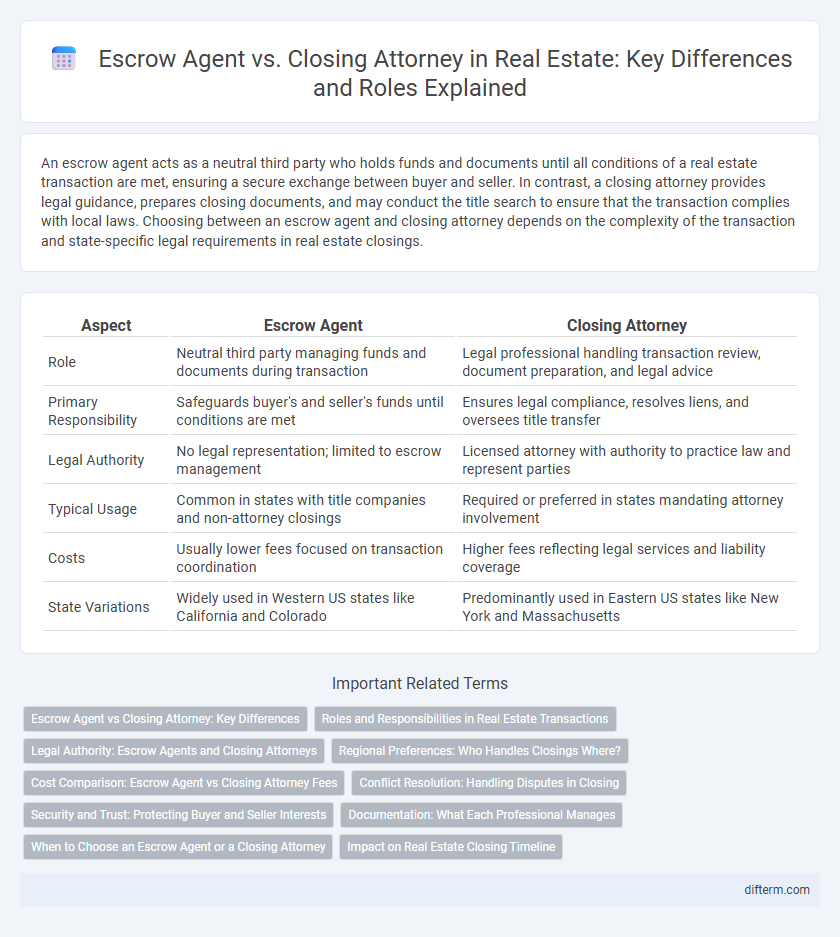

An escrow agent acts as a neutral third party who holds funds and documents until all conditions of a real estate transaction are met, ensuring a secure exchange between buyer and seller. In contrast, a closing attorney provides legal guidance, prepares closing documents, and may conduct the title search to ensure that the transaction complies with local laws. Choosing between an escrow agent and closing attorney depends on the complexity of the transaction and state-specific legal requirements in real estate closings.

Table of Comparison

| Aspect | Escrow Agent | Closing Attorney |

|---|---|---|

| Role | Neutral third party managing funds and documents during transaction | Legal professional handling transaction review, document preparation, and legal advice |

| Primary Responsibility | Safeguards buyer's and seller's funds until conditions are met | Ensures legal compliance, resolves liens, and oversees title transfer |

| Legal Authority | No legal representation; limited to escrow management | Licensed attorney with authority to practice law and represent parties |

| Typical Usage | Common in states with title companies and non-attorney closings | Required or preferred in states mandating attorney involvement |

| Costs | Usually lower fees focused on transaction coordination | Higher fees reflecting legal services and liability coverage |

| State Variations | Widely used in Western US states like California and Colorado | Predominantly used in Eastern US states like New York and Massachusetts |

Escrow Agent vs Closing Attorney: Key Differences

An escrow agent holds funds and documents securely during the real estate transaction to ensure all conditions are met before release, while a closing attorney oversees the legal aspects, prepares documents, and facilitates the property transfer process. Escrow agents act as neutral third parties without providing legal advice, whereas closing attorneys provide legal counsel and handle title issues or disputes. Understanding the distinct roles of escrow agents and closing attorneys is critical for smooth, compliant real estate closings.

Roles and Responsibilities in Real Estate Transactions

An escrow agent in real estate transactions manages the holding and disbursement of funds and documents according to the terms agreed upon by both parties, ensuring a neutral third-party safeguards assets until closing conditions are met. A closing attorney, on the other hand, provides legal oversight throughout the transaction, prepares and reviews closing documents, ensures title clearance, and facilitates the final transfer of ownership. While the escrow agent focuses on secure fund management, the closing attorney addresses legal compliance and dispute resolution in the real estate closing process.

Legal Authority: Escrow Agents and Closing Attorneys

Escrow agents manage funds and documents during real estate transactions without providing legal counsel, operating under fiduciary duties defined by state regulations. Closing attorneys possess legal authority to draft and review contracts, address title issues, and resolve disputes, ensuring compliance with real estate laws. Their involvement varies by jurisdiction, impacting the legal oversight and protection available to buyers and sellers.

Regional Preferences: Who Handles Closings Where?

In the United States, escrow agents predominantly manage real estate closings in Western states like California, Arizona, and Washington, where neutral third-party management of funds and documents ensures a secure transaction process. Conversely, closing attorneys are more common in Southern and Northeastern states such as New York, Georgia, and New Jersey, where legal professionals oversee the contractual and title aspects to provide comprehensive legal representation. Regional legal frameworks and customary practices significantly influence whether escrow agents or closing attorneys handle real estate closings, shaping the buyer and seller experience accordingly.

Cost Comparison: Escrow Agent vs Closing Attorney Fees

Escrow agents typically charge a flat fee ranging from $300 to $700, offering a cost-effective solution for handling real estate transactions, especially in states where attorneys are not mandated at closing. Closing attorneys, however, often bill hourly rates between $150 and $400 or charge a percentage of the transaction amount, which can lead to higher overall costs depending on the complexity of the deal. Understanding these fee structures is essential for buyers and sellers aiming to manage closing costs efficiently while ensuring proper legal oversight.

Conflict Resolution: Handling Disputes in Closing

Escrow agents act as neutral third parties who hold funds securely until all contract conditions are met, minimizing conflict by following predetermined protocols. Closing attorneys provide legal expertise to address and resolve disputes promptly during the closing process, ensuring compliance with state laws and protecting client interests. Both roles are essential for effective conflict resolution, but closing attorneys typically have more authority to intervene in legal disagreements.

Security and Trust: Protecting Buyer and Seller Interests

Escrow agents serve as neutral third parties who securely hold funds and documents during real estate transactions, ensuring impartiality and safeguarding buyer and seller interests. Closing attorneys provide legal oversight, verifying compliance with contracts and local laws to minimize risks and resolve disputes. Both roles are essential in enhancing transaction security and building trust through transparency and accountability.

Documentation: What Each Professional Manages

Escrow agents handle the secure holding and management of funds and documents such as the earnest money deposit, purchase agreements, and title documents to ensure all conditions are met before release. Closing attorneys review and prepare critical legal documents including the deed, mortgage, title insurance policies, and closing disclosures to comply with state laws and protect clients' legal interests. Both professionals coordinate the proper execution and recording of paperwork but differ in their legal advisory roles and fiduciary responsibilities during real estate transactions.

When to Choose an Escrow Agent or a Closing Attorney

Choose an escrow agent when a neutral third party is needed to manage funds and documents securely during a real estate transaction, ensuring impartiality without providing legal advice. Opt for a closing attorney when legal expertise is essential to review contracts, resolve title issues, or handle complex negotiations that require interpretation of real estate law. Deciding between an escrow agent and a closing attorney depends on the transaction's complexity, legal requirements, and state regulations that may mandate attorney involvement.

Impact on Real Estate Closing Timeline

An escrow agent streamlines the real estate closing timeline by securely holding funds and documents until all conditions are met, reducing delays caused by miscommunication. Closing attorneys conduct thorough legal reviews and prepare essential documents, which can extend the process but ensure compliance and protect parties from legal risks. Choosing an escrow agent typically expedites closings, while a closing attorney may lengthen the timeline to guarantee legal accuracy.

escrow agent vs closing attorney Infographic

difterm.com

difterm.com