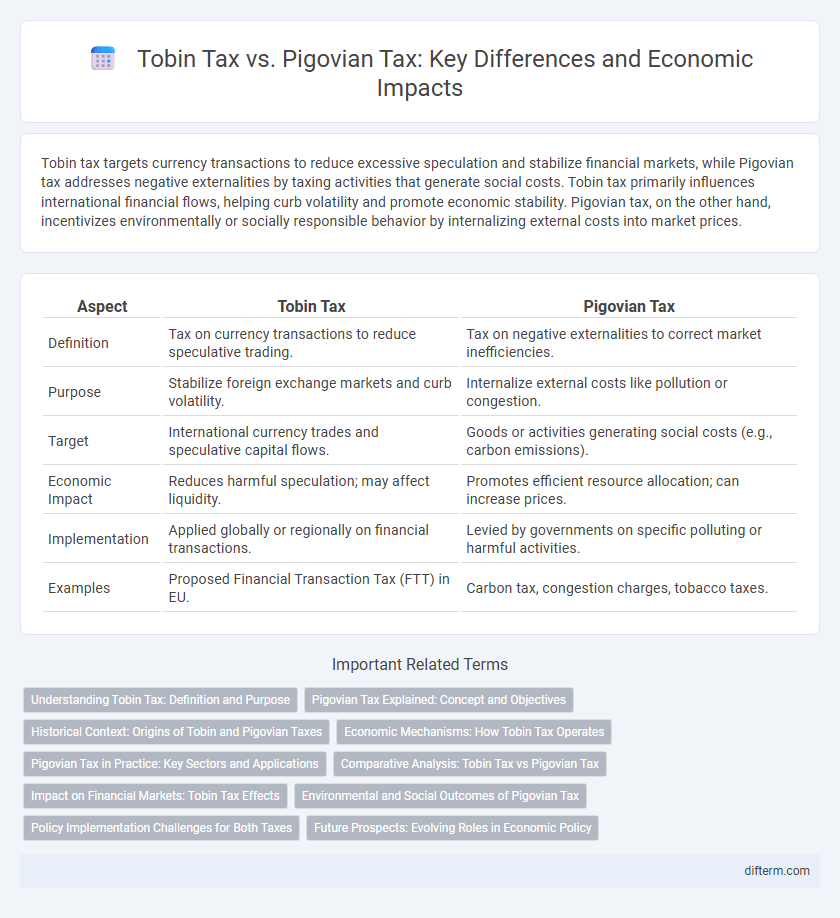

Tobin tax targets currency transactions to reduce excessive speculation and stabilize financial markets, while Pigovian tax addresses negative externalities by taxing activities that generate social costs. Tobin tax primarily influences international financial flows, helping curb volatility and promote economic stability. Pigovian tax, on the other hand, incentivizes environmentally or socially responsible behavior by internalizing external costs into market prices.

Table of Comparison

| Aspect | Tobin Tax | Pigovian Tax |

|---|---|---|

| Definition | Tax on currency transactions to reduce speculative trading. | Tax on negative externalities to correct market inefficiencies. |

| Purpose | Stabilize foreign exchange markets and curb volatility. | Internalize external costs like pollution or congestion. |

| Target | International currency trades and speculative capital flows. | Goods or activities generating social costs (e.g., carbon emissions). |

| Economic Impact | Reduces harmful speculation; may affect liquidity. | Promotes efficient resource allocation; can increase prices. |

| Implementation | Applied globally or regionally on financial transactions. | Levied by governments on specific polluting or harmful activities. |

| Examples | Proposed Financial Transaction Tax (FTT) in EU. | Carbon tax, congestion charges, tobacco taxes. |

Understanding Tobin Tax: Definition and Purpose

The Tobin tax is a levy on short-term currency transactions aimed at reducing market volatility and speculative trading, promoting greater financial stability. It targets rapid capital flows that can disrupt economies, especially in developing countries, by discouraging excessive currency speculation. Unlike the Pigovian tax, which addresses externalities like pollution, the Tobin tax specifically focuses on correcting market inefficiencies in the foreign exchange market.

Pigovian Tax Explained: Concept and Objectives

Pigovian tax aims to correct negative externalities by imposing costs equivalent to the social damage caused by harmful activities, incentivizing producers and consumers to reduce undesirable behaviors. It targets market failures where private costs diverge from social costs, promoting efficient resource allocation and environmental sustainability. Unlike the Tobin tax, which primarily focuses on financial transactions to reduce market volatility, the Pigovian tax directly addresses the external costs of pollution, congestion, and other public harms.

Historical Context: Origins of Tobin and Pigovian Taxes

The Tobin tax, proposed by economist James Tobin in the 1970s, aimed to reduce currency speculation and stabilize international financial markets by imposing a small levy on foreign exchange transactions. The Pigovian tax, rooted in the work of economist Arthur Pigou in the early 20th century, targets negative externalities such as pollution by taxing activities that generate social costs not reflected in market prices. Both taxes embody economic strategies to correct market failures, with Tobin's approach focusing on financial market volatility and Pigou's on environmental and social externalities.

Economic Mechanisms: How Tobin Tax Operates

The Tobin tax operates by imposing a small levy on currency transactions to reduce short-term speculative trading and stabilize exchange rates. This mechanism discourages rapid currency fluctuations that can lead to financial crises by increasing the cost of high-frequency trades. Unlike Pigovian taxes, which target negative externalities like pollution, the Tobin tax specifically targets financial market volatility, aiming to promote long-term investment and economic stability.

Pigovian Tax in Practice: Key Sectors and Applications

Pigovian taxes are widely applied in sectors where negative externalities impose societal costs, such as carbon emissions in energy production, tobacco consumption, and congestion pricing in urban transportation. These taxes incentivize producers and consumers to reduce harmful activities by internalizing external costs, leading to more socially optimal outcomes. In environmental policy, Pigovian taxes on pollutants have proven effective in lowering emissions and promoting sustainable practices across industries.

Comparative Analysis: Tobin Tax vs Pigovian Tax

The Tobin tax targets short-term currency speculation by imposing a small levy on foreign exchange transactions to reduce market volatility, whereas the Pigovian tax addresses negative externalities like pollution by charging producers to internalize social costs. Tobin tax primarily aims to stabilize financial markets and deter speculative capital flows, while Pigovian tax incentivizes behavioral changes to correct market inefficiencies and promote environmental sustainability. Both taxes serve as corrective fiscal tools, but their scope, purpose, and economic impact differ significantly in addressing distinct market failures.

Impact on Financial Markets: Tobin Tax Effects

The Tobin tax, a small levy on currency transactions, aims to reduce short-term speculative trading and market volatility by increasing transaction costs. Its implementation often leads to decreased liquidity and trading volume in foreign exchange markets, potentially stabilizing exchange rates but also raising concerns about market efficiency. Empirical studies suggest the Tobin tax can dampen excessive speculation but may inadvertently hinder capital flows necessary for market functioning.

Environmental and Social Outcomes of Pigovian Tax

Pigovian taxes are designed to internalize externalities by imposing costs on activities that generate negative environmental and social impacts, such as pollution or carbon emissions. These taxes incentivize businesses and individuals to reduce harmful behaviors, promoting cleaner air, water, and sustainable resource use, which leads to improved public health and ecosystem preservation. Empirical studies show that Pigovian taxes effectively reduce greenhouse gas emissions and encourage investment in green technologies, thereby supporting long-term environmental sustainability and social welfare.

Policy Implementation Challenges for Both Taxes

Tobin tax faces practical difficulties in global coordination due to varying national financial regulations, leading to potential tax evasion and market distortions. Pigovian tax implementation struggles with accurately quantifying externalities and setting effective tax rates without stifling economic growth or innovation. Both taxes require robust monitoring systems and political consensus to overcome resistance from affected industries and prevent unintended economic consequences.

Future Prospects: Evolving Roles in Economic Policy

Tobin tax and Pigovian tax are poised to play increasingly pivotal roles in shaping future economic policies by addressing financial market volatility and externalities, respectively. Emerging trends in global economic regulation underscore heightened interest in Tobin tax as a tool to curb speculative currency trading, while Pigovian tax gains traction for internalizing environmental and social costs. Policymakers are increasingly integrating these taxes into comprehensive frameworks to promote fiscal sustainability and equitable growth.

Tobin tax vs Pigovian tax Infographic

difterm.com

difterm.com