A Comparative Market Analysis (CMA) helps real estate professionals estimate a property's value based on recent sales of similar homes in the area, providing a strategic pricing tool for sellers and buyers. An appraisal, conducted by a licensed appraiser, offers an official and unbiased valuation used primarily for loan underwriting and financing approval. Understanding the difference ensures buyers, sellers, and agents can make informed decisions regarding property pricing and market positioning.

Table of Comparison

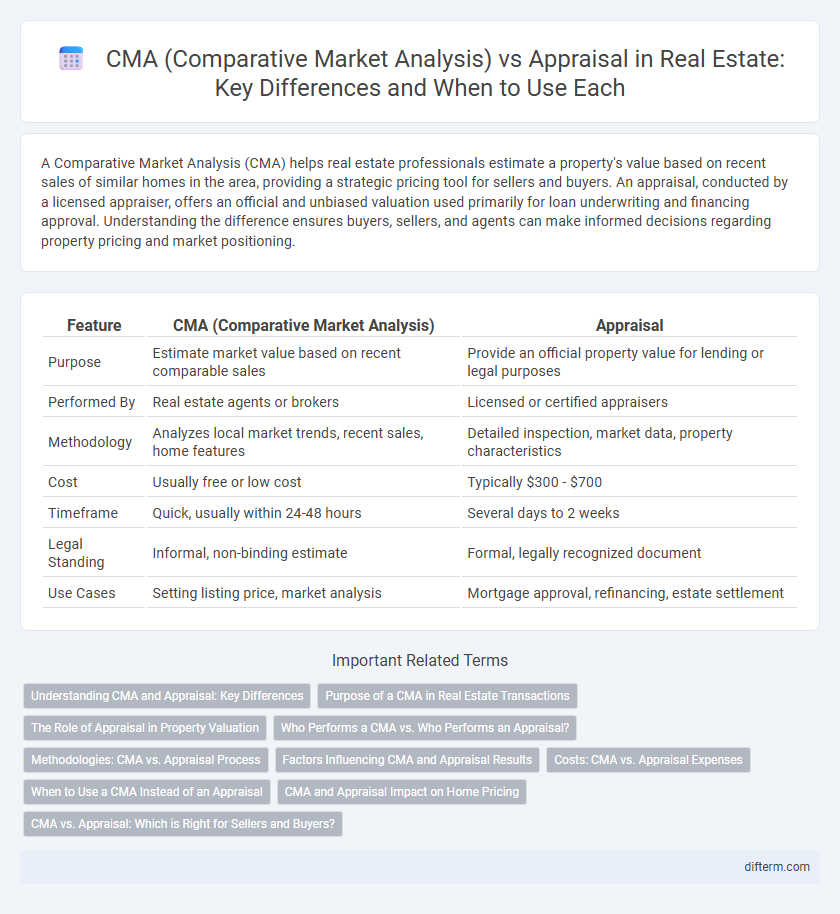

| Feature | CMA (Comparative Market Analysis) | Appraisal |

|---|---|---|

| Purpose | Estimate market value based on recent comparable sales | Provide an official property value for lending or legal purposes |

| Performed By | Real estate agents or brokers | Licensed or certified appraisers |

| Methodology | Analyzes local market trends, recent sales, home features | Detailed inspection, market data, property characteristics |

| Cost | Usually free or low cost | Typically $300 - $700 |

| Timeframe | Quick, usually within 24-48 hours | Several days to 2 weeks |

| Legal Standing | Informal, non-binding estimate | Formal, legally recognized document |

| Use Cases | Setting listing price, market analysis | Mortgage approval, refinancing, estate settlement |

Understanding CMA and Appraisal: Key Differences

A Comparative Market Analysis (CMA) is a report prepared by real estate agents using recent sales data of similar properties to estimate a home's market value, primarily aiding sellers and buyers in pricing decisions. An appraisal is a formal evaluation conducted by a licensed appraiser, following standardized methods and regulations, to provide an objective, certified property value often required by lenders for mortgage approval. While CMA offers a market-driven estimate based on current trends, appraisals deliver an independent, legally recognized property valuation critical for financing and legal purposes.

Purpose of a CMA in Real Estate Transactions

A Comparative Market Analysis (CMA) in real estate serves to estimate a property's current market value by comparing it with recently sold, active, and expired listings in the same area. Unlike appraisals, which provide an official valuation for lending or legal purposes conducted by licensed appraisers, CMAs guide sellers and buyers in setting competitive prices and making informed offers. Accurate CMAs help real estate agents strategically position properties for sale to attract potential buyers and expedite transactions.

The Role of Appraisal in Property Valuation

Appraisal plays a critical role in property valuation by providing an unbiased, professional estimate of a home's market value based on detailed inspections and market data analysis. Unlike a Comparative Market Analysis (CMA), which is typically prepared by real estate agents using recent sales of similar properties, an appraisal is conducted by certified appraisers adhering to standardized protocols and legal requirements. The appraisal is essential for securing mortgage financing, ensuring lender confidence, and offering legal protection in high-stake real estate transactions.

Who Performs a CMA vs. Who Performs an Appraisal?

A Comparative Market Analysis (CMA) is typically performed by a licensed real estate agent or broker who uses recent sales data of similar properties to estimate a home's market value. An appraisal is conducted by a certified appraiser, a licensed professional trained to provide an unbiased, detailed valuation often required by lenders during the mortgage approval process. While CMAs are used primarily for pricing strategies in real estate transactions, appraisals have legal and financial significance in verifying property value.

Methodologies: CMA vs. Appraisal Process

CMA involves analyzing recently sold properties, active listings, and expired listings within a specific area to estimate a home's market value using current market trends and comparable sales data. The appraisal process requires a licensed appraiser to conduct an in-depth property inspection, evaluate physical conditions, and apply standardized valuation methods such as the cost, income, or sales comparison approaches. While CMA relies on accessible market data for valuation estimates, appraisals provide a more formal and regulated assessment critical for financing and legal purposes.

Factors Influencing CMA and Appraisal Results

CMA results are influenced by recent sales data, property location, size, and condition, reflecting current market trends to estimate a home's value. Appraisal outcomes depend on a licensed appraiser's assessment, incorporating property features, comparable sales, and local market conditions, often for lending purposes. Both methods weigh factors like neighborhood desirability and market demand but differ in purpose and methodology, impacting final valuation discrepancies.

Costs: CMA vs. Appraisal Expenses

A Comparative Market Analysis (CMA) is typically free or low-cost, performed by real estate agents to estimate property value using recent sales data of similar homes. In contrast, an appraisal involves a licensed appraiser conducting a detailed, formal evaluation, usually costing between $300 and $600 depending on the property's size and location. Homeowners and buyers often opt for a CMA for preliminary assessments to save money, while an appraisal is necessary for mortgage approval and legal transactions due to its official status.

When to Use a CMA Instead of an Appraisal

A Comparative Market Analysis (CMA) is ideal when a real estate agent or seller needs a quick, cost-effective estimate of a property's value based on recent sales of similar homes in the area. Unlike an appraisal, which is conducted by a licensed appraiser and required for mortgage financing or legal purposes, a CMA is primarily used during the listing process to set a competitive asking price. Sellers and agents typically use a CMA to gauge market trends and adjust pricing strategies without the expense and formality of a full appraisal.

CMA and Appraisal Impact on Home Pricing

A Comparative Market Analysis (CMA) uses recent sales data of similar properties to estimate a home's market value, providing real-time pricing insight for sellers and buyers in competitive markets. An appraisal, conducted by a licensed professional, offers a formal and objective valuation, often required by lenders to confirm a home's worth for mortgage approval. While CMAs influence listing strategies and negotiation, appraisals impact final sale prices and financing decisions, making both essential for accurate home pricing.

CMA vs. Appraisal: Which is Right for Sellers and Buyers?

A Comparative Market Analysis (CMA) provides sellers and buyers with an estimated property value based on recent sales of similar homes in the area, making it ideal for pricing strategies and quick market assessments. In contrast, an appraisal is a formal, lender-ordered evaluation conducted by a licensed appraiser, offering an accurate, unbiased property value often required during financing or legal transactions. Sellers seeking competitive pricing and buyers wanting market trends should rely on CMA, while those needing official valuation for loans or legal purposes must opt for an appraisal.

CMA (Comparative Market Analysis) vs Appraisal Infographic

difterm.com

difterm.com