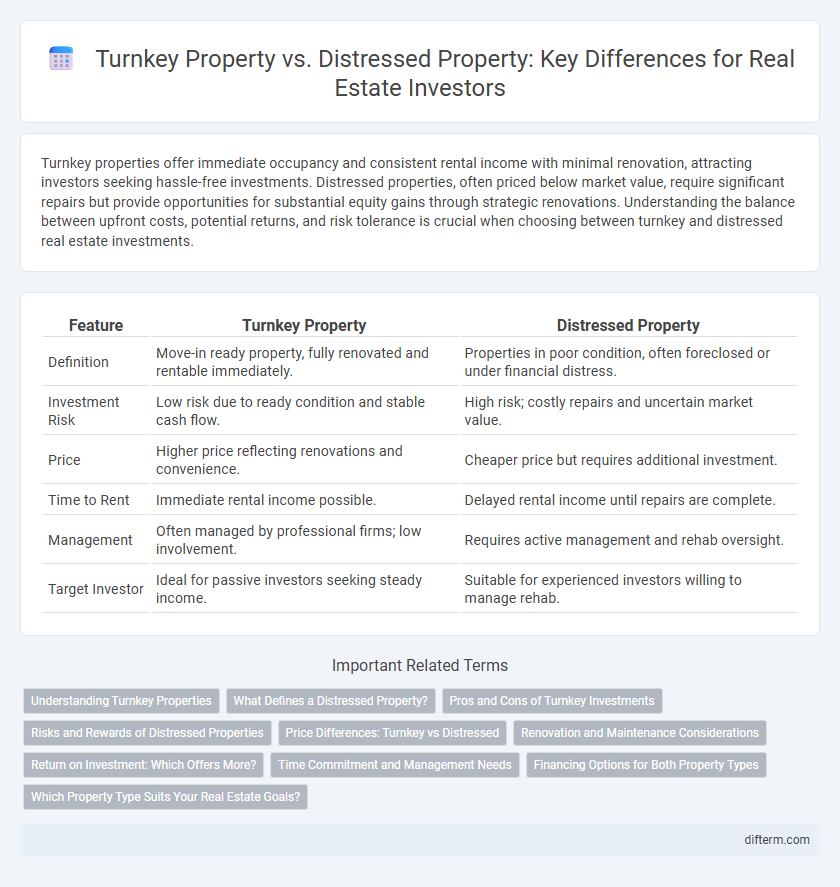

Turnkey properties offer immediate occupancy and consistent rental income with minimal renovation, attracting investors seeking hassle-free investments. Distressed properties, often priced below market value, require significant repairs but provide opportunities for substantial equity gains through strategic renovations. Understanding the balance between upfront costs, potential returns, and risk tolerance is crucial when choosing between turnkey and distressed real estate investments.

Table of Comparison

| Feature | Turnkey Property | Distressed Property |

|---|---|---|

| Definition | Move-in ready property, fully renovated and rentable immediately. | Properties in poor condition, often foreclosed or under financial distress. |

| Investment Risk | Low risk due to ready condition and stable cash flow. | High risk; costly repairs and uncertain market value. |

| Price | Higher price reflecting renovations and convenience. | Cheaper price but requires additional investment. |

| Time to Rent | Immediate rental income possible. | Delayed rental income until repairs are complete. |

| Management | Often managed by professional firms; low involvement. | Requires active management and rehab oversight. |

| Target Investor | Ideal for passive investors seeking steady income. | Suitable for experienced investors willing to manage rehab. |

Understanding Turnkey Properties

Turnkey properties are fully renovated homes that require little to no immediate repairs, making them ideal for investors seeking hassle-free income generation. Unlike distressed properties, turnkey homes often come with established tenants and property management services, ensuring steady cash flow from day one. These properties are typically located in stable markets, reducing investment risk and simplifying the rental process.

What Defines a Distressed Property?

A distressed property is defined by its compromised condition or financial status, often resulting from foreclosure, bankruptcy, or severe disrepair. These properties typically sell below market value due to urgent sale needs or existing structural and legal issues. Investors targeting distressed properties must carefully evaluate repair costs, market potential, and legal encumbrances for profitability.

Pros and Cons of Turnkey Investments

Turnkey property investments offer immediate rental income with minimal effort, making them ideal for passive investors seeking hassle-free management. These properties are typically renovated and tenant-ready, reducing upfront renovation costs and vacancy periods but often come with higher purchase prices compared to distressed properties. However, the premium cost and potential for lower appreciation rates can limit long-term gains, while distressed properties may require substantial repairs but offer greater value-add opportunities.

Risks and Rewards of Distressed Properties

Distressed properties offer the potential for significant financial gain due to their below-market prices and opportunities for value-add through renovation. However, these properties carry substantial risks including hidden structural damages, legal complications, and longer holding periods that can increase carrying costs. Investors must conduct thorough due diligence and budget for unforeseen repairs to mitigate the inherent risks associated with distressed real estate investments.

Price Differences: Turnkey vs Distressed

Turnkey properties generally command higher prices due to their move-in readiness and minimal immediate repair costs, attracting buyers seeking convenience and reduced risk. Distressed properties are priced significantly lower, reflecting the need for extensive renovations, potential legal complications, and extended timelines before habitation or resale. These price differences highlight the trade-off between initial investment costs and the time, effort, and capital required for rehabilitation in the real estate market.

Renovation and Maintenance Considerations

Turnkey properties require minimal renovation, as they are move-in ready with updated systems and finishes, reducing immediate maintenance costs and time investment. Distressed properties often demand extensive repairs, including structural fixes, plumbing, and electrical upgrades, which can significantly increase renovation budgets and prolong the timeline before occupancy. Investors must assess the scope of renovation and ongoing maintenance expenses when comparing these property types to ensure alignment with their financial goals and risk tolerance.

Return on Investment: Which Offers More?

Turnkey properties offer immediate rental income and reduced management costs, often resulting in stable and predictable returns on investment due to their move-in ready condition. Distressed properties require significant repairs, presenting higher risk but potential for substantial ROI if renovation costs are managed effectively and the property is acquired below market value. Investors prioritizing short-term cash flow typically favor turnkey properties, whereas those seeking higher long-term gains often lean toward distressed properties for value appreciation opportunities.

Time Commitment and Management Needs

Turnkey properties require minimal time commitment as they are fully renovated and often come with property management services, making them ideal for investors seeking passive income. Distressed properties demand significant time and effort for repairs, inspections, and renovations, often necessitating active management to maximize ROI. Investors must evaluate their availability and expertise before choosing between the hassle-free convenience of turnkey homes and the hands-on challenges of distressed assets.

Financing Options for Both Property Types

Turnkey properties often qualify for conventional financing with lower interest rates due to their move-in ready condition and higher resale values, making them attractive to traditional lenders. Distressed properties typically require specialized financing options such as hard money loans, renovation loans (like FHA 203(k)), or private funding due to their poor condition and increased risk factors. Investors should evaluate loan-to-value ratios and renovation cost estimates when comparing financing options between turnkey and distressed properties.

Which Property Type Suits Your Real Estate Goals?

Turnkey properties offer fully renovated, move-in ready homes ideal for investors seeking immediate rental income and minimal management hassle. Distressed properties, often sold below market value, require significant repairs but present opportunities for high returns through value appreciation and customization. Assessing your investment timeline, budget, and willingness to handle renovation challenges will determine which property type aligns best with your real estate goals.

Turnkey Property vs Distressed Property Infographic

difterm.com

difterm.com