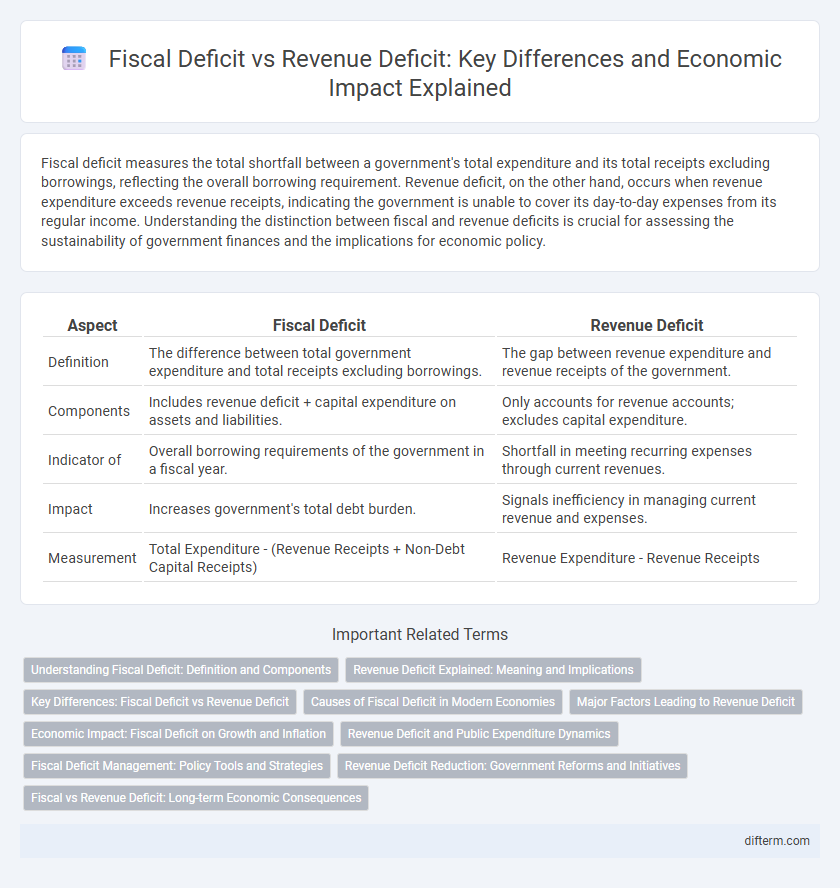

Fiscal deficit measures the total shortfall between a government's total expenditure and its total receipts excluding borrowings, reflecting the overall borrowing requirement. Revenue deficit, on the other hand, occurs when revenue expenditure exceeds revenue receipts, indicating the government is unable to cover its day-to-day expenses from its regular income. Understanding the distinction between fiscal and revenue deficits is crucial for assessing the sustainability of government finances and the implications for economic policy.

Table of Comparison

| Aspect | Fiscal Deficit | Revenue Deficit |

|---|---|---|

| Definition | The difference between total government expenditure and total receipts excluding borrowings. | The gap between revenue expenditure and revenue receipts of the government. |

| Components | Includes revenue deficit + capital expenditure on assets and liabilities. | Only accounts for revenue accounts; excludes capital expenditure. |

| Indicator of | Overall borrowing requirements of the government in a fiscal year. | Shortfall in meeting recurring expenses through current revenues. |

| Impact | Increases government's total debt burden. | Signals inefficiency in managing current revenue and expenses. |

| Measurement | Total Expenditure - (Revenue Receipts + Non-Debt Capital Receipts) | Revenue Expenditure - Revenue Receipts |

Understanding Fiscal Deficit: Definition and Components

Fiscal deficit represents the shortfall between a government's total expenditure and its total revenue, excluding borrowings, highlighting the need for external financing. It comprises revenue deficit and capital expenditure, with revenue deficit indicating the gap between revenue expenditure and revenue receipts. Understanding these components is crucial for analyzing a country's fiscal health and sustainability of public finances.

Revenue Deficit Explained: Meaning and Implications

Revenue deficit occurs when a government's revenue expenditure surpasses its revenue receipts, indicating that current income is insufficient to cover daily operations. This deficit highlights a borrow-to-spend situation on routine expenses rather than investment, reflecting fiscal imbalance and affecting economic stability. Persistent revenue deficits can lead to higher fiscal deficits, increased borrowing costs, and limited funds for capital investments critical for economic growth.

Key Differences: Fiscal Deficit vs Revenue Deficit

Fiscal deficit measures the total shortfall between government expenditure and total receipts excluding borrowings, reflecting the overall borrowing requirement. Revenue deficit occurs when the government's revenue expenditure exceeds its revenue receipts, indicating a shortfall in funds required for day-to-day operations. The fiscal deficit includes both revenue and capital expenditures, while the revenue deficit strictly pertains to revenue accounts, highlighting different aspects of fiscal health.

Causes of Fiscal Deficit in Modern Economies

Fiscal deficit in modern economies primarily stems from increased government expenditure on social welfare, infrastructure development, and subsidies while revenue growth remains sluggish due to lower tax compliance and stagnant economic performance. External factors such as global economic slowdowns and currency depreciation exacerbate the fiscal imbalance by reducing export revenues and increasing debt servicing costs. Structural issues like inefficient tax administration and persistent budgetary rigidities further contribute to the widening fiscal deficit.

Major Factors Leading to Revenue Deficit

Revenue deficit primarily arises from a gap between the government's total revenue receipts and its revenue expenditure, indicating that the government is unable to cover its day-to-day expenses through regular income sources like taxes. Major factors leading to revenue deficit include poor tax compliance, lower than expected non-tax revenue, subsidy burdens, and high interest payments on previous debts. Structural issues such as inefficient public sector enterprises and underperformance in key revenue-generating sectors further exacerbate the revenue shortfall.

Economic Impact: Fiscal Deficit on Growth and Inflation

Fiscal deficit measures the total shortfall of the government's revenue relative to its expenditures, reflecting the need for borrowing that can stimulate economic growth by financing infrastructure and development projects. However, sustained fiscal deficits may lead to inflationary pressures as increased government spending boosts aggregate demand beyond the economy's productive capacity. High fiscal deficits can crowd out private investment, raising interest rates and potentially slowing long-term economic growth while exacerbating inflation risks.

Revenue Deficit and Public Expenditure Dynamics

Revenue deficit measures the gap between the government's net income and its total expenditure, highlighting the shortfall in funds available to cover operational costs. High revenue deficits indicate excessive public expenditure on subsidies, salaries, and interest payments, which strains fiscal resources and limits investment capacity. Understanding revenue deficit dynamics is crucial for fiscal consolidation, as persistent deficits can lead to unsustainable borrowing and impact economic stability.

Fiscal Deficit Management: Policy Tools and Strategies

Fiscal deficit management relies on policy tools like expenditure rationalization, enhancing tax revenues through broadening the tax base, and prudent borrowing strategies to balance growth and fiscal sustainability. Strategies include implementing expenditure ceilings, improving tax administration efficiency, and adopting medium-term fiscal frameworks to ensure transparent and accountable deficit control. Effective fiscal deficit management promotes macroeconomic stability by reducing inflationary pressures and maintaining investor confidence.

Revenue Deficit Reduction: Government Reforms and Initiatives

The government has implemented targeted fiscal reforms and expenditure rationalization to achieve significant revenue deficit reduction, enhancing fiscal stability and investor confidence. Measures such as broadening the tax base, improving tax compliance through digitalization, and curbing non-essential subsidies have directly contributed to narrowing the revenue gap. These initiatives align with sustainable fiscal management goals, ensuring improved allocation of resources for growth-oriented public spending.

Fiscal vs Revenue Deficit: Long-term Economic Consequences

Fiscal deficit, representing the gap between total government expenditure and total revenue excluding borrowings, signals the need for external financing and can lead to higher public debt and interest burdens over time. Revenue deficit, reflecting the shortfall in government's regular income compared to its revenue expenditure, indicates that even operational costs are not covered, necessitating borrowing that may crowd out productive investments. Persistent fiscal deficits can undermine economic stability by increasing inflationary pressures, while sustained revenue deficits often impede the government's ability to finance essential services, ultimately constraining long-term economic growth and development.

Fiscal Deficit vs Revenue Deficit Infographic

difterm.com

difterm.com