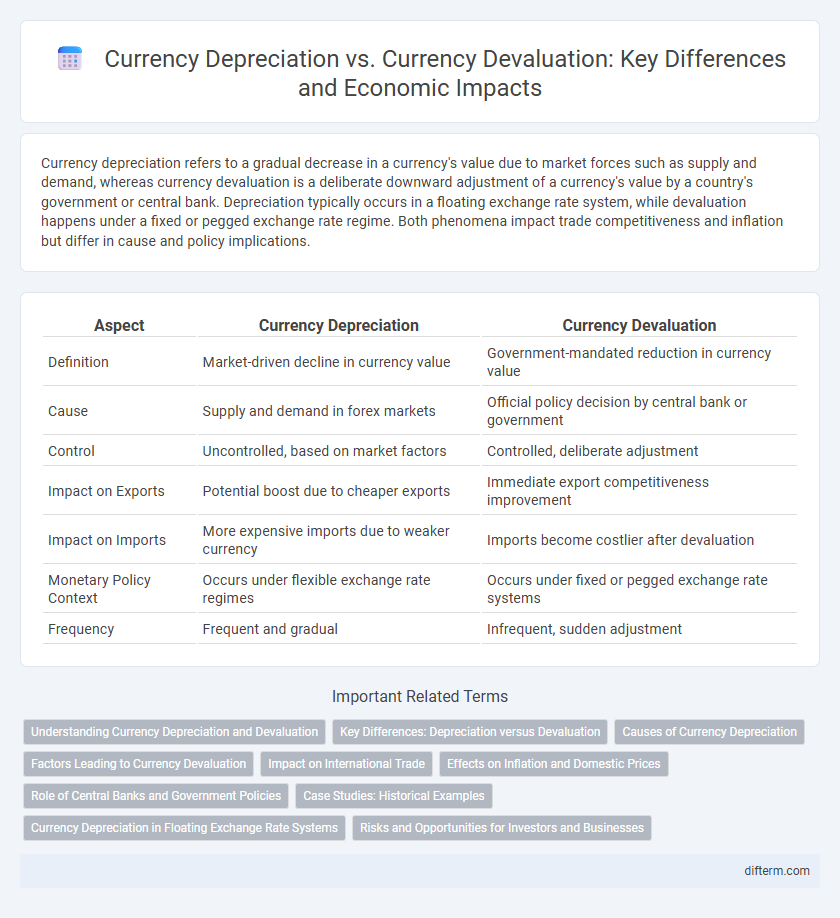

Currency depreciation refers to a gradual decrease in a currency's value due to market forces such as supply and demand, whereas currency devaluation is a deliberate downward adjustment of a currency's value by a country's government or central bank. Depreciation typically occurs in a floating exchange rate system, while devaluation happens under a fixed or pegged exchange rate regime. Both phenomena impact trade competitiveness and inflation but differ in cause and policy implications.

Table of Comparison

| Aspect | Currency Depreciation | Currency Devaluation |

|---|---|---|

| Definition | Market-driven decline in currency value | Government-mandated reduction in currency value |

| Cause | Supply and demand in forex markets | Official policy decision by central bank or government |

| Control | Uncontrolled, based on market factors | Controlled, deliberate adjustment |

| Impact on Exports | Potential boost due to cheaper exports | Immediate export competitiveness improvement |

| Impact on Imports | More expensive imports due to weaker currency | Imports become costlier after devaluation |

| Monetary Policy Context | Occurs under flexible exchange rate regimes | Occurs under fixed or pegged exchange rate systems |

| Frequency | Frequent and gradual | Infrequent, sudden adjustment |

Understanding Currency Depreciation and Devaluation

Currency depreciation refers to a gradual decline in the value of a currency due to market forces and economic conditions, often influenced by factors like inflation, interest rates, and trade balances. Currency devaluation is a deliberate downward adjustment of a currency's value by a government or central bank, typically to boost exports and reduce trade deficits. Understanding the distinction highlights how depreciation is market-driven, while devaluation is a policy action aimed at correcting economic imbalances.

Key Differences: Depreciation versus Devaluation

Currency depreciation refers to a gradual decline in a currency's value due to market forces like supply and demand in a floating exchange rate system. Currency devaluation is a deliberate downward adjustment of a currency's value by a government or central bank in a fixed exchange rate regime. Key differences include the causes--depreciation is market-driven, while devaluation is policy-driven--and the exchange rate systems in which they occur.

Causes of Currency Depreciation

Currency depreciation occurs primarily due to market-driven factors such as changes in foreign exchange supply and demand, including trade imbalances where a country imports more than it exports. Inflation differentials between countries reduce a currency's purchasing power, leading investors to seek stronger currencies. Speculative activities and shifts in interest rates that favor other economies also contribute to a currency losing value against others over time.

Factors Leading to Currency Devaluation

Currency devaluation occurs when a government intentionally lowers the value of its currency relative to foreign currencies, often to boost exports by making them cheaper and reduce trade deficits. Key factors leading to currency devaluation include persistent trade imbalances, high inflation rates, fiscal deficits, and political instability that undermine investor confidence. Central bank policies such as lowering interest rates and accumulating foreign debt can also trigger deliberate devaluation to regain competitiveness.

Impact on International Trade

Currency depreciation leads to a gradual decline in a country's exchange rate due to market forces, making exports cheaper and more competitive internationally while increasing the cost of imports. Currency devaluation is a deliberate policy action to reduce the value of a currency, aimed at boosting export volumes by making goods and services less expensive for foreign buyers and correcting trade imbalances. Both mechanisms affect trade balances, but devaluation often triggers retaliatory measures from trading partners, whereas depreciation reflects natural market adjustments.

Effects on Inflation and Domestic Prices

Currency depreciation, often occurring gradually due to market forces, increases the cost of imported goods, leading to higher inflation and rising domestic prices. Currency devaluation, a deliberate policy decision to lower a currency's value, typically causes a swift increase in inflationary pressures by making imports more expensive and boosting costs for consumers and businesses. Both mechanisms reduce purchasing power and can trigger cost-push inflation, but devaluation tends to have a more immediate and pronounced effect on inflation dynamics.

Role of Central Banks and Government Policies

Currency depreciation occurs naturally in the foreign exchange markets due to supply and demand fluctuations, while currency devaluation is a deliberate policy action by governments or central banks to lower the currency's value in a fixed exchange rate system. Central banks influence depreciation through interest rate adjustments and open market operations, impacting investor confidence and capital flows. Government policies, including monetary easing or trade tariffs, can trigger devaluation to improve export competitiveness or correct trade imbalances.

Case Studies: Historical Examples

Currency depreciation occurred in the 1997 Asian Financial Crisis when Thailand's baht lost significant value due to market pressures, leading to severe economic downturns across the region. In contrast, currency devaluation was exemplified by the United Kingdom's decision in 1967 to officially lower the pound sterling's value to boost exports and address trade imbalances. These historical cases highlight how depreciation is typically market-driven while devaluation is a deliberate policy tool to adjust a country's competitive position in global trade.

Currency Depreciation in Floating Exchange Rate Systems

Currency depreciation occurs in floating exchange rate systems when market forces of supply and demand cause a currency's value to decline relative to others, reflecting changes in economic factors such as inflation, interest rates, and trade balances. Unlike currency devaluation, which is a deliberate policy action by a government or central bank to lower the currency value, depreciation is an automatic response to market dynamics. This natural adjustment helps correct trade imbalances and can impact export competitiveness and inflation rates.

Risks and Opportunities for Investors and Businesses

Currency depreciation, often driven by market forces, can create investment opportunities through cheaper exports but introduces risks like increased import costs and inflation for businesses reliant on foreign inputs. Currency devaluation, typically a government policy action, can improve trade competitiveness yet may trigger loss of investor confidence and capital flight. Investors and businesses must carefully assess foreign exchange volatility to strategize effectively in global markets.

Currency depreciation vs Currency devaluation Infographic

difterm.com

difterm.com