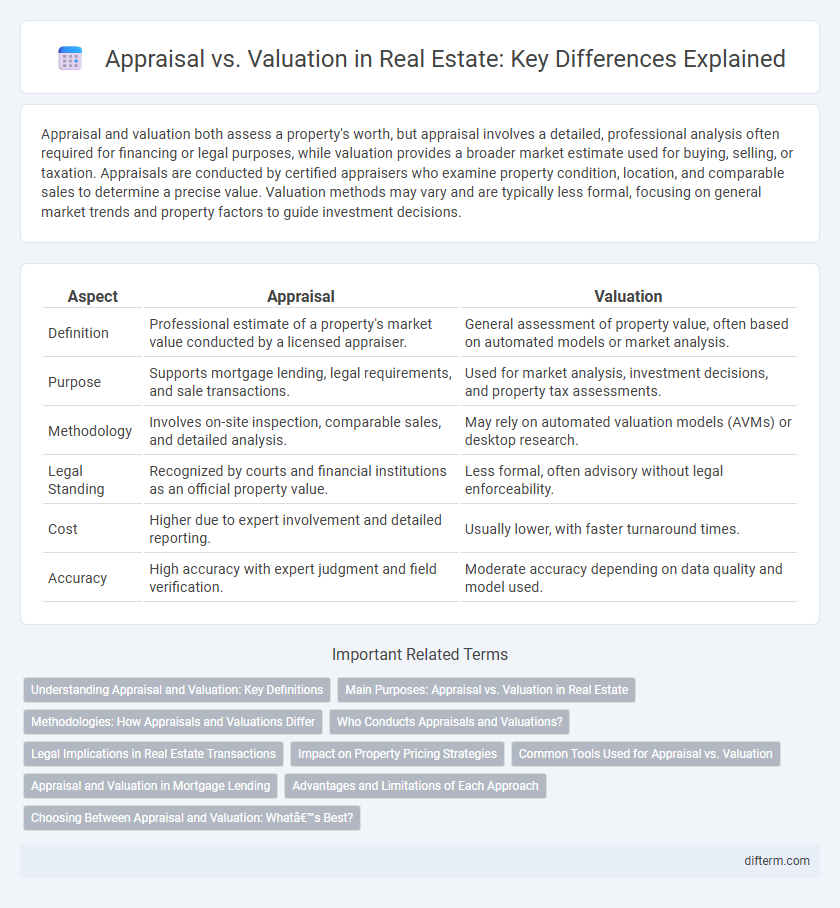

Appraisal and valuation both assess a property's worth, but appraisal involves a detailed, professional analysis often required for financing or legal purposes, while valuation provides a broader market estimate used for buying, selling, or taxation. Appraisals are conducted by certified appraisers who examine property condition, location, and comparable sales to determine a precise value. Valuation methods may vary and are typically less formal, focusing on general market trends and property factors to guide investment decisions.

Table of Comparison

| Aspect | Appraisal | Valuation |

|---|---|---|

| Definition | Professional estimate of a property's market value conducted by a licensed appraiser. | General assessment of property value, often based on automated models or market analysis. |

| Purpose | Supports mortgage lending, legal requirements, and sale transactions. | Used for market analysis, investment decisions, and property tax assessments. |

| Methodology | Involves on-site inspection, comparable sales, and detailed analysis. | May rely on automated valuation models (AVMs) or desktop research. |

| Legal Standing | Recognized by courts and financial institutions as an official property value. | Less formal, often advisory without legal enforceability. |

| Cost | Higher due to expert involvement and detailed reporting. | Usually lower, with faster turnaround times. |

| Accuracy | High accuracy with expert judgment and field verification. | Moderate accuracy depending on data quality and model used. |

Understanding Appraisal and Valuation: Key Definitions

Appraisal and valuation are essential terms in real estate, with appraisal referring to a professional opinion of a property's market value conducted by a licensed appraiser using standardized methods. Valuation encompasses a broader process, often including appraisals but also considering factors like market trends, location, and economic conditions to estimate property worth. Accurate understanding of both concepts ensures informed decision-making in buying, selling, financing, or investing in real estate.

Main Purposes: Appraisal vs. Valuation in Real Estate

Appraisal in real estate primarily serves to provide an unbiased, professional estimate of a property's market value for purposes such as financing, taxation, and legal matters. Valuation is a broader concept encompassing various methods to determine property worth, often used for investment analysis, sale negotiation, and portfolio management. The main purpose of appraisal is to support transactions and compliance, while valuation guides strategic financial decisions.

Methodologies: How Appraisals and Valuations Differ

Appraisals rely on standardized, often regulated methodologies combining comparative market analysis, cost approach, and income approach to determine a property's fair market value for lending or legal purposes. Valuations employ a broader range of techniques, including automated valuation models (AVMs), market trend analyses, and investor-driven assessments, focusing on market conditions and subjective factors. The primary methodological difference lies in appraisals' strict adherence to formal guidelines versus valuations' flexibility to adapt methods based on specific client needs or market contexts.

Who Conducts Appraisals and Valuations?

Licensed appraisers conduct appraisals, providing expert, unbiased property assessments based on industry standards and regulatory requirements. Valuations are often performed by real estate agents, brokers, or valuation firms, focusing on market conditions and comparative analysis to estimate property value. Both processes rely on professional expertise, but appraisals are typically mandatory for mortgage lending and legal purposes.

Legal Implications in Real Estate Transactions

Appraisal and valuation differ significantly in legal implications within real estate transactions; appraisals, conducted by licensed professionals, provide an unbiased estimate of market value often required by lenders and courts, ensuring compliance with regulatory standards. Valuations, while offering property worth estimates, may lack standardized methods and formal recognition in legal proceedings, potentially impacting contract enforceability and dispute resolution. Understanding these distinctions is crucial for accurate property assessment and mitigating legal risks during real estate deals.

Impact on Property Pricing Strategies

Appraisal provides an expert, objective assessment of a property's market value based on comprehensive data analysis, influencing pricing strategies by establishing credible benchmarks for buyers and sellers. Valuation incorporates broader factors, including market trends and future potential, enabling developers and investors to adjust pricing models strategically to maximize returns. Accurate differentiation between appraisal and valuation ensures optimized pricing decisions that reflect true market conditions and investor goals.

Common Tools Used for Appraisal vs. Valuation

Appraisal commonly employs tools such as comparative market analysis (CMA), property condition reports, and income capitalization methods to estimate a property's market value. Valuation often integrates broader techniques including discounted cash flow analysis, replacement cost models, and statistical market trend evaluations to assess asset value more comprehensively. Both processes utilize property inspection and location analysis, but appraisal emphasizes immediate market conditions while valuation considers long-term investment potential.

Appraisal and Valuation in Mortgage Lending

In mortgage lending, appraisal and valuation serve distinct roles in determining property worth, with appraisal offering an expert, lender-required assessment by certified appraisers to ensure accurate loan risks. Valuation often refers to a broader market analysis that may incorporate automated tools or comparative market data but lacks the formal certification needed for loan approval. Understanding the differences in scope, methodology, and regulatory requirements is crucial for lenders and borrowers to navigate mortgage financing effectively.

Advantages and Limitations of Each Approach

Appraisal provides a detailed, professional assessment of property value based on market trends, comparable sales, and physical inspections, offering legal and financial reliability but often demands higher costs and more time. Valuation offers a quicker, less expensive estimate influenced by automated models or generalized market data, useful for fast decision-making but prone to inaccuracies due to lack of personalized scrutiny. Both methods help investors and homeowners gauge property worth, yet appraisals excel in precision while valuations prioritize speed and convenience.

Choosing Between Appraisal and Valuation: What’s Best?

Choosing between appraisal and valuation depends on the purpose and accuracy required in real estate transactions, with appraisals providing a more detailed, licensed professional assessment for lenders and legal matters, while valuations offer a broader market estimate often used by investors and buyers. Appraisals follow stringent industry standards, such as USPAP, ensuring reliability and defensibility in financing or court scenarios. Valuations, though less formal, leverage market trends and comparative analysis to guide pricing strategies and investment decisions efficiently.

appraisal vs valuation Infographic

difterm.com

difterm.com