Co-op apartments require buyers to purchase shares in a corporation owning the building, resulting in a more stringent approval process and potential restrictions on pet ownership. Condos provide individual ownership of units with more flexibility in pet policies and generally easier financing options. Understanding these differences helps pet owners choose housing that aligns with their lifestyle and pet care needs.

Table of Comparison

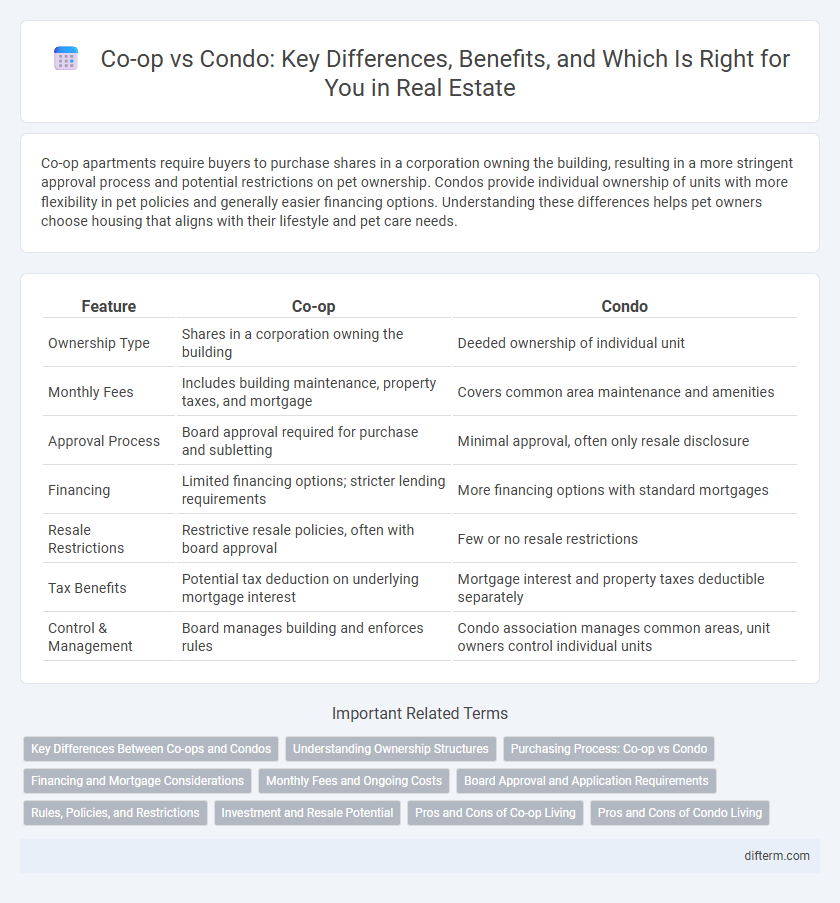

| Feature | Co-op | Condo |

|---|---|---|

| Ownership Type | Shares in a corporation owning the building | Deeded ownership of individual unit |

| Monthly Fees | Includes building maintenance, property taxes, and mortgage | Covers common area maintenance and amenities |

| Approval Process | Board approval required for purchase and subletting | Minimal approval, often only resale disclosure |

| Financing | Limited financing options; stricter lending requirements | More financing options with standard mortgages |

| Resale Restrictions | Restrictive resale policies, often with board approval | Few or no resale restrictions |

| Tax Benefits | Potential tax deduction on underlying mortgage interest | Mortgage interest and property taxes deductible separately |

| Control & Management | Board manages building and enforces rules | Condo association manages common areas, unit owners control individual units |

Key Differences Between Co-ops and Condos

Co-ops require purchasing shares in a corporation that owns the building, offering shareholders a proprietary lease, while condos involve outright ownership of individual units and a shared interest in common areas. Financing for co-ops often demands higher down payments and tighter lender requirements compared to condo mortgages. Maintenance fees in co-ops typically cover underlying building expenses and property taxes, whereas condo fees primarily fund common area upkeep and amenities.

Understanding Ownership Structures

Co-ops involve purchasing shares in a corporation that owns the building, granting the buyer a proprietary lease, while condos provide direct ownership of the individual unit and a share of common areas. In co-ops, board approval is often required for purchase and subletting, influencing control and restrictions, whereas condos offer greater autonomy with fewer restrictions on ownership and renting. Understanding these ownership structures is crucial for real estate investors to assess financial implications, legal responsibilities, and lifestyle preferences.

Purchasing Process: Co-op vs Condo

Purchasing a co-op involves applying for board approval, submitting financial documents, and attending an interview, which can extend the timeline significantly compared to condos. Condo purchases resemble traditional real estate transactions, often requiring standard mortgage approval and fewer restrictions, leading to a faster closing process. Co-op buyers face stringent financial requirements and have limited financing options, while condo buyers enjoy more flexibility with loans and resale opportunities.

Financing and Mortgage Considerations

Co-op financing typically requires larger down payments, often ranging from 20% to 25%, with stricter approval processes due to board requirements and limited availability of conventional mortgages. Condo buyers often have access to a broader range of mortgage options, including FHA and VA loans, with lower down payment requirements, generally around 5% to 10%. Mortgage approval for co-ops involves evaluating the corporation's financial health, making lender scrutiny more rigorous compared to the individual property assessments common in condo financing.

Monthly Fees and Ongoing Costs

Co-op monthly fees typically cover building maintenance, property taxes, and underlying mortgage payments, often resulting in higher fees compared to condos. Condo owners pay monthly association fees that generally exclude property taxes, which are billed separately, offering more transparent ongoing costs. Understanding these financial distinctions is crucial for buyers evaluating long-term affordability in real estate investments.

Board Approval and Application Requirements

Co-op ownership typically requires stringent board approval, including detailed financial disclosures, personal interviews, and references, reflecting collective decision-making by co-op shareholders. Condo applications are generally more straightforward, focusing on credit checks and background screenings without the need for extensive board interviews or personal evaluations. The approval process in co-ops can be more time-consuming and subjective compared to the more standardized, faster procedures in condo purchases.

Rules, Policies, and Restrictions

Co-ops typically enforce stricter rules, including rigorous board approval processes and limitations on subletting, impacting flexibility for residents. Condos offer more autonomy with fewer restrictions, allowing owners greater freedom to rent or renovate their units. Understanding these differences in governance policies is crucial for buyers considering investment stability and lifestyle preferences.

Investment and Resale Potential

Co-ops generally have lower purchase prices but stricter approval processes and more limited financing options, which can affect their resale potential and restrict investor appeal. Condos offer greater flexibility for investors, easier financing, and typically higher appreciation rates, making them more attractive for long-term investment and resale. Market trends show condos outperform co-ops in liquidity and value growth, especially in urban areas with high demand.

Pros and Cons of Co-op Living

Co-op living offers lower purchase prices and often includes maintenance fees that cover utilities and building amenities, providing cost-effective urban housing solutions. However, co-op boards impose strict approval processes and resale restrictions, limiting ownership flexibility and sometimes resulting in less control over property decisions. Despite these limitations, co-ops foster a strong sense of community among residents due to shared ownership of the building.

Pros and Cons of Condo Living

Condo living offers homeowners direct ownership of their unit and a share of common areas, providing greater control over property decisions and potential appreciation in value. Residents benefit from amenities such as gyms, pools, and security services, enhancing lifestyle convenience and community engagement. However, condo fees can be high and monthly dues may increase unexpectedly, with rules and covenants governed by the condo association potentially limiting customization and personal use of the property.

Co-op vs Condo Infographic

difterm.com

difterm.com