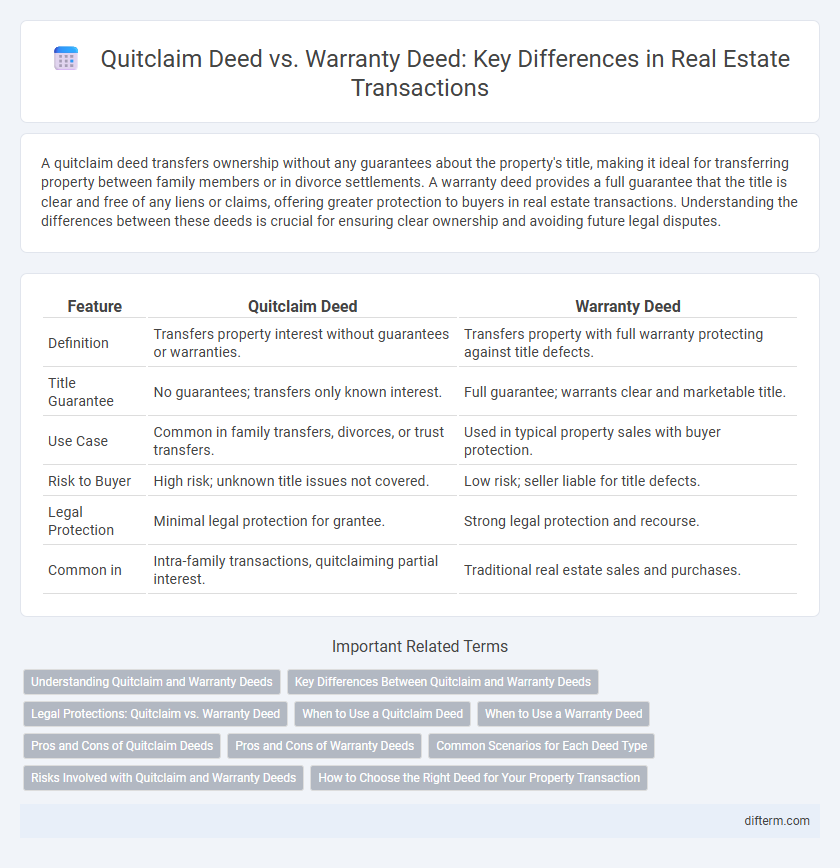

A quitclaim deed transfers ownership without any guarantees about the property's title, making it ideal for transferring property between family members or in divorce settlements. A warranty deed provides a full guarantee that the title is clear and free of any liens or claims, offering greater protection to buyers in real estate transactions. Understanding the differences between these deeds is crucial for ensuring clear ownership and avoiding future legal disputes.

Table of Comparison

| Feature | Quitclaim Deed | Warranty Deed |

|---|---|---|

| Definition | Transfers property interest without guarantees or warranties. | Transfers property with full warranty protecting against title defects. |

| Title Guarantee | No guarantees; transfers only known interest. | Full guarantee; warrants clear and marketable title. |

| Use Case | Common in family transfers, divorces, or trust transfers. | Used in typical property sales with buyer protection. |

| Risk to Buyer | High risk; unknown title issues not covered. | Low risk; seller liable for title defects. |

| Legal Protection | Minimal legal protection for grantee. | Strong legal protection and recourse. |

| Common in | Intra-family transactions, quitclaiming partial interest. | Traditional real estate sales and purchases. |

Understanding Quitclaim and Warranty Deeds

Quitclaim deeds transfer ownership interest in a property without guarantees about the title's validity, often used between family members or to clear up title issues. Warranty deeds provide a full guarantee that the seller holds clear title and has the legal right to sell, protecting the buyer from future claims. Understanding the differences helps buyers and sellers choose the appropriate deed for secure real estate transactions.

Key Differences Between Quitclaim and Warranty Deeds

Quitclaim deeds transfer a seller's interest in a property without any guarantees about the title's validity or defects, offering minimal protection to the buyer. Warranty deeds provide a full legal guarantee that the seller holds clear title to the property, ensuring protection against future claims or liens. The key differences lie in the level of title assurance and liability, with warranty deeds providing comprehensive warranties and quitclaim deeds conveying ownership "as-is" without warranties.

Legal Protections: Quitclaim vs. Warranty Deed

A Warranty Deed offers comprehensive legal protections by guaranteeing clear title and defending against future claims or liens, making it the preferred choice for buyers seeking security. In contrast, a Quitclaim Deed transfers ownership without any warranties, providing no assurance against title defects or encumbrances. Understanding these legal distinctions is critical in real estate transactions to ensure the extent of title protection matches the risk tolerance of parties involved.

When to Use a Quitclaim Deed

A quitclaim deed is ideal for transferring property ownership quickly between familiar parties, such as family members or divorcing spouses, where warranty protections are less critical. It conveys whatever interest the grantor has without guaranteeing the title's validity, making it unsuitable for sales involving third parties or where clear title assurance is necessary. Use a quitclaim deed primarily in intra-family transfers, correcting title defects, or removing a name from the deed.

When to Use a Warranty Deed

A Warranty Deed is essential when purchasing property to ensure the buyer receives clear title with legally guaranteed protections against future claims. This deed is typically used in traditional real estate transactions involving third-party buyers to provide warranties covering the property's entire history. It is most appropriate when thorough title assurance is necessary to secure ownership and avoid potential legal disputes.

Pros and Cons of Quitclaim Deeds

Quitclaim deeds offer a quick and simple way to transfer property ownership without warranties, making them ideal for transfers between family members or in divorce settlements. They provide limited protection to the grantee because the grantor does not guarantee clear title, increasing the risk of undisclosed liens or claims. Due to this lack of warranty, quitclaim deeds are generally not recommended for traditional real estate transactions where title assurance is critical.

Pros and Cons of Warranty Deeds

Warranty deeds offer the strongest protection for real estate buyers by guaranteeing clear title and defending against future claims, ensuring legal recourse if issues arise. The comprehensive nature of warranty deeds requires sellers to disclose and address any title defects, which can delay transactions and increase complexity. Buyers benefit from increased security and peace of mind, while sellers may face greater liability and responsibilities compared to quitclaim deeds.

Common Scenarios for Each Deed Type

Quitclaim deeds are often used in scenarios involving intra-family property transfers, divorce settlements, or clearing up title issues due to their simplicity and lack of guarantees. Warranty deeds are commonly utilized in traditional real estate sales, ensuring the buyer receives clear title with full legal protections against past claims or liens. Investors and lenders prefer warranty deeds for their assurance of title integrity and buyer protection in market transactions.

Risks Involved with Quitclaim and Warranty Deeds

Quitclaim deeds transfer property ownership without guaranteeing clear title, exposing buyers to potential risks such as undisclosed liens or ownership disputes. Warranty deeds provide buyers with assurances and legal protections against title defects, significantly reducing risks by guaranteeing the seller's clear ownership and the right to transfer the property. Choosing a quitclaim deed increases the likelihood of legal complications, while warranty deeds offer greater security in real estate transactions.

How to Choose the Right Deed for Your Property Transaction

Choosing the right deed for your property transaction depends on the level of protection and assurance you need as a buyer or seller. A warranty deed guarantees clear title and protects against any past ownership claims, making it ideal for purchasing property from unknown sellers. Conversely, a quitclaim deed transfers whatever interest the grantor has without guarantees, often used between family members or to clear title issues.

Quitclaim Deed vs Warranty Deed Infographic

difterm.com

difterm.com