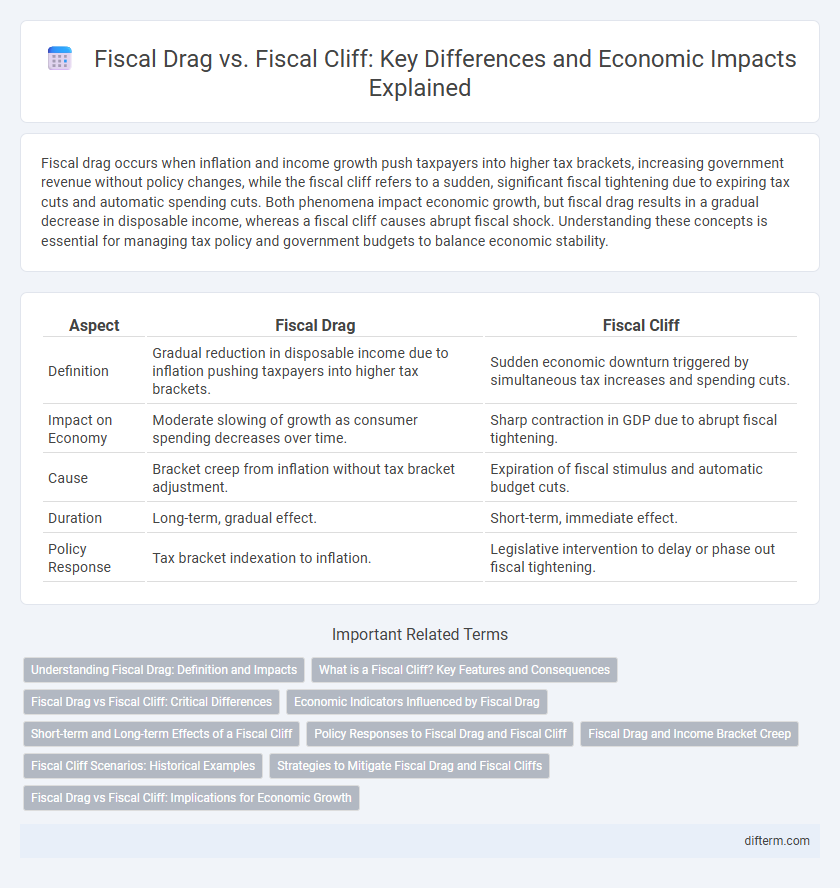

Fiscal drag occurs when inflation and income growth push taxpayers into higher tax brackets, increasing government revenue without policy changes, while the fiscal cliff refers to a sudden, significant fiscal tightening due to expiring tax cuts and automatic spending cuts. Both phenomena impact economic growth, but fiscal drag results in a gradual decrease in disposable income, whereas a fiscal cliff causes abrupt fiscal shock. Understanding these concepts is essential for managing tax policy and government budgets to balance economic stability.

Table of Comparison

| Aspect | Fiscal Drag | Fiscal Cliff |

|---|---|---|

| Definition | Gradual reduction in disposable income due to inflation pushing taxpayers into higher tax brackets. | Sudden economic downturn triggered by simultaneous tax increases and spending cuts. |

| Impact on Economy | Moderate slowing of growth as consumer spending decreases over time. | Sharp contraction in GDP due to abrupt fiscal tightening. |

| Cause | Bracket creep from inflation without tax bracket adjustment. | Expiration of fiscal stimulus and automatic budget cuts. |

| Duration | Long-term, gradual effect. | Short-term, immediate effect. |

| Policy Response | Tax bracket indexation to inflation. | Legislative intervention to delay or phase out fiscal tightening. |

Understanding Fiscal Drag: Definition and Impacts

Fiscal drag occurs when inflation and income growth push taxpayers into higher tax brackets, increasing tax revenue without changes in tax rates, thereby reducing disposable income and dampening consumer spending. This automatic upward adjustment can slow economic growth by increasing the tax burden relative to real income, often unnoticed by policymakers and taxpayers. Understanding fiscal drag helps in designing tax policies that balance revenue needs and economic stimulus without abrupt fiscal shocks.

What is a Fiscal Cliff? Key Features and Consequences

A fiscal cliff occurs when a set of previously enacted laws simultaneously expire or take effect, leading to a sudden reduction in government spending and an increase in taxes. Key features include sharp fiscal tightening, which can contract economic growth and increase unemployment rates. The consequences often involve increased budget deficits if the cliff is avoided through additional borrowing, or a potential recession if strict fiscal measures are enforced abruptly.

Fiscal Drag vs Fiscal Cliff: Critical Differences

Fiscal drag occurs when inflation and income growth push taxpayers into higher tax brackets, increasing tax revenue without changes in tax rates, which gradually slows economic growth. Fiscal cliff refers to a sudden and significant fiscal tightening triggered by expiring tax cuts or automatic spending cuts, leading to abrupt economic contraction. The critical difference lies in fiscal drag's gradual impact versus the fiscal cliff's immediate and severe fiscal shock.

Economic Indicators Influenced by Fiscal Drag

Fiscal drag impacts key economic indicators such as disposable income, consumer spending, and inflation rates by gradually increasing tax burdens without policy changes. This process reduces households' real income, leading to decreased aggregate demand and slower economic growth. Monitoring wage inflation and tax receipts provides critical insights into the extent of fiscal drag on the economy.

Short-term and Long-term Effects of a Fiscal Cliff

A fiscal cliff triggers immediate, sharp fiscal contraction due to simultaneous tax increases and spending cuts, leading to a short-term decline in aggregate demand and potential recession. In the long term, a fiscal cliff can stabilize public finances by reducing debt levels and restoring investor confidence but risks slowing economic growth if austerity measures suppress productive investment. Unlike fiscal drag's gradual tax burden increase, the fiscal cliff's abrupt changes create intense short-term economic volatility with uncertain long-term growth outcomes.

Policy Responses to Fiscal Drag and Fiscal Cliff

Policy responses to fiscal drag often include targeted tax relief and increased government spending to stimulate economic growth and offset reduced consumer purchasing power. In contrast, addressing the fiscal cliff involves a balanced approach of phased tax increases and spending cuts designed to reduce budget deficits without triggering a sharp economic downturn. Policymakers prioritize gradual adjustments and automatic stabilizers to mitigate adverse effects on GDP and employment levels during these fiscal challenges.

Fiscal Drag and Income Bracket Creep

Fiscal drag occurs when inflation and nominal income growth push taxpayers into higher income brackets, increasing tax revenue without legislated rate changes, leading to income bracket creep. This phenomenon reduces disposable income and can slow economic growth by effectively raising tax burdens, especially in progressive tax systems lacking bracket adjustments for inflation. Unlike a sudden fiscal cliff, fiscal drag is a gradual process that subtly tightens fiscal policy over time.

Fiscal Cliff Scenarios: Historical Examples

Fiscal cliff scenarios often occur when abrupt tax increases and spending cuts coincide, leading to sudden economic contraction. The U.S. experienced a notable fiscal cliff in 2012, where automatic budget cuts and tax expirations threatened financial markets and consumer confidence. Historical examples highlight the risks of sharp fiscal tightening without phased adjustments, emphasizing the need for careful policy calibration to avoid recession.

Strategies to Mitigate Fiscal Drag and Fiscal Cliffs

Strategies to mitigate fiscal drag and fiscal cliffs include adjusting tax brackets for inflation to prevent bracket creep and implementing phased tax rate changes to avoid sudden economic shocks. Policymakers often use gradual spending cuts or revenue increases to smooth budgetary adjustments and maintain economic stability. Employing automatic stabilizers such as unemployment benefits and progressive taxation also helps cushion the impact of fiscal contractions on the economy.

Fiscal Drag vs Fiscal Cliff: Implications for Economic Growth

Fiscal drag occurs when inflation and income growth push taxpayers into higher tax brackets, effectively increasing tax burdens without policy changes, which can slow consumer spending and dampen economic growth. A fiscal cliff represents a sudden, significant increase in taxes or a sharp decrease in government spending due to policy expirations, causing abrupt economic contraction and uncertainty. Understanding the nuanced impacts of fiscal drag as a gradual constraint versus the fiscal cliff's immediate shock is crucial for policymakers aiming to balance revenue generation with sustaining economic momentum.

Fiscal drag vs Fiscal cliff Infographic

difterm.com

difterm.com