Seigniorage represents the revenue governments earn by issuing currency, effectively generating money without raising taxes. Inflation tax occurs when increased money supply erodes the purchasing power of existing currency holders, functioning as an indirect levy on the public. While seigniorage provides short-term fiscal benefits, excessive reliance can trigger inflation tax, harming economic stability.

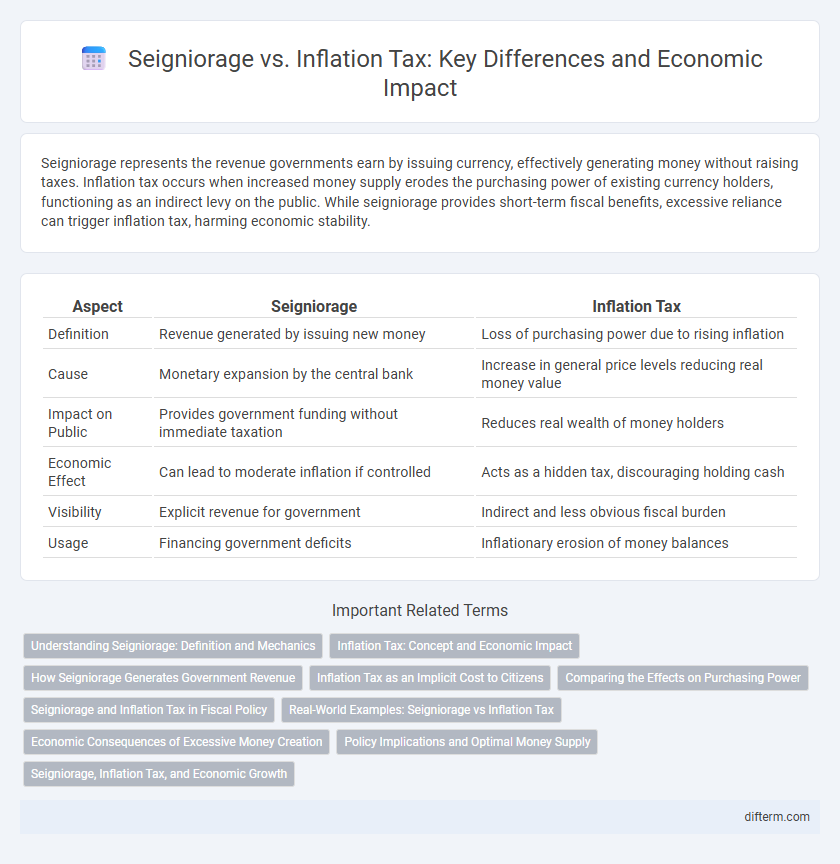

Table of Comparison

| Aspect | Seigniorage | Inflation Tax |

|---|---|---|

| Definition | Revenue generated by issuing new money | Loss of purchasing power due to rising inflation |

| Cause | Monetary expansion by the central bank | Increase in general price levels reducing real money value |

| Impact on Public | Provides government funding without immediate taxation | Reduces real wealth of money holders |

| Economic Effect | Can lead to moderate inflation if controlled | Acts as a hidden tax, discouraging holding cash |

| Visibility | Explicit revenue for government | Indirect and less obvious fiscal burden |

| Usage | Financing government deficits | Inflationary erosion of money balances |

Understanding Seigniorage: Definition and Mechanics

Seigniorage represents the revenue a government earns by issuing currency, essentially the profit from producing money at a cost lower than its face value. It functions as an implicit tax on holders of money because increasing the money supply leads to inflation, which reduces the real value of cash balances. Understanding this mechanism reveals how seigniorage acts as an inflation tax, impacting purchasing power and influencing monetary policy decisions.

Inflation Tax: Concept and Economic Impact

Inflation tax refers to the reduction in the purchasing power of money held by the public due to inflation, effectively acting as a hidden tax on cash balances. This erosion of real wealth disproportionately affects individuals with fixed nominal incomes and savings, leading to decreased consumer spending and potential shifts toward inflation-hedged assets. Economically, inflation tax can reduce government borrowing costs but also distorts resource allocation and undermines long-term investment and economic growth.

How Seigniorage Generates Government Revenue

Seigniorage generates government revenue by allowing the state to print money, increasing the monetary base without raising taxes. This process creates purchasing power for the government, effectively financing expenditures through newly created currency. However, excessive reliance on seigniorage can lead to inflation, reducing the real value of money and acting as an implicit tax on holders of cash.

Inflation Tax as an Implicit Cost to Citizens

Inflation tax represents a hidden economic burden where rising prices erode the real value of money held by citizens, effectively diminishing their purchasing power without direct government levies. Unlike seigniorage, which is revenue generated from money creation, inflation tax imposes an implicit cost by reducing the wealth of money holders through inflation-induced depreciation. This covert transfer of wealth acts as a regressive mechanism, disproportionately impacting lower-income households who hold a higher proportion of their assets in cash.

Comparing the Effects on Purchasing Power

Seigniorage generates government revenue by increasing the money supply, which can lead to inflationary pressures that erode purchasing power over time. Inflation tax indirectly reduces the real value of money holdings by decreasing the currency's purchasing power, effectively acting as a hidden tax on holders of cash and fixed incomes. Comparing both, seigniorage directly affects inflation rates, while inflation tax captures the resulting loss in real wealth, but both diminish consumer purchasing power through monetary expansion.

Seigniorage and Inflation Tax in Fiscal Policy

Seigniorage represents the government's revenue generated by issuing currency, effectively financing fiscal deficits without increasing taxes through traditional means. Inflation tax occurs when excessive money creation erodes the real value of cash holdings, disproportionately impacting holders of money rather than formal taxpayers. Both seigniorage and inflation tax serve as non-traditional fiscal tools but risk destabilizing the economy by fueling inflation and reducing public trust in monetary policy.

Real-World Examples: Seigniorage vs Inflation Tax

Seigniorage represents the revenue that governments generate by issuing currency, often used to finance budget deficits without raising taxes, exemplified by Zimbabwe's hyperinflation episode where excessive money printing led to real economic losses. Inflation tax, on the other hand, erodes the purchasing power of money held by the public, effectively acting as a hidden tax that reduces real wealth, as seen in Venezuela's inflation exceeding 1,000,000%, severely impacting savings and income. These real-world examples highlight how excessive reliance on seigniorage can trigger runaway inflation, disproportionately harming holders of cash and fixed-income assets.

Economic Consequences of Excessive Money Creation

Excessive money creation leads to high seigniorage but triggers inflation tax, eroding real wealth and distorting price signals in the economy. Persistent inflation reduces the currency's purchasing power, impacting savings and income distribution, while increased uncertainty hampers investment and economic growth. Central banks must balance money supply growth to avoid the negative consequences of inflationary finance on economic stability.

Policy Implications and Optimal Money Supply

Seigniorage, the revenue generated by issuing money, can act as a non-distortionary source of government funds but risks accelerating inflation if overused, effectively functioning as an inflation tax that erodes real balances held by the public. Policymakers must balance the money supply to optimize revenue without triggering hyperinflation, which requires careful calibration of monetary expansion in alignment with economic growth and velocity of money. Optimal money supply policies hinge on minimizing inflation tax burdens while maintaining sufficient liquidity to support transaction needs and fiscal financing, ensuring macroeconomic stability and sustainable public finance.

Seigniorage, Inflation Tax, and Economic Growth

Seigniorage represents the revenue generated by a government through money creation, effectively acting as an implicit tax on holders of cash during inflationary periods. Inflation tax reduces the purchasing power of money, leading to distortions in savings and consumption that can hinder economic growth. Understanding the balance between seigniorage and inflation tax is crucial for policymakers aiming to maintain price stability while supporting sustainable economic expansion.

Seigniorage vs Inflation Tax Infographic

difterm.com

difterm.com