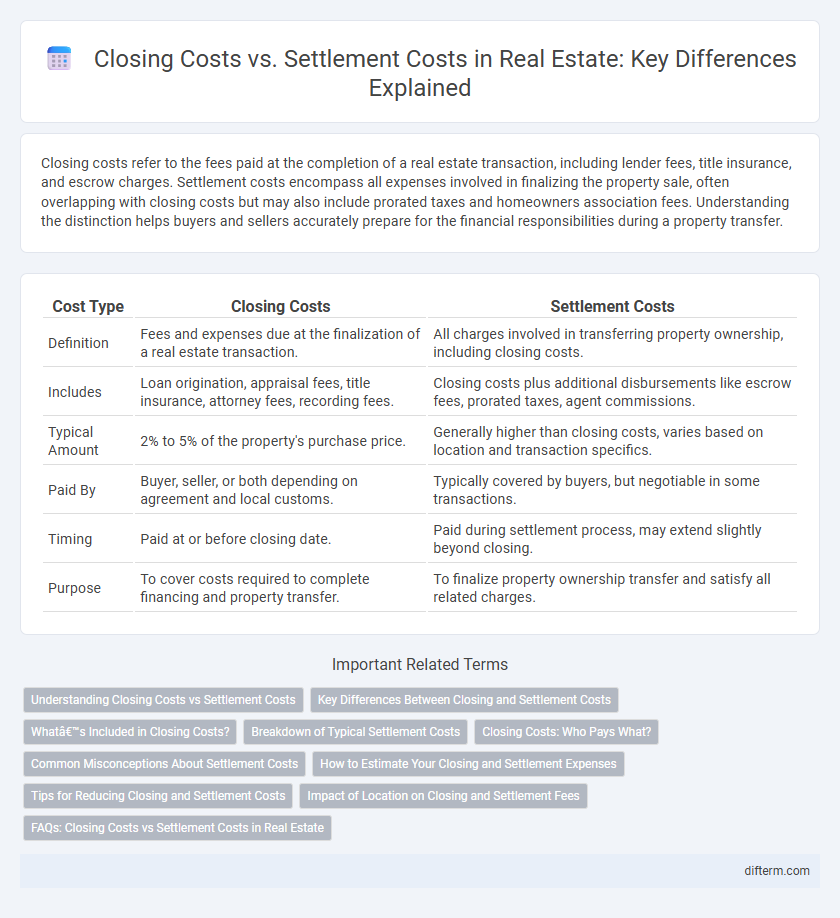

Closing costs refer to the fees paid at the completion of a real estate transaction, including lender fees, title insurance, and escrow charges. Settlement costs encompass all expenses involved in finalizing the property sale, often overlapping with closing costs but may also include prorated taxes and homeowners association fees. Understanding the distinction helps buyers and sellers accurately prepare for the financial responsibilities during a property transfer.

Table of Comparison

| Cost Type | Closing Costs | Settlement Costs |

|---|---|---|

| Definition | Fees and expenses due at the finalization of a real estate transaction. | All charges involved in transferring property ownership, including closing costs. |

| Includes | Loan origination, appraisal fees, title insurance, attorney fees, recording fees. | Closing costs plus additional disbursements like escrow fees, prorated taxes, agent commissions. |

| Typical Amount | 2% to 5% of the property's purchase price. | Generally higher than closing costs, varies based on location and transaction specifics. |

| Paid By | Buyer, seller, or both depending on agreement and local customs. | Typically covered by buyers, but negotiable in some transactions. |

| Timing | Paid at or before closing date. | Paid during settlement process, may extend slightly beyond closing. |

| Purpose | To cover costs required to complete financing and property transfer. | To finalize property ownership transfer and satisfy all related charges. |

Understanding Closing Costs vs Settlement Costs

Closing costs encompass all fees and expenses a buyer or seller pays to finalize a real estate transaction, including lender fees, title insurance, and appraisal charges. Settlement costs refer specifically to expenses related to the actual transfer of property ownership, such as escrow fees and recording fees. Understanding the distinction helps buyers anticipate the total financial outlay required to complete a home purchase.

Key Differences Between Closing and Settlement Costs

Closing costs primarily include fees related to the loan origination, appraisal, title insurance, and escrow services, paid at the end of a real estate transaction. Settlement costs encompass a broader range of expenses, including closing costs plus additional charges such as property taxes, recording fees, and seller's attorney fees. Understanding these distinctions helps buyers and sellers accurately budget for all expenses involved in finalizing a property purchase.

What’s Included in Closing Costs?

Closing costs typically include loan origination fees, appraisal fees, title insurance, escrow fees, and recording charges required to finalize a real estate transaction. Settlement costs may encompass all closing costs plus additional expenses such as home inspections, attorney fees, and prepaid items like property taxes and homeowners insurance. Understanding the breakdown of these fees helps buyers and sellers accurately budget for the total amount needed to complete a property purchase.

Breakdown of Typical Settlement Costs

Typical settlement costs in real estate include lender fees, title insurance, escrow fees, recording fees, and property taxes, which contribute to the total expenses paid at closing. Closing costs encompass all these settlement fees plus additional expenses like attorney fees or loan origination charges. Understanding the breakdown of settlement costs helps buyers and sellers anticipate their financial obligations during the transfer of property ownership.

Closing Costs: Who Pays What?

Closing costs typically include fees for loan origination, appraisal, title search, and escrow services, with buyers usually responsible for appraisal and lender fees. Sellers often pay for real estate agent commissions, title insurance, and transfer taxes, though these costs can vary by region and negotiation. Understanding who pays what during closing helps both parties budget accurately for finalizing the property transaction.

Common Misconceptions About Settlement Costs

Settlement costs and closing costs are often mistakenly used interchangeably, but settlement costs encompass a broader range of fees involved in finalizing a real estate transaction. Many buyers assume settlement costs only include lender-related fees, overlooking expenses such as title insurance, escrow fees, and recording charges that are integral to the settlement process. Understanding these distinctions helps prevent budgeting errors and ensures transparency in the financial obligations of purchasing property.

How to Estimate Your Closing and Settlement Expenses

Closing costs typically include lender fees, appraisal charges, title insurance, and escrow fees, while settlement costs cover expenses related to the finalization of a property transaction such as attorney fees and recording fees. To accurately estimate your closing and settlement expenses, review your Loan Estimate document carefully, which outlines expected charges, and consult with your real estate agent or closing attorney for specific local fees. Budgeting around 2% to 5% of the home purchase price helps ensure sufficient funds to cover all closing and settlement costs.

Tips for Reducing Closing and Settlement Costs

Reducing closing and settlement costs involves negotiating seller concessions, shopping for competitive title insurance rates, and reviewing loan estimates carefully to avoid unexpected fees. Buyers can also save by opting for a no-closing-cost mortgage or bundling services like home inspections and appraisals with the lender. Understanding the breakdown of fees and working with real estate agents experienced in cost-saving strategies helps minimize expenses during the transaction.

Impact of Location on Closing and Settlement Fees

Closing and settlement costs vary significantly based on geographic location, with urban areas typically exhibiting higher fees due to increased property values and local taxes. States with stringent real estate regulations often impose additional costs for title insurance, recording fees, and attorney services, impacting the overall transaction expense. Buyers and sellers should account for regional variations in escrow fees, transfer taxes, and lender charges to accurately estimate total closing and settlement fees.

FAQs: Closing Costs vs Settlement Costs in Real Estate

Closing costs in real estate typically include fees such as loan origination, title insurance, appraisal, and escrow charges incurred during the finalization of a property purchase. Settlement costs encompass all closing costs but may also cover additional expenses like prorated property taxes and homeowner's association fees paid at settlement. Understanding the distinction helps buyers and sellers budget accurately and ensures transparency throughout the transaction process.

closing costs vs settlement costs Infographic

difterm.com

difterm.com