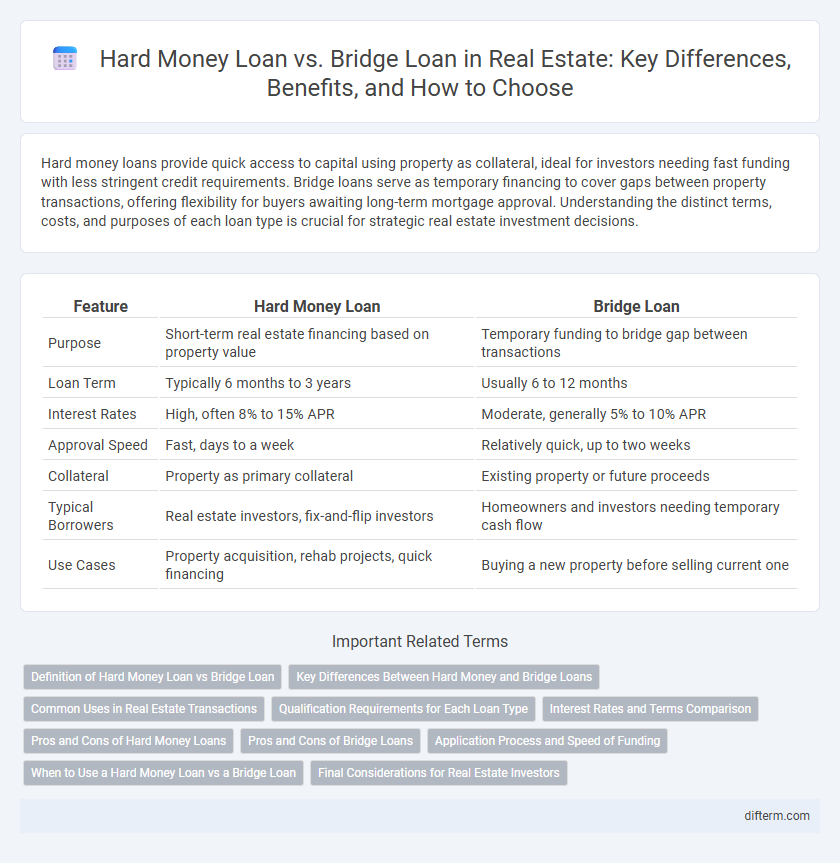

Hard money loans provide quick access to capital using property as collateral, ideal for investors needing fast funding with less stringent credit requirements. Bridge loans serve as temporary financing to cover gaps between property transactions, offering flexibility for buyers awaiting long-term mortgage approval. Understanding the distinct terms, costs, and purposes of each loan type is crucial for strategic real estate investment decisions.

Table of Comparison

| Feature | Hard Money Loan | Bridge Loan |

|---|---|---|

| Purpose | Short-term real estate financing based on property value | Temporary funding to bridge gap between transactions |

| Loan Term | Typically 6 months to 3 years | Usually 6 to 12 months |

| Interest Rates | High, often 8% to 15% APR | Moderate, generally 5% to 10% APR |

| Approval Speed | Fast, days to a week | Relatively quick, up to two weeks |

| Collateral | Property as primary collateral | Existing property or future proceeds |

| Typical Borrowers | Real estate investors, fix-and-flip investors | Homeowners and investors needing temporary cash flow |

| Use Cases | Property acquisition, rehab projects, quick financing | Buying a new property before selling current one |

Definition of Hard Money Loan vs Bridge Loan

Hard money loans are short-term, asset-based loans secured by real estate, typically used for quick financing with higher interest rates and flexible terms. Bridge loans are temporary financing solutions designed to bridge the gap between purchasing a new property and selling an existing one, offering fast funding with short repayment periods. Both loan types provide essential cash flow for real estate investors but differ in purpose, terms, and repayment structure.

Key Differences Between Hard Money and Bridge Loans

Hard money loans are asset-based loans secured by real estate, often used for short-term financing with higher interest rates and faster approval processes. Bridge loans provide temporary funding to bridge gaps during property transactions, typically offering lower interest rates and flexible repayment terms compared to hard money loans. Key differences include loan purpose, interest rates, approval speed, and risk assessment, with hard money loans focusing on borrower credit and asset value, while bridge loans emphasize transaction timing and property value.

Common Uses in Real Estate Transactions

Hard money loans are commonly used for short-term real estate investments such as fix-and-flip projects or properties that require quick closing due to their fast approval and funding process. Bridge loans provide temporary financing to bridge gaps between buying a new property and selling an existing one, often utilized in residential transactions to avoid missing purchase opportunities. Both loan types serve specific needs in real estate transactions, with hard money loans favoring rehab investors and bridge loans supporting homeowners and developers managing transitional phases.

Qualification Requirements for Each Loan Type

Hard money loans primarily require property value and borrower's equity as qualification criteria, with less emphasis on credit score and income verification. Bridge loans often demand stronger creditworthiness, evidence of income, and existing financing details, reflecting their short-term nature and higher risk. Both loan types prioritize collateral but differ significantly in borrower qualification processes and documentation requirements.

Interest Rates and Terms Comparison

Hard money loans typically feature higher interest rates ranging from 10% to 18%, reflecting their riskier, short-term nature with terms often between 6 to 12 months. Bridge loans offer comparatively lower rates, usually between 6% and 12%, with slightly longer terms from 12 to 36 months, designed to provide temporary financing until permanent funding is secured. Both loan types prioritize speed and flexibility, but hard money loans carry steeper costs due to lender risk and asset-based underwriting.

Pros and Cons of Hard Money Loans

Hard money loans offer quick approval and funding, making them ideal for real estate investors needing fast cash, but they come with higher interest rates and shorter terms compared to traditional loans. These loans rely on the property's value rather than borrower credit, reducing qualification barriers but increasing risk if property value drops. While hard money loans provide flexibility and speed, the cost and potential for foreclosure should be carefully considered before commitment.

Pros and Cons of Bridge Loans

Bridge loans offer quick financing solutions with flexible terms, ideal for real estate investors needing to secure properties before permanent financing is arranged. They typically have higher interest rates and shorter repayment periods compared to traditional loans, which can increase overall borrowing costs. Limited eligibility and the risk of foreclosure if the property does not sell on time are notable drawbacks to consider when choosing a bridge loan for real estate transactions.

Application Process and Speed of Funding

Hard money loans typically require minimal documentation and focus on the property's value, enabling quick approval often within days. Bridge loans involve more comprehensive underwriting, including income verification and credit analysis, which can extend the funding timeline to one or two weeks. Investors choose hard money loans for fast access to capital, while bridge loans suit those needing short-term financing with detailed risk assessment.

When to Use a Hard Money Loan vs a Bridge Loan

Hard money loans are ideal for real estate investors needing fast cash for property flips or when traditional financing is unavailable due to poor credit or property condition. Bridge loans work best for homeowners or developers requiring temporary financing to bridge the gap between buying a new property and selling an existing one. Choosing a hard money loan suits short-term, high-risk projects, while bridge loans support seamless transitions in property ownership or refinancing.

Final Considerations for Real Estate Investors

Hard money loans offer quick access to capital with higher interest rates, ideal for investors needing fast financing on distressed properties. Bridge loans provide short-term funding to bridge gaps between transactions, often with lower costs but stricter approval criteria. Real estate investors should evaluate loan terms, repayment flexibility, and property condition to determine the best financing strategy for maximizing ROI and minimizing risk.

Hard Money Loan vs Bridge Loan Infographic

difterm.com

difterm.com