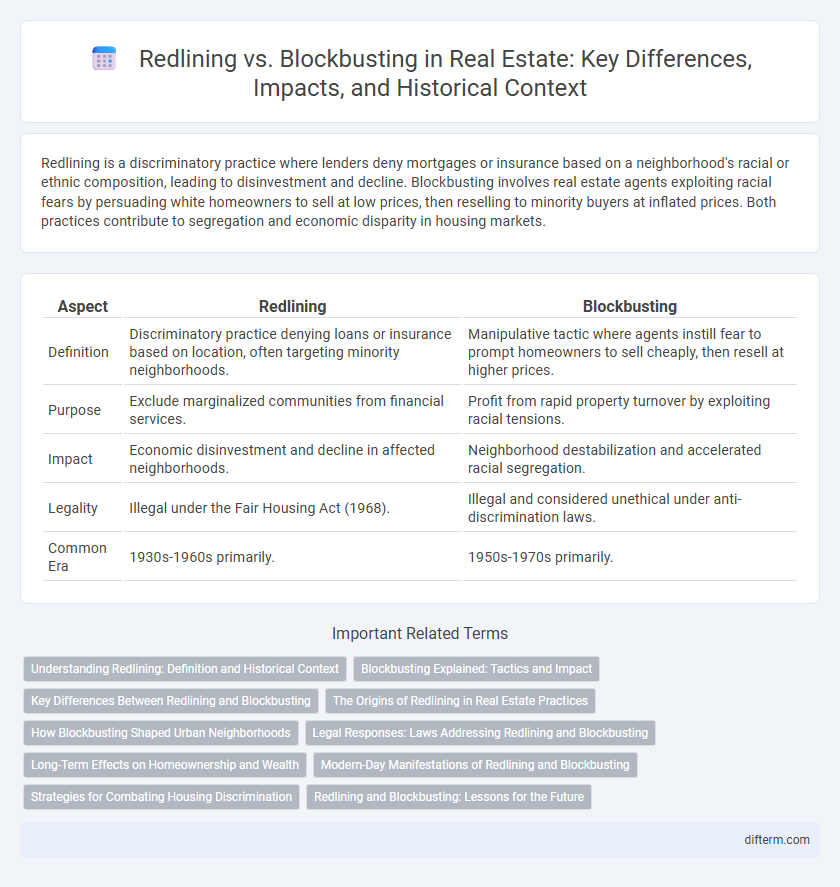

Redlining is a discriminatory practice where lenders deny mortgages or insurance based on a neighborhood's racial or ethnic composition, leading to disinvestment and decline. Blockbusting involves real estate agents exploiting racial fears by persuading white homeowners to sell at low prices, then reselling to minority buyers at inflated prices. Both practices contribute to segregation and economic disparity in housing markets.

Table of Comparison

| Aspect | Redlining | Blockbusting |

|---|---|---|

| Definition | Discriminatory practice denying loans or insurance based on location, often targeting minority neighborhoods. | Manipulative tactic where agents instill fear to prompt homeowners to sell cheaply, then resell at higher prices. |

| Purpose | Exclude marginalized communities from financial services. | Profit from rapid property turnover by exploiting racial tensions. |

| Impact | Economic disinvestment and decline in affected neighborhoods. | Neighborhood destabilization and accelerated racial segregation. |

| Legality | Illegal under the Fair Housing Act (1968). | Illegal and considered unethical under anti-discrimination laws. |

| Common Era | 1930s-1960s primarily. | 1950s-1970s primarily. |

Understanding Redlining: Definition and Historical Context

Redlining is a discriminatory practice in real estate where banks and insurance companies deny or limit services to residents of certain areas based on racial or ethnic composition, often outlined on maps in red ink. Originating in the 1930s during the New Deal era, the practice systematically marginalized minority communities, restricting access to mortgages and contributing to urban decay. Understanding redlining's historical context reveals deep-rooted inequalities in housing finance and urban development that continue to impact real estate markets today.

Blockbusting Explained: Tactics and Impact

Blockbusting in real estate involves agents exploiting racial fears by persuading white homeowners to sell properties cheaply, anticipating minority groups moving into the neighborhood. This tactic inflates property sales short-term but drives long-term neighborhood decline through forced demographic shifts and reduced property values. The impact of blockbusting perpetuates segregation, undermines community stability, and contributes to systemic inequality in housing markets.

Key Differences Between Redlining and Blockbusting

Redlining is a discriminatory practice where banks and insurers refuse or limit loans, mortgages, and insurance within specific neighborhoods, often based on racial or ethnic composition, leading to systemic disinvestment. Blockbusting involves real estate agents exploiting racial fears by persuading white homeowners to sell properties at reduced prices, then reselling them at higher rates to minority buyers, thereby inflating property values and segregating neighborhoods. The key difference lies in redlining institutional exclusion from financial services, whereas blockbusting manipulates market transactions to induce demographic shifts.

The Origins of Redlining in Real Estate Practices

Redlining originated in the 1930s when the Home Owners' Loan Corporation (HOLC) created color-coded maps to assess mortgage risk in housing markets, systematically marking minority neighborhoods as high-risk and denying them financial services. This discriminatory practice entrenched racial segregation and limited wealth accumulation opportunities for Black and other marginalized communities. Redlining's deep roots in federal policy laid the groundwork for ongoing disparities in homeownership and neighborhood investment.

How Blockbusting Shaped Urban Neighborhoods

Blockbusting significantly shaped urban neighborhoods by accelerating racial segregation and property value fluctuations. Real estate agents exploited fears of racial integration, prompting white homeowners to sell properties at reduced prices, which were then sold to minority families at inflated rates. This practice destabilized communities, leading to rapid demographic shifts and economic decline in affected areas.

Legal Responses: Laws Addressing Redlining and Blockbusting

The Fair Housing Act of 1968 explicitly prohibits redlining and blockbusting, making discriminatory housing practices illegal nationwide. Enforcement agencies like HUD and the Department of Justice work to investigate and penalize violations, ensuring fair access to housing regardless of race or ethnicity. State and local laws also complement federal statutes by providing additional protections and mechanisms for victims to seek legal recourse.

Long-Term Effects on Homeownership and Wealth

Redlining systematically denied mortgage access to minority neighborhoods, leading to disinvestment, depreciated home values, and entrenched wealth gaps that persist across generations. Blockbusting exploited racial fears to induce rapid property sales at deflated prices, destabilizing communities and accelerating white flight which undermined homeownership stability and wealth accumulation for minorities. Both practices contributed to long-term segregation and economic disparity, severely limiting minority families' ability to build equity and transfer wealth through homeownership.

Modern-Day Manifestations of Redlining and Blockbusting

Modern-day manifestations of redlining persist through discriminatory lending practices and digital mapping algorithms that limit access to mortgage approvals and affordable housing in predominantly minority neighborhoods. Blockbusting tactics have evolved into aggressive marketing strategies and predatory buying that exploit fears of neighborhood decline to drive sales and inflate property values. These practices contribute to ongoing residential segregation and economic disparities within urban real estate markets.

Strategies for Combating Housing Discrimination

Effective strategies for combating housing discrimination include enforcing fair housing laws like the Fair Housing Act to prevent redlining and blockbusting practices. Community education and outreach programs promote awareness of tenant rights and encourage reporting discriminatory actions. Financial institutions implementing equitable lending policies and government oversight help reduce systemic biases in mortgage approvals and property sales.

Redlining and Blockbusting: Lessons for the Future

Redlining and blockbusting represent historic discriminatory real estate practices that fueled racial segregation and economic disparity in urban neighborhoods. Redlining involved denying financial services to residents in predominantly minority communities, while blockbusting manipulated homeowners into selling their properties at low prices by stoking racial fears. Understanding these harmful practices highlights the importance of enforcing fair housing laws and promoting equitable lending to prevent similar patterns of discrimination in the future.

Redlining vs Blockbusting Infographic

difterm.com

difterm.com