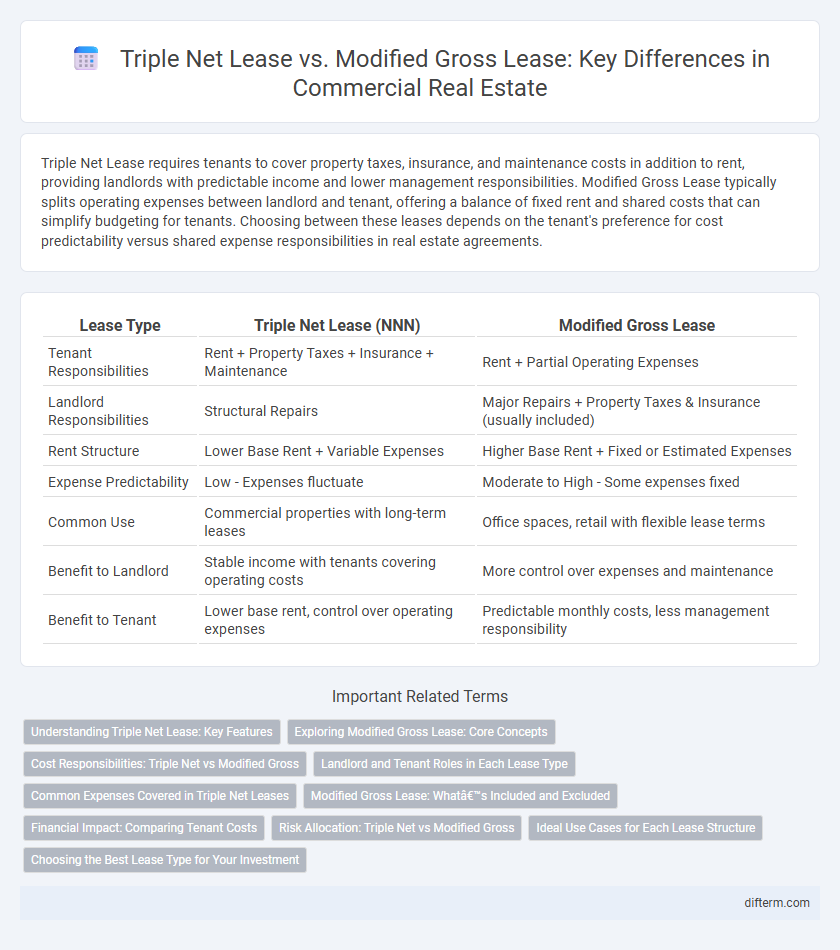

Triple Net Lease requires tenants to cover property taxes, insurance, and maintenance costs in addition to rent, providing landlords with predictable income and lower management responsibilities. Modified Gross Lease typically splits operating expenses between landlord and tenant, offering a balance of fixed rent and shared costs that can simplify budgeting for tenants. Choosing between these leases depends on the tenant's preference for cost predictability versus shared expense responsibilities in real estate agreements.

Table of Comparison

| Lease Type | Triple Net Lease (NNN) | Modified Gross Lease |

|---|---|---|

| Tenant Responsibilities | Rent + Property Taxes + Insurance + Maintenance | Rent + Partial Operating Expenses |

| Landlord Responsibilities | Structural Repairs | Major Repairs + Property Taxes & Insurance (usually included) |

| Rent Structure | Lower Base Rent + Variable Expenses | Higher Base Rent + Fixed or Estimated Expenses |

| Expense Predictability | Low - Expenses fluctuate | Moderate to High - Some expenses fixed |

| Common Use | Commercial properties with long-term leases | Office spaces, retail with flexible lease terms |

| Benefit to Landlord | Stable income with tenants covering operating costs | More control over expenses and maintenance |

| Benefit to Tenant | Lower base rent, control over operating expenses | Predictable monthly costs, less management responsibility |

Understanding Triple Net Lease: Key Features

A Triple Net Lease (NNN) requires tenants to pay not only rent but also property taxes, insurance, and maintenance costs, providing landlords with predictable net income and reduced financial risk. This lease structure is common in commercial real estate, especially for long-term properties like retail and industrial spaces, where tenants assume significant operating expenses. Understanding the key features of a Triple Net Lease helps investors evaluate cash flow stability and tenant responsibilities compared to other lease types.

Exploring Modified Gross Lease: Core Concepts

A Modified Gross Lease balances expenses between landlord and tenant by having the tenant pay base rent plus a portion of operating costs, such as utilities and maintenance, while the landlord covers property taxes and insurance. This lease type offers more financial predictability for tenants compared to a Triple Net Lease, where tenants are responsible for all property expenses including taxes, insurance, and maintenance. Understanding the allocation of expenses in a Modified Gross Lease is essential for negotiating fair terms and managing cash flow effectively in commercial real estate agreements.

Cost Responsibilities: Triple Net vs Modified Gross

Triple Net Lease requires tenants to cover property taxes, insurance, and maintenance costs, transferring most financial responsibilities from the landlord to the tenant. Modified Gross Lease often involves the landlord paying some operating expenses, such as property taxes or insurance, while tenants typically cover a portion of utilities and maintenance. Understanding these cost responsibilities is crucial for tenants and landlords to accurately budget lease expenses and manage risk.

Landlord and Tenant Roles in Each Lease Type

In a Triple Net Lease, tenants assume responsibility for property taxes, insurance, and maintenance costs, significantly reducing the landlord's financial obligations and management duties. Conversely, a Modified Gross Lease typically requires the landlord to cover base expenses like property taxes and insurance, while tenants pay a portion of operating costs, balancing financial responsibilities between both parties. This delineation impacts cash flow predictability for landlords and cost control for tenants, influencing lease negotiations and property management strategies.

Common Expenses Covered in Triple Net Leases

Triple net leases require tenants to cover property taxes, insurance premiums, and maintenance costs, resulting in lower base rent but higher overall expenses. Modified gross leases typically have landlords paying some or all common area maintenance fees and property taxes, offering more predictable monthly payments for tenants. Understanding the allocation of common expenses in these lease types helps investors and tenants assess risk and financial commitment accurately.

Modified Gross Lease: What’s Included and Excluded

Modified Gross Lease typically includes base rent and a portion of operating expenses such as property taxes, insurance, and maintenance, with tenants responsible for utilities and janitorial services. Expenses not covered in this lease structure often involve structural repairs and capital improvements, which remain the landlord's responsibility. This arrangement provides tenants with predictable costs while allowing landlords to manage major property expenses.

Financial Impact: Comparing Tenant Costs

Triple Net Lease (NNN) places most financial responsibilities on tenants, including property taxes, insurance, and maintenance, significantly increasing their overall expenses compared to Modified Gross Leases. Modified Gross Leases offer a more predictable cost structure by requiring tenants to pay a base rent plus a portion of operating expenses, reducing unexpected financial burdens. Understanding these financial implications is crucial for tenants and landlords when negotiating lease terms and budgeting for commercial real estate investments.

Risk Allocation: Triple Net vs Modified Gross

In a Triple Net Lease, tenants assume most property-related risks by paying for taxes, insurance, and maintenance, resulting in lower landlord responsibility and more predictable landlord expenses. Modified Gross Leases split risks more evenly, with landlords covering some operating expenses while tenants pay a base rent and a portion of costs, providing a balanced risk allocation. Understanding these distinctions helps landlords and tenants tailor lease agreements to their risk tolerance and financial strategy.

Ideal Use Cases for Each Lease Structure

Triple Net Lease is ideal for investors seeking predictable, long-term income with minimal landlord responsibilities, making it popular for single-tenant retail or industrial properties. Modified Gross Lease suits tenants prioritizing shared operating expenses and landlords who want to balance control and income stability, often used in multi-tenant office buildings. Understanding these lease structures helps align property management strategies with financial goals and tenant profiles in commercial real estate.

Choosing the Best Lease Type for Your Investment

Choosing the best lease type for your investment hinges on understanding the differences between Triple Net Lease (NNN) and Modified Gross Lease structures. Triple Net Leases shift property expenses such as taxes, insurance, and maintenance to tenants, providing predictable income and reducing landlord risk, ideal for long-term commercial investors seeking stable cash flow. Modified Gross Leases offer a hybrid approach where landlords cover some operating costs while tenants pay base rent plus a portion of expenses, balancing risk and flexibility for both parties in multifamily or retail investments.

Triple Net Lease vs Modified Gross Lease Infographic

difterm.com

difterm.com