A Triple Net Lease (NNN) requires tenants to cover property taxes, insurance, and maintenance costs in addition to rent, reducing the landlord's financial responsibilities. Full Service Leases include all operating expenses in the rent, simplifying budgeting for tenants but often resulting in higher monthly payments. Understanding these differences helps investors and tenants choose lease structures that align with their financial goals and management preferences.

Table of Comparison

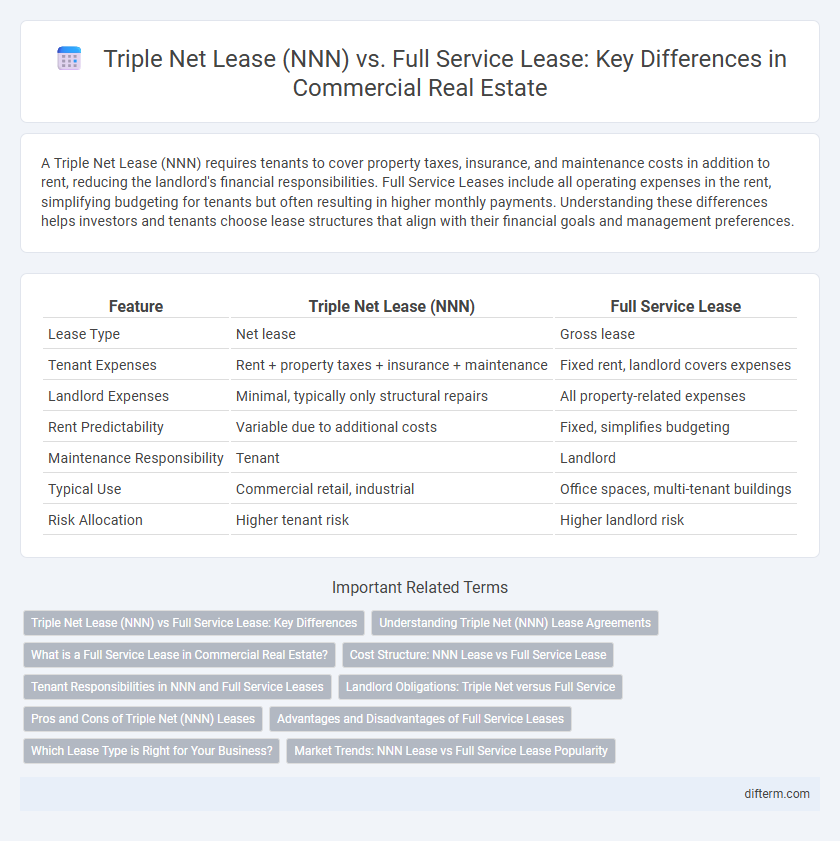

| Feature | Triple Net Lease (NNN) | Full Service Lease |

|---|---|---|

| Lease Type | Net lease | Gross lease |

| Tenant Expenses | Rent + property taxes + insurance + maintenance | Fixed rent, landlord covers expenses |

| Landlord Expenses | Minimal, typically only structural repairs | All property-related expenses |

| Rent Predictability | Variable due to additional costs | Fixed, simplifies budgeting |

| Maintenance Responsibility | Tenant | Landlord |

| Typical Use | Commercial retail, industrial | Office spaces, multi-tenant buildings |

| Risk Allocation | Higher tenant risk | Higher landlord risk |

Triple Net Lease (NNN) vs Full Service Lease: Key Differences

Triple Net Lease (NNN) requires tenants to cover property taxes, insurance, and maintenance costs separately from rent, while Full Service Lease includes these expenses within a single rent payment, offering predictable monthly costs. NNN leases are common in commercial real estate, providing landlords with reduced financial risk and tenants with cost transparency. In contrast, Full Service Leases favor tenants seeking simplicity and fewer management responsibilities.

Understanding Triple Net (NNN) Lease Agreements

Triple Net (NNN) lease agreements require tenants to pay property taxes, insurance, and maintenance costs in addition to base rent, transferring substantial operational responsibilities from landlords to tenants. This lease structure benefits landlords by reducing management burdens and ensuring predictable net income, while tenants gain more control over property expenses. Understanding these financial obligations is crucial for investors and tenants to evaluate risk, cash flow, and long-term cost efficiency in commercial real estate agreements.

What is a Full Service Lease in Commercial Real Estate?

A Full Service Lease in commercial real estate requires the landlord to cover all property expenses, including taxes, insurance, and maintenance, bundled into the tenant's rent. This lease type simplifies budgeting for tenants by eliminating variable costs and providing predictable monthly payments. It contrasts with a Triple Net Lease (NNN), where tenants bear these additional expenses separately, often resulting in lower base rent but higher overall cost variability.

Cost Structure: NNN Lease vs Full Service Lease

Triple Net Lease (NNN) requires tenants to pay base rent plus property taxes, insurance, and maintenance costs, making monthly expenses more variable but often lower initially. Full Service Lease incorporates all operating expenses, including taxes, insurance, and maintenance, into a single fixed rent payment, providing predictable and stable monthly costs. Understanding these cost structures is crucial for tenants evaluating cash flow management and long-term financial commitments in commercial real estate leases.

Tenant Responsibilities in NNN and Full Service Leases

In a Triple Net Lease (NNN), tenants bear responsibility for property taxes, insurance, and maintenance costs, resulting in greater control but increased financial obligations. Full Service Leases transfer these operating expenses to landlords, as tenants pay a single rent amount covering all property-related costs, simplifying budgeting. Understanding these distinctions in tenant responsibilities is crucial for real estate investors and businesses when negotiating lease terms and managing cash flow.

Landlord Obligations: Triple Net versus Full Service

In a Triple Net Lease (NNN), landlords have minimal obligations, primarily ensuring structural integrity and addressing major repairs, as tenants bear most operating expenses including taxes, insurance, and maintenance. Full Service Leases require landlords to cover all operating costs such as property taxes, insurance, maintenance, and utilities, providing tenants with a predictable, all-inclusive rent. This fundamental difference shifts financial risk and operational responsibilities from landlords to tenants in NNN leases, while full service leases place the burden squarely on the landlord.

Pros and Cons of Triple Net (NNN) Leases

Triple Net (NNN) leases require tenants to pay property taxes, insurance, and maintenance costs, reducing landlord responsibilities and ensuring stable cash flow. Tenants benefit from lower base rent but face unpredictable expenses due to variable operating costs. The NNN structure shifts financial risk to tenants, which can deter risk-averse lessees but attract those seeking greater control over property expenses.

Advantages and Disadvantages of Full Service Leases

Full Service Leases offer tenants the convenience of predictable monthly expenses by including property taxes, insurance, and maintenance costs in one rent payment, reducing administrative burdens and unexpected costs. However, landlords may pass on inefficiencies or increased operating expenses to tenants, potentially leading to higher overall rent compared to Triple Net Leases where tenants pay actual expenses separately. Tenants benefit from service management and simplified budgeting but may lack transparency and control over specific operating costs, which can be a disadvantage in fluctuating market conditions.

Which Lease Type is Right for Your Business?

Choosing between a Triple Net Lease (NNN) and a Full Service Lease depends on your business's financial predictability and maintenance preferences. NNN leases require tenants to pay property taxes, insurance, and maintenance costs, offering lower base rent but variable expenses, ideal for businesses seeking control over property management. Full Service Leases bundle all expenses into a single rent payment, providing consistent costs and less administrative burden, making them suitable for companies valuing simplicity and budget stability.

Market Trends: NNN Lease vs Full Service Lease Popularity

Triple Net Leases (NNN) have gained popularity in commercial real estate markets due to their lower base rents and predictable expense responsibilities for tenants, appealing to investors seeking stable cash flows. Full Service Leases continue to dominate in high-demand urban areas where tenants prefer all-inclusive costs and simplified expense management. Market trends indicate a growing preference for NNN leases in suburban and industrial sectors, while full service leases remain favored in office and retail spaces with high tenant turnover.

Triple Net Lease (NNN) vs Full Service Lease Infographic

difterm.com

difterm.com