Property tax is a standard levy imposed annually on real estate based on its assessed value to fund local government services, while a special assessment is a one-time or periodic charge for specific improvements that directly benefit the property, such as road repairs or sewer upgrades. Unlike property taxes, special assessments are not based on market value but on the cost of the specific project allocated among property owners. Understanding the distinction helps homeowners anticipate expenses related to maintaining and improving their neighborhood infrastructure.

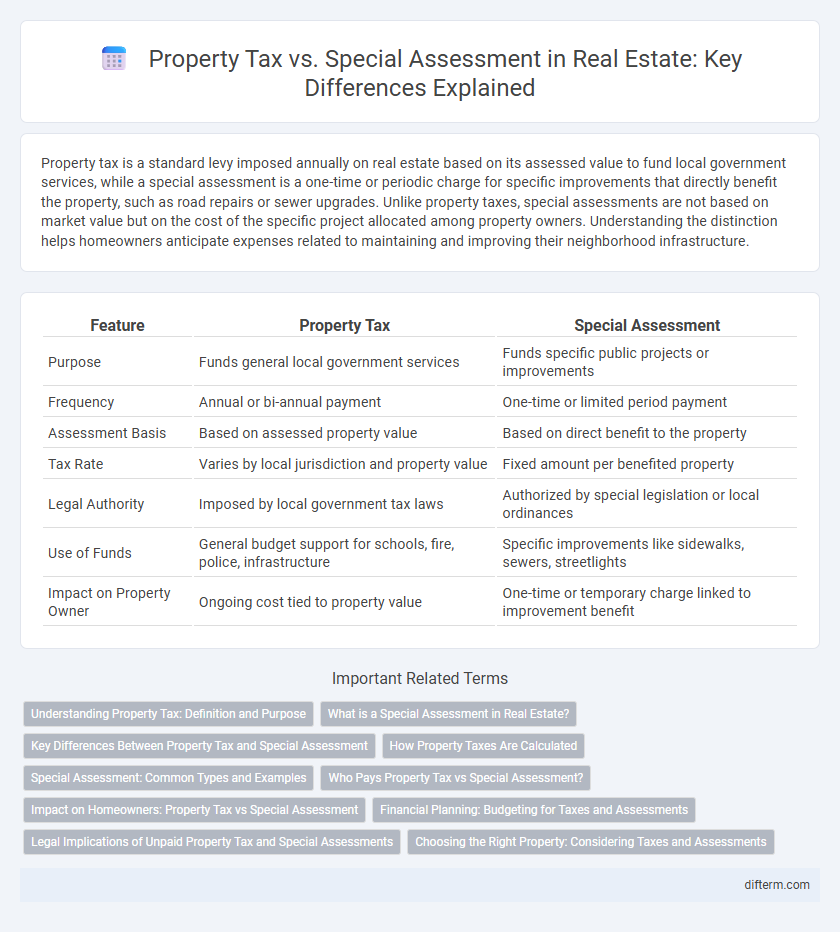

Table of Comparison

| Feature | Property Tax | Special Assessment |

|---|---|---|

| Purpose | Funds general local government services | Funds specific public projects or improvements |

| Frequency | Annual or bi-annual payment | One-time or limited period payment |

| Assessment Basis | Based on assessed property value | Based on direct benefit to the property |

| Tax Rate | Varies by local jurisdiction and property value | Fixed amount per benefited property |

| Legal Authority | Imposed by local government tax laws | Authorized by special legislation or local ordinances |

| Use of Funds | General budget support for schools, fire, police, infrastructure | Specific improvements like sidewalks, sewers, streetlights |

| Impact on Property Owner | Ongoing cost tied to property value | One-time or temporary charge linked to improvement benefit |

Understanding Property Tax: Definition and Purpose

Property tax is a recurring levy imposed by local governments based on the assessed value of real estate, primarily funding public services such as schools, infrastructure, and emergency services. It is calculated annually using the property's assessed market value multiplied by the local tax rate, reflecting the property's contribution to community funding. Unlike special assessments, property tax is a general obligation charge that applies uniformly across all taxable properties in the jurisdiction.

What is a Special Assessment in Real Estate?

A special assessment in real estate is a charge imposed on property owners to fund specific public projects, such as street improvements, sidewalks, or sewer upgrades, that directly benefit their property. Unlike regular property taxes based on assessed property value, special assessments are one-time or periodic fees calculated based on the property's frontage or a fixed rate assigned to the benefiting area. Special assessments are separate from general property taxes and must be paid in addition to regular tax bills, directly reflecting localized improvements.

Key Differences Between Property Tax and Special Assessment

Property tax is a recurring charge based on the assessed value of real estate, funding general municipal services such as schools, police, and infrastructure, while special assessments are one-time or periodic fees levied for specific public projects benefiting the property, like road improvements or sewage systems. Property taxes are calculated annually and apply uniformly to all properties within a jurisdiction, whereas special assessments vary by the extent of benefit received and are often tied directly to the improvement's cost. Understanding these distinctions impacts homeowner budgeting and property valuation, as special assessments are separate from the regular tax bill and may affect resale considerations.

How Property Taxes Are Calculated

Property taxes are calculated based on the assessed value of the property multiplied by the local tax rate, determined by municipal or county authorities. Assessors evaluate factors such as land value, improvements, and market conditions to establish the taxable value, which directly influences the tax amount owed. Special assessments differ as they are fees levied for specific public projects that directly benefit the property, calculated separately from regular property taxes.

Special Assessment: Common Types and Examples

Special assessments in real estate are fees imposed on property owners to fund specific public projects that directly benefit their property, such as sidewalk improvements, sewer upgrades, or street lighting installation. Common types of special assessments include curb and gutter repairs, stormwater drainage systems, and neighborhood security enhancements, each assessed based on the property's frontage or square footage. Unlike general property taxes, these assessments are temporary and targeted, ensuring that only properties benefiting from the improvement share the cost.

Who Pays Property Tax vs Special Assessment?

Property taxes are typically paid by all property owners based on the assessed value of their real estate within a taxing jurisdiction. Special assessments are charged only to property owners who directly benefit from specific public improvements, such as new sidewalks or sewer lines. While property taxes fund general local government services, special assessments cover targeted projects impacting particular properties.

Impact on Homeowners: Property Tax vs Special Assessment

Property tax impacts homeowners by providing a stable source of revenue for local governments, calculated based on assessed property value and generally used for ongoing public services like schools and infrastructure. Special assessments are one-time or periodic charges imposed for specific local improvements, such as street repairs or sewer upgrades, directly affecting homeowners within the benefiting area. The financial burden of property taxes is predictable and spread over time, whereas special assessments can result in sudden, substantial costs that may influence home affordability and market value.

Financial Planning: Budgeting for Taxes and Assessments

Understanding the distinction between property tax and special assessments is crucial for effective financial planning in real estate. Property tax is an ongoing expense based on assessed property value, while special assessments are one-time charges for specific public improvements like sidewalks or streetlights. Accurate budgeting requires factoring in both predictable taxes and potential special assessments to avoid unexpected financial strain.

Legal Implications of Unpaid Property Tax and Special Assessments

Unpaid property taxes result in a government lien that can lead to foreclosure and loss of ownership rights, while special assessment delinquencies may trigger separate liens specific to local improvements. Legal actions for unpaid property taxes often involve tax sale auctions that transfer title, whereas special assessments, though enforceable, might have differing priority in lien hierarchy. Both obligations carry penalties and interest, emphasizing the critical nature of timely payments to avoid legal forfeiture and credit damage.

Choosing the Right Property: Considering Taxes and Assessments

Evaluating property tax rates alongside special assessments is crucial when choosing the right real estate investment, as these costs directly impact long-term affordability and property value. Property taxes are recurring obligations based on assessed value, while special assessments fund specific local improvements, potentially causing unexpected financial burdens. Careful analysis of both ensures informed decisions, balancing immediate purchase costs with future fiscal responsibilities.

property tax vs special assessment Infographic

difterm.com

difterm.com