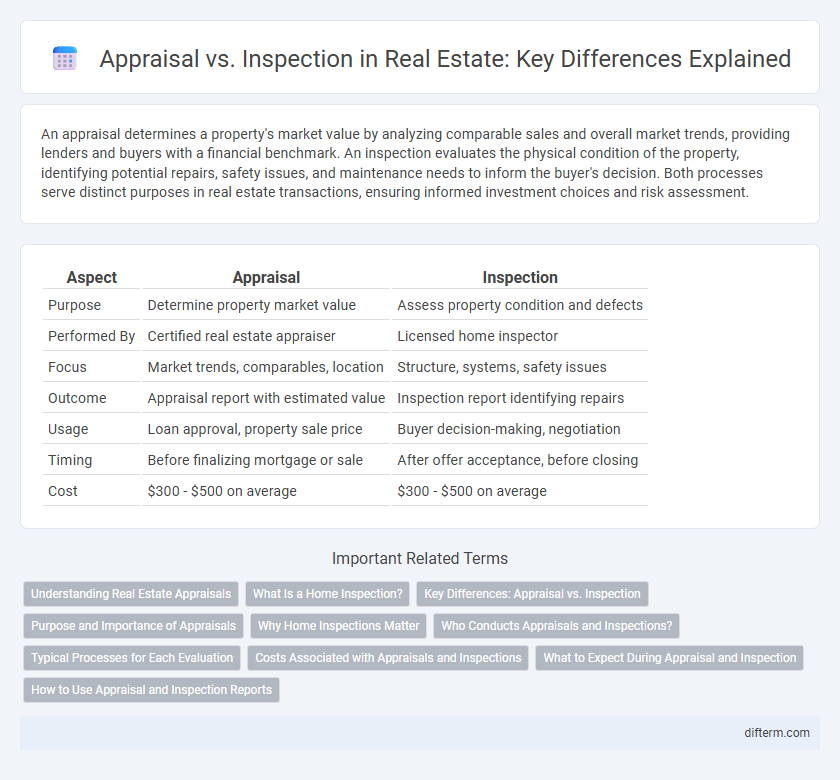

An appraisal determines a property's market value by analyzing comparable sales and overall market trends, providing lenders and buyers with a financial benchmark. An inspection evaluates the physical condition of the property, identifying potential repairs, safety issues, and maintenance needs to inform the buyer's decision. Both processes serve distinct purposes in real estate transactions, ensuring informed investment choices and risk assessment.

Table of Comparison

| Aspect | Appraisal | Inspection |

|---|---|---|

| Purpose | Determine property market value | Assess property condition and defects |

| Performed By | Certified real estate appraiser | Licensed home inspector |

| Focus | Market trends, comparables, location | Structure, systems, safety issues |

| Outcome | Appraisal report with estimated value | Inspection report identifying repairs |

| Usage | Loan approval, property sale price | Buyer decision-making, negotiation |

| Timing | Before finalizing mortgage or sale | After offer acceptance, before closing |

| Cost | $300 - $500 on average | $300 - $500 on average |

Understanding Real Estate Appraisals

Real estate appraisals provide an expert, unbiased estimate of a property's market value based on factors such as location, comparable sales, and property condition. Unlike inspections, which assess the physical state and identify potential repairs, appraisals influence loan approval and sale price decisions. Accurate appraisals are essential for lenders, buyers, and sellers to ensure fair market transactions and investment security.

What Is a Home Inspection?

A home inspection is a thorough evaluation of a property's condition, focusing on structural elements, systems, and potential safety issues. Licensed inspectors assess components such as the roof, foundation, plumbing, electrical systems, and HVAC to identify defects or necessary repairs. This process provides buyers and sellers with detailed insights into the home's current state, separate from the property's market value assessed in an appraisal.

Key Differences: Appraisal vs. Inspection

Appraisal determines a property's market value by evaluating factors such as location, condition, and recent comparable sales, essential for mortgage approval and investment decisions. Inspection assesses the physical condition of a home, identifying structural issues, safety concerns, and necessary repairs to inform buyers and sellers. Both processes serve distinct purposes: appraisal focuses on value estimation, while inspection concentrates on property condition and maintenance needs.

Purpose and Importance of Appraisals

Appraisals determine a property's market value by evaluating factors such as location, condition, and recent sales of comparable homes, which is crucial for mortgage approval and investment decisions. Inspections focus on identifying structural and mechanical issues within the property to assess its condition and potential repair costs. Understanding the distinct purposes of appraisals and inspections ensures informed real estate transactions and protects buyers and lenders.

Why Home Inspections Matter

Home inspections provide a detailed assessment of a property's condition, identifying potential issues that may not be evident during an appraisal. Unlike appraisals, which focus on market value, inspections evaluate structural integrity, systems functionality, and safety concerns, offering buyers crucial information for informed decisions. This proactive evaluation helps prevent costly repairs and ensures transparency in real estate transactions.

Who Conducts Appraisals and Inspections?

Appraisals are conducted by licensed or certified appraisers who assess a property's market value based on comparable sales, location, and condition. Inspections are performed by certified home inspectors who evaluate the physical condition of a property's systems and structure. Both professionals provide critical information for buyers, sellers, and lenders during real estate transactions.

Typical Processes for Each Evaluation

Appraisal typically involves a licensed appraiser analyzing recent sales data, property condition, location, and market trends to estimate a home's fair market value. Inspection focuses on a licensed inspector assessing the physical condition of the property, including structural components, systems, and safety hazards. Both processes generate detailed reports, but appraisal centers on value determination for loans and sales, while inspection addresses potential repairs and maintenance issues.

Costs Associated with Appraisals and Inspections

Appraisal costs typically range from $300 to $600, reflecting the professional evaluation of a property's market value needed for loan approval or sales negotiation. Inspection fees usually span $300 to $500 and cover a detailed assessment of the property's condition, identifying potential repairs or safety hazards. Both costs vary by location and property type but represent essential investments for informed real estate transactions.

What to Expect During Appraisal and Inspection

During a real estate appraisal, a licensed appraiser evaluates the property's value by examining its condition, size, location, and comparable sales in the area. An inspection involves a certified home inspector conducting a detailed assessment of the home's structural components, systems, and potential safety issues. Buyers should expect the appraisal to primarily influence loan approval while the inspection highlights maintenance or repair needs before closing.

How to Use Appraisal and Inspection Reports

Appraisal and inspection reports serve distinct purposes in real estate transactions, providing key insights for buyers, sellers, and lenders; appraisal reports assess the property's market value based on comparable sales, location, and condition, aiding in financing decisions and pricing strategies. Inspection reports detail the property's physical condition, identifying structural issues, safety hazards, and necessary repairs to protect buyers from unforeseen expenses. Utilizing both reports together ensures informed decision-making, allowing parties to negotiate repairs, adjust offers, and secure appropriate financing based on comprehensive property evaluation.

appraisal vs inspection Infographic

difterm.com

difterm.com