The Consumer Price Index (CPI) measures the average change in prices paid by consumers for goods and services, reflecting the cost of living and inflation experienced by households. The Producer Price Index (PPI) tracks the average change in selling prices received by domestic producers for their output, highlighting price trends at the wholesale level. Comparing CPI and PPI offers insights into inflationary pressures across the supply chain, from production costs to retail prices.

Table of Comparison

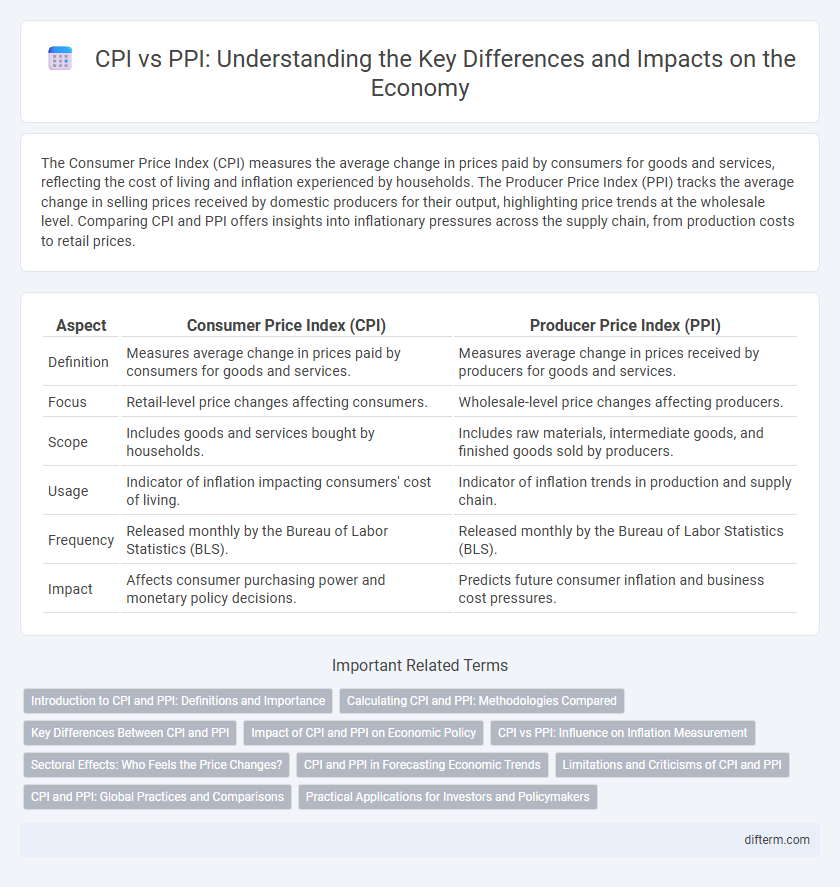

| Aspect | Consumer Price Index (CPI) | Producer Price Index (PPI) |

|---|---|---|

| Definition | Measures average change in prices paid by consumers for goods and services. | Measures average change in prices received by producers for goods and services. |

| Focus | Retail-level price changes affecting consumers. | Wholesale-level price changes affecting producers. |

| Scope | Includes goods and services bought by households. | Includes raw materials, intermediate goods, and finished goods sold by producers. |

| Usage | Indicator of inflation impacting consumers' cost of living. | Indicator of inflation trends in production and supply chain. |

| Frequency | Released monthly by the Bureau of Labor Statistics (BLS). | Released monthly by the Bureau of Labor Statistics (BLS). |

| Impact | Affects consumer purchasing power and monetary policy decisions. | Predicts future consumer inflation and business cost pressures. |

Introduction to CPI and PPI: Definitions and Importance

The Consumer Price Index (CPI) measures the average change over time in the prices paid by urban consumers for a basket of goods and services, reflecting retail inflation experienced by households. The Producer Price Index (PPI) tracks the average change in selling prices received by domestic producers for their output, serving as a leading indicator of wholesale inflation. Both indices are critical for economic analysis, guiding monetary policy decisions and inflation forecasting.

Calculating CPI and PPI: Methodologies Compared

Calculating the Consumer Price Index (CPI) involves tracking the price changes of a fixed basket of goods and services purchased by households, weighted according to consumer expenditure patterns. The Producer Price Index (PPI) calculation focuses on measuring average changes in selling prices received by domestic producers for their output, categorized by industry and product stages. Both indices use different weighting schemes and data sources, with CPI reflecting retail prices and consumer impact, while PPI emphasizes wholesale prices and production input costs.

Key Differences Between CPI and PPI

The Consumer Price Index (CPI) measures the average change in prices paid by urban consumers for a basket of goods and services, reflecting the retail-level inflation experienced by households. The Producer Price Index (PPI) tracks the average change in selling prices received by domestic producers for their output, capturing inflation at the wholesale level before goods reach consumers. CPI primarily focuses on final consumer goods and services, whereas PPI emphasizes raw materials, intermediate goods, and finished products at the production stage.

Impact of CPI and PPI on Economic Policy

The Consumer Price Index (CPI) measures changes in the retail prices of goods and services purchased by households, directly influencing monetary policy decisions aimed at controlling inflation and adjusting interest rates. The Producer Price Index (PPI) tracks wholesale price changes from the perspective of producers, serving as an early indicator of cost-push inflation that can affect future consumer prices and wage negotiations. Policymakers analyze both CPI and PPI data to formulate balanced fiscal and monetary strategies that stabilize economic growth, manage inflation expectations, and guide decisions on social welfare and taxation.

CPI vs PPI: Influence on Inflation Measurement

The Consumer Price Index (CPI) measures the average change in prices paid by consumers for goods and services, directly reflecting inflation experienced by households. The Producer Price Index (PPI) tracks price changes from the perspective of producers, capturing wholesale price fluctuations before goods reach retail markets. Differences between CPI and PPI influence inflation measurement by highlighting the transition of cost pressures through the supply chain, where rising PPI often signals upcoming changes in consumer inflation reflected in the CPI.

Sectoral Effects: Who Feels the Price Changes?

The Consumer Price Index (CPI) directly reflects price changes experienced by households, highlighting the cost of goods and services in retail sectors such as food, energy, and housing. In contrast, the Producer Price Index (PPI) captures price fluctuations at the wholesale or production level, primarily affecting manufacturers, suppliers, and industries engaged in raw materials and intermediate goods. Sectoral effects reveal that while CPI impacts consumer spending and demand patterns, PPI influences industrial input costs, profit margins, and ultimately, pricing strategies across supply chains.

CPI and PPI in Forecasting Economic Trends

Consumer Price Index (CPI) measures changes in the retail prices paid by consumers, reflecting inflation's impact on household expenses, while Producer Price Index (PPI) tracks price changes from the perspective of producers, capturing shifts in wholesale costs. CPI provides direct insight into consumer price inflation, signaling demand-driven economic trends, whereas PPI serves as an early indicator of future CPI movements by highlighting cost pressures faced by producers. Forecasting economic trends leverages CPI to gauge purchasing power and consumer confidence, while PPI helps predict inflationary pressures upstream in the supply chain, enabling more comprehensive economic analysis.

Limitations and Criticisms of CPI and PPI

The Consumer Price Index (CPI) faces limitations such as substitution bias, where consumers may change purchasing habits due to price changes, leading to inaccurate inflation measurement. CPI often struggles to represent quality changes and new product introductions, which can distort the true cost of living. The Producer Price Index (PPI) is criticized for its narrow focus on goods, excluding services and often missing price pressures at later stages of the supply chain, limiting its effectiveness in forecasting retail inflation.

CPI and PPI: Global Practices and Comparisons

The Consumer Price Index (CPI) measures changes in the retail price of a basket of goods and services purchased by households, reflecting consumer inflation, while the Producer Price Index (PPI) tracks changes in prices received by domestic producers for their output, indicating inflation at the wholesale level. Globally, CPI is widely used for adjusting wages and social benefits, with countries like the US and EU prioritizing it for monetary policy decisions, whereas PPI serves as a leading indicator of consumer inflation trends in economies such as China and Germany. Comparisons reveal that CPI focuses on final demand price changes, while PPI captures input and intermediate goods price movements, offering complementary insights into inflation dynamics across diverse economic contexts.

Practical Applications for Investors and Policymakers

The Consumer Price Index (CPI) measures inflation by tracking changes in the prices paid by consumers for a basket of goods and services, directly influencing monetary policy decisions and interest rate adjustments. The Producer Price Index (PPI) captures price changes from the perspective of producers, reflecting input cost trends that can signal future CPI movements and profit margin pressures for businesses. Investors and policymakers use CPI to gauge consumer purchasing power and inflationary impact, while PPI serves as an early indicator of supply chain inflation and cost pressures that can affect investment valuations and economic forecasts.

Consumer Price Index (CPI) vs Producer Price Index (PPI) Infographic

difterm.com

difterm.com