Pass-through expenses in real estate refer to operating costs that landlords pass directly to tenants, such as utilities and maintenance fees, which fluctuate monthly based on actual usage. Base year expenses are fixed amounts determined during the lease's inception, where tenants pay increases only if actual costs exceed the base year benchmark. Understanding the difference helps tenants anticipate variable charges and negotiate fair lease terms.

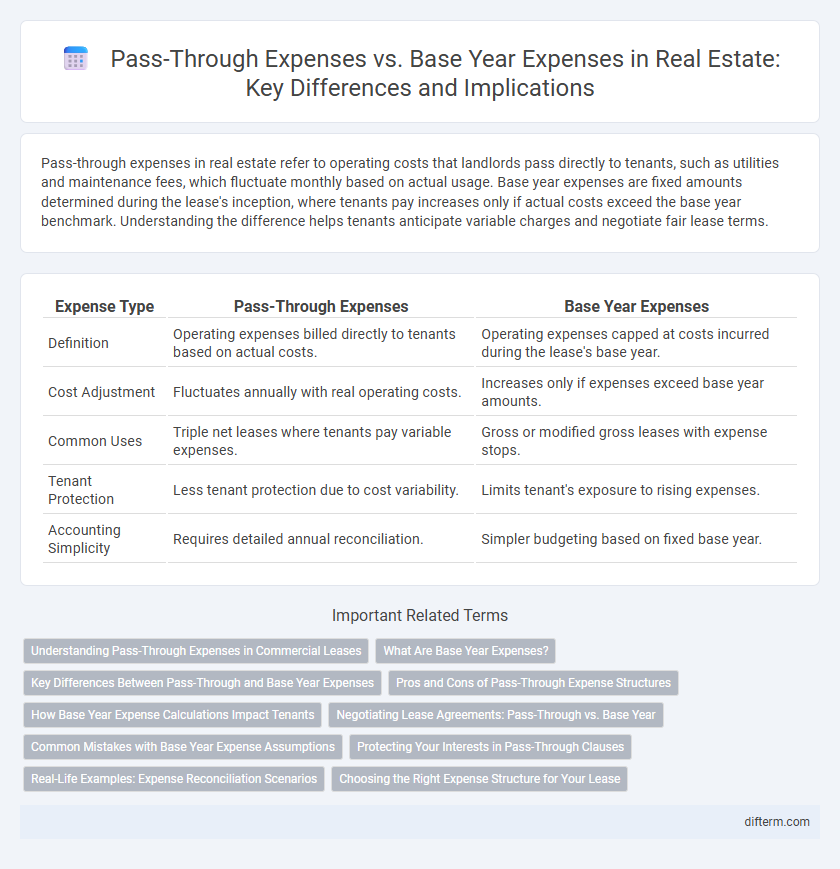

Table of Comparison

| Expense Type | Pass-Through Expenses | Base Year Expenses |

|---|---|---|

| Definition | Operating expenses billed directly to tenants based on actual costs. | Operating expenses capped at costs incurred during the lease's base year. |

| Cost Adjustment | Fluctuates annually with real operating costs. | Increases only if expenses exceed base year amounts. |

| Common Uses | Triple net leases where tenants pay variable expenses. | Gross or modified gross leases with expense stops. |

| Tenant Protection | Less tenant protection due to cost variability. | Limits tenant's exposure to rising expenses. |

| Accounting Simplicity | Requires detailed annual reconciliation. | Simpler budgeting based on fixed base year. |

Understanding Pass-Through Expenses in Commercial Leases

Pass-through expenses in commercial leases refer to operating costs such as property taxes, insurance, and maintenance fees that landlords pass directly to tenants, allowing for accurate cost allocation based on actual usage or lease terms. These expenses contrast with base year expenses, where tenants pay increases above a predefined base year amount, which may not reflect current costs. Understanding pass-through expenses helps tenants anticipate variable costs and negotiate transparent lease agreements that align expenses with the property's ongoing operational costs.

What Are Base Year Expenses?

Base year expenses refer to the operating costs of a commercial property during the initial lease year, serving as a benchmark for calculating tenant responsibility in subsequent years. These expenses typically include property taxes, insurance, and maintenance costs, which tenants pay only when they exceed the base year amount. Understanding base year expenses is crucial for commercial real estate leases structured as triple net (NNN) or modified gross, where tenants share increases in operating costs beyond the established baseline.

Key Differences Between Pass-Through and Base Year Expenses

Pass-through expenses refer to operating costs that landlords charge tenants directly, often including utilities, property taxes, and maintenance fees, which fluctuate based on actual usage or changes. Base year expenses establish a fixed baseline for certain operating costs in a commercial lease, with tenants paying only increases above this initial year's expenses, ensuring predictability in future charges. The key difference lies in pass-through expenses reflecting real-time costs passed to tenants, while base year expenses create a stable reference point for incremental expense adjustments.

Pros and Cons of Pass-Through Expense Structures

Pass-through expense structures allow landlords to directly transfer property operating costs such as maintenance, taxes, and insurance to tenants, promoting transparent cost allocation and reducing landlord risk exposure. This approach incentivizes tenants to minimize expenses but can create budgeting uncertainty due to variable monthly charges, potentially leading to disputes over expense calculations. While pass-through arrangements increase financial clarity and align tenant usage with costs, they require detailed accounting and tenant diligence to manage fluctuations effectively.

How Base Year Expense Calculations Impact Tenants

Base year expense calculations establish a fixed baseline for operating costs, ensuring tenants are responsible only for increases in expenses beyond that initial year, which helps control unpredictable rent escalations. This system allows landlords to pass through variable expenses, such as maintenance and property taxes, while protecting tenants from sudden spikes in costs incurred before their lease began. Tenants benefit from clearer budgeting and financial planning since pass-through expenses are incremental and tied directly to actual increases over the base year.

Negotiating Lease Agreements: Pass-Through vs. Base Year

Negotiating lease agreements requires a clear understanding of pass-through expenses and base year expenses, as these terms impact tenant costs directly. Pass-through expenses allocate actual operating costs such as property taxes, insurance, and maintenance proportionally to tenants, while base year expenses establish a fixed expense baseline that tenants pay only for increases beyond that year. Evaluating the landlord's expense history and market standards helps tenants negotiate fair terms, minimizing unexpected financial liabilities over the lease term.

Common Mistakes with Base Year Expense Assumptions

Confusing pass-through expenses with base year expenses often leads to inaccurate tenant cost projections and disputes over reimbursements. A common mistake is assuming all operating expense increases are recoverable when base year expenses only allow tenants to pay incremental increases beyond a fixed baseline. Misinterpreting base year expense assumptions risks overestimating tenant obligations and undermines effective lease negotiations in commercial real estate.

Protecting Your Interests in Pass-Through Clauses

Pass-through expenses in commercial leases require tenants to pay their share of property operating costs, while base year expenses limit increases to costs above a specified baseline year. Carefully reviewing pass-through clauses ensures tenants are not overcharged for expenses unrelated to their occupancy or overall property maintenance. Protecting your interests involves negotiating clear definitions, caps on expense increases, and the right to audit landlord records to verify accurate billing.

Real-Life Examples: Expense Reconciliation Scenarios

Pass-through expenses in commercial leases refer to costs such as property taxes, insurance, and maintenance fees that tenants reimburse based on actual expenses incurred, while base year expenses set a fixed reference point for calculating future expense increases. In real-life scenarios, if a tenant's base year is 2023 with $50,000 in operating expenses, any increase in subsequent years, like $55,000 in 2024, results in the tenant paying the $5,000 difference. Conversely, pass-through expenses require tenants to pay their proportionate share of actual expenses annually, which can fluctuate more unpredictably based on market conditions and property management decisions.

Choosing the Right Expense Structure for Your Lease

Pass-through expenses allow landlords to recover variable operating costs such as utilities, property taxes, and maintenance directly from tenants, ensuring transparency and alignment with actual property usage. Base year expenses limit tenant payments to increases over a specified baseline year, providing predictable costs but potentially shifting financial risks if expenses fluctuate widely. Selecting the appropriate expense structure depends on balancing risk tolerance, budgeting preferences, and the specific lease terms negotiated between landlord and tenant.

Pass-through expenses vs Base year expenses Infographic

difterm.com

difterm.com