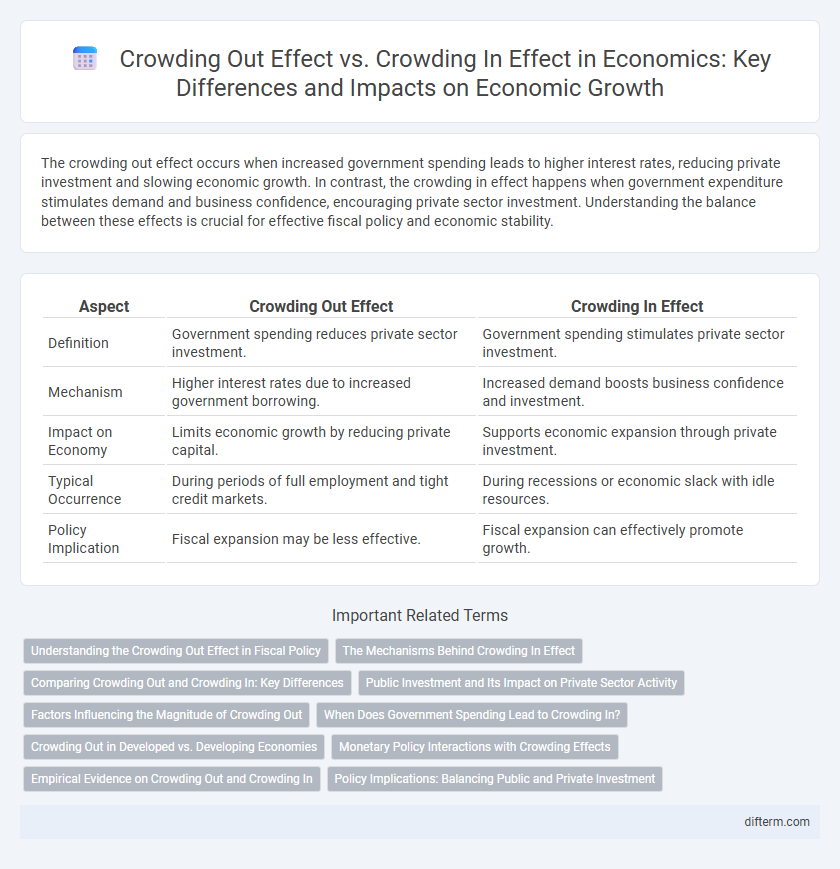

The crowding out effect occurs when increased government spending leads to higher interest rates, reducing private investment and slowing economic growth. In contrast, the crowding in effect happens when government expenditure stimulates demand and business confidence, encouraging private sector investment. Understanding the balance between these effects is crucial for effective fiscal policy and economic stability.

Table of Comparison

| Aspect | Crowding Out Effect | Crowding In Effect |

|---|---|---|

| Definition | Government spending reduces private sector investment. | Government spending stimulates private sector investment. |

| Mechanism | Higher interest rates due to increased government borrowing. | Increased demand boosts business confidence and investment. |

| Impact on Economy | Limits economic growth by reducing private capital. | Supports economic expansion through private investment. |

| Typical Occurrence | During periods of full employment and tight credit markets. | During recessions or economic slack with idle resources. |

| Policy Implication | Fiscal expansion may be less effective. | Fiscal expansion can effectively promote growth. |

Understanding the Crowding Out Effect in Fiscal Policy

The crowding out effect occurs when increased government borrowing drives up interest rates, reducing private investment and slowing economic growth. In contrast, the crowding in effect happens when government spending stimulates demand, encouraging businesses to invest more due to improved economic prospects. Understanding the crowding out effect is crucial for fiscal policy as excessive public debt can limit private sector activity, affecting long-term productivity and employment.

The Mechanisms Behind Crowding In Effect

The crowding in effect occurs when increased government spending stimulates private sector investment by boosting overall demand and improving business confidence. This mechanism works through lower interest rates and enhanced economic activity, encouraging firms to expand and innovate. As a result, government expenditure can complement rather than substitute private investment, fostering sustained economic growth.

Comparing Crowding Out and Crowding In: Key Differences

Crowding out occurs when increased government borrowing raises interest rates, reducing private investment, while crowding in happens when government spending stimulates private sector growth and investment. The key difference lies in their impact on private investment: crowding out restricts it due to higher costs, whereas crowding in encourages it by boosting economic demand. Understanding these effects is crucial for policy decisions affecting fiscal stimulus and interest rate management.

Public Investment and Its Impact on Private Sector Activity

Public investment can lead to crowding out when increased government borrowing raises interest rates, reducing private sector access to capital and dampening private investment. Conversely, crowding in occurs when public investment in infrastructure, education, or technology enhances productivity and creates favorable conditions, stimulating additional private sector activity. The net impact depends on the efficiency and scale of public projects and prevailing economic conditions.

Factors Influencing the Magnitude of Crowding Out

The magnitude of the crowding out effect is influenced by factors such as interest rate sensitivity of private investment, the level of government borrowing, and prevailing economic conditions like inflation and output gaps. High interest rate sensitivity tends to increase crowding out by raising borrowing costs for private firms, while a large output gap may reduce crowding out due to underutilized resources. Conversely, in cases where government spending boosts overall demand, crowding in occurs, especially when private investment responds positively to improved economic prospects and low interest rates.

When Does Government Spending Lead to Crowding In?

Government spending leads to crowding in when it stimulates private investment by improving infrastructure, increasing demand, or enhancing overall economic confidence. This effect is more likely during periods of economic slack or recession when private sector money is insufficient to maintain growth. Empirical evidence suggests that targeted public investments in high-multiplier sectors catalyze private sector participation, thereby expanding economic activity rather than displacing it.

Crowding Out in Developed vs. Developing Economies

In developed economies, crowding out occurs when increased government borrowing raises interest rates, reducing private investment and slowing economic growth. Developing economies often experience less pronounced crowding out due to underdeveloped financial markets and higher investment needs that absorb government spending without significantly displacing private sector funds. The contrasting impact reflects differences in capital market maturity, fiscal capacity, and investment demand between developed and developing countries.

Monetary Policy Interactions with Crowding Effects

Monetary policy influences crowding out and crowding in effects by altering interest rates, which directly affect private investment levels. When expansionary monetary policy lowers interest rates, it can offset crowding out caused by increased government borrowing, thereby encouraging private sector spending and investment. Conversely, contractionary monetary policy may exacerbate crowding out by raising borrowing costs, reducing private investment alongside public spending.

Empirical Evidence on Crowding Out and Crowding In

Empirical evidence on the crowding out effect demonstrates that increased government spending often leads to a reduction in private investment, particularly when public borrowing drives up interest rates. Conversely, studies on the crowding in effect reveal scenarios where government expenditure stimulates private sector growth by improving infrastructure and boosting aggregate demand. Macro-economic data from OECD countries indicate that the impact varies significantly based on fiscal policy design, economic conditions, and the scale of government intervention.

Policy Implications: Balancing Public and Private Investment

The crowding out effect occurs when increased government spending leads to higher interest rates, reducing private investment and slowing economic growth. Conversely, the crowding in effect happens when public investment stimulates private sector activity by improving infrastructure or market conditions, enhancing overall productivity. Policy implications emphasize the need for balanced fiscal strategies that maximize public investment benefits while minimizing displacement of private capital to sustain long-term economic development.

Crowding out effect vs Crowding in effect Infographic

difterm.com

difterm.com