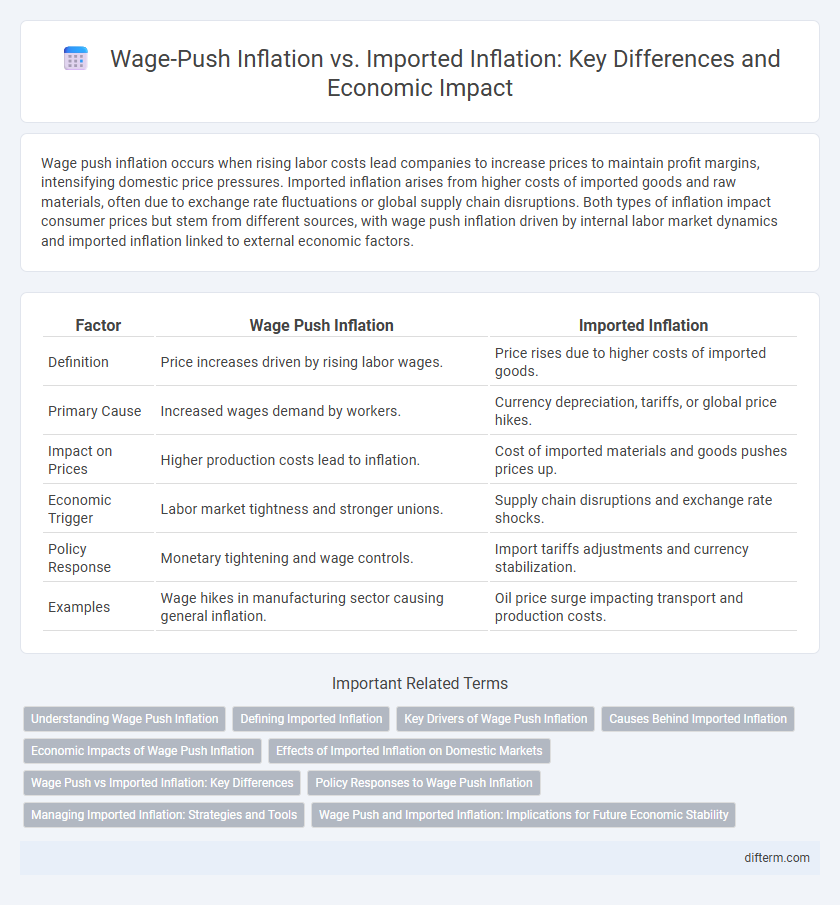

Wage push inflation occurs when rising labor costs lead companies to increase prices to maintain profit margins, intensifying domestic price pressures. Imported inflation arises from higher costs of imported goods and raw materials, often due to exchange rate fluctuations or global supply chain disruptions. Both types of inflation impact consumer prices but stem from different sources, with wage push inflation driven by internal labor market dynamics and imported inflation linked to external economic factors.

Table of Comparison

| Factor | Wage Push Inflation | Imported Inflation |

|---|---|---|

| Definition | Price increases driven by rising labor wages. | Price rises due to higher costs of imported goods. |

| Primary Cause | Increased wages demand by workers. | Currency depreciation, tariffs, or global price hikes. |

| Impact on Prices | Higher production costs lead to inflation. | Cost of imported materials and goods pushes prices up. |

| Economic Trigger | Labor market tightness and stronger unions. | Supply chain disruptions and exchange rate shocks. |

| Policy Response | Monetary tightening and wage controls. | Import tariffs adjustments and currency stabilization. |

| Examples | Wage hikes in manufacturing sector causing general inflation. | Oil price surge impacting transport and production costs. |

Understanding Wage Push Inflation

Wage push inflation occurs when rising wages increase production costs, compelling businesses to raise prices to maintain profit margins. This type of inflation primarily stems from strong labor markets and increased bargaining power among workers, often leading to a wage-price spiral. Unlike imported inflation, which results from higher costs of foreign goods and services, wage push inflation originates domestically within an economy's labor market dynamics.

Defining Imported Inflation

Imported inflation occurs when the cost of imported goods and services rises, leading to an overall increase in domestic price levels. This type of inflation is often driven by exchange rate depreciation or global commodity price shocks, which raise production costs for businesses relying on foreign inputs. Unlike wage-push inflation, which stems from rising labor costs, imported inflation directly reflects external economic pressures impacting domestic inflation rates.

Key Drivers of Wage Push Inflation

Wage push inflation is primarily driven by rising labor costs resulting from strong labor unions, tight labor markets, and increased minimum wages, which force employers to raise prices to maintain profit margins. Key drivers include higher collective bargaining power, low unemployment rates leading to wage competition, and government-mandated wage hikes. These factors intensify production costs, contrasting with imported inflation that stems from rising prices of imported goods due to exchange rate fluctuations or global supply chain disruptions.

Causes Behind Imported Inflation

Imported inflation primarily stems from increased costs of foreign goods and services, driven by currency depreciation or rising global commodity prices. Supply chain disruptions and tariffs exacerbate these price hikes by limiting the availability and increasing the costs of imports. Fluctuations in exchange rates directly impact the local currency value of imported products, contributing significantly to inflationary pressures.

Economic Impacts of Wage Push Inflation

Wage push inflation primarily drives higher production costs as rising wages increase business expenses, leading to price hikes in goods and services. This inflationary pressure can reduce corporate profit margins, constrain investment, and erode consumer purchasing power, slowing overall economic growth. In contrast to imported inflation, which stems from external price shocks, wage push inflation originates domestically, often causing persistent inflation due to rising labor costs.

Effects of Imported Inflation on Domestic Markets

Imported inflation significantly raises production costs by increasing prices of raw materials and intermediate goods, leading to higher consumer prices in domestic markets. Exchange rate depreciation amplifies this effect by making imported goods more expensive, which pressures local businesses to adjust their pricing strategies. Persistent imported inflation reduces purchasing power, squeezes profit margins, and can trigger a wage-price spiral as workers demand higher salaries to cope with rising living costs.

Wage Push vs Imported Inflation: Key Differences

Wage push inflation arises when rising labor costs lead to increased production expenses, causing overall price levels to climb, often driven by strong wage demands or tight labor markets. Imported inflation occurs when higher prices for imported goods, frequently due to exchange rate depreciation or global commodity price increases, raise domestic inflation. The key difference lies in wage push inflation originating internally from labor market conditions, while imported inflation results from external factors affecting the cost of foreign goods and services.

Policy Responses to Wage Push Inflation

Policy responses to wage push inflation often include tightening monetary policy through interest rate hikes to curb excessive wage growth and reduce inflationary pressures. Governments may also implement wage controls or moderate public sector wage increases to stabilize labor costs without triggering higher inflation. Coordinated dialogue between policymakers, employers, and labor unions can help balance wage demands with productivity improvements, mitigating the risk of sustained wage-driven inflation.

Managing Imported Inflation: Strategies and Tools

Managing imported inflation requires strategic currency stabilization and supply chain diversification to mitigate cost shocks from foreign goods and services. Central banks often employ targeted monetary policies, including foreign exchange interventions, to reduce volatility and control price rises linked to import dependence. Governments can negotiate trade agreements and promote local production to decrease reliance on imports, thereby dampening imported inflation's impact on the domestic economy.

Wage Push and Imported Inflation: Implications for Future Economic Stability

Wage push inflation rises when increased labor costs drive overall price levels higher, often reflecting tight labor markets and strong wage demands that can erode profit margins and consumer purchasing power. Imported inflation occurs when the cost of imported goods and raw materials escalates due to exchange rate fluctuations or global supply chain disruptions, directly increasing domestic prices. Understanding the balance between wage push and imported inflation is crucial for policymakers aiming to maintain future economic stability while calibrating monetary and fiscal measures effectively.

Wage push inflation vs Imported inflation Infographic

difterm.com

difterm.com