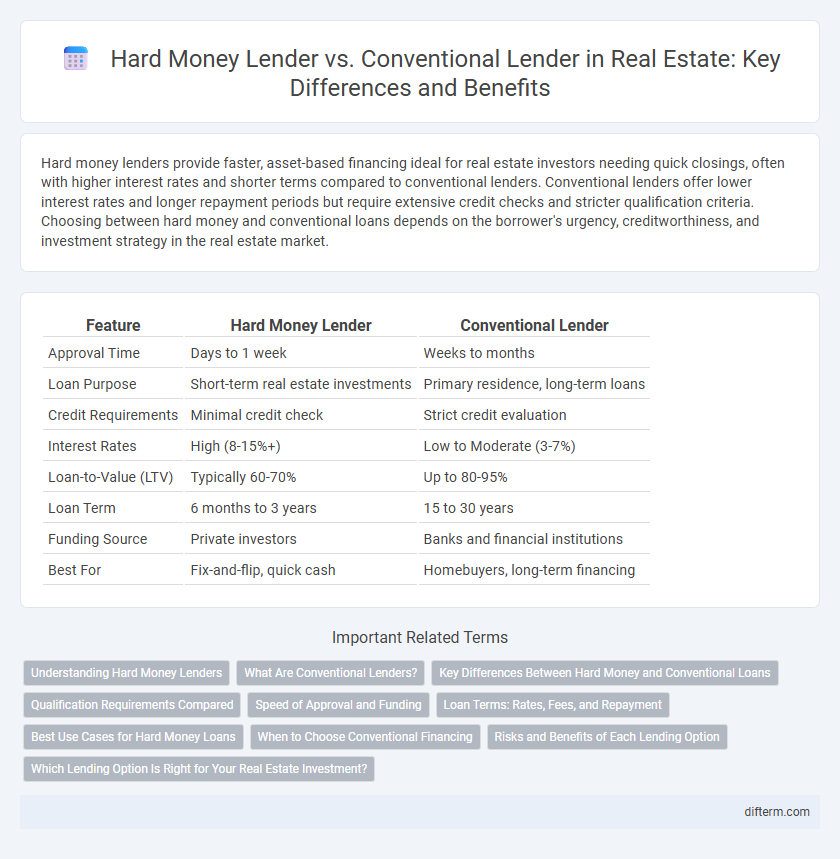

Hard money lenders provide faster, asset-based financing ideal for real estate investors needing quick closings, often with higher interest rates and shorter terms compared to conventional lenders. Conventional lenders offer lower interest rates and longer repayment periods but require extensive credit checks and stricter qualification criteria. Choosing between hard money and conventional loans depends on the borrower's urgency, creditworthiness, and investment strategy in the real estate market.

Table of Comparison

| Feature | Hard Money Lender | Conventional Lender |

|---|---|---|

| Approval Time | Days to 1 week | Weeks to months |

| Loan Purpose | Short-term real estate investments | Primary residence, long-term loans |

| Credit Requirements | Minimal credit check | Strict credit evaluation |

| Interest Rates | High (8-15%+) | Low to Moderate (3-7%) |

| Loan-to-Value (LTV) | Typically 60-70% | Up to 80-95% |

| Loan Term | 6 months to 3 years | 15 to 30 years |

| Funding Source | Private investors | Banks and financial institutions |

| Best For | Fix-and-flip, quick cash | Homebuyers, long-term financing |

Understanding Hard Money Lenders

Hard money lenders provide short-term, asset-based loans primarily secured by real estate, targeting borrowers who need quick financing or have less-than-perfect credit. Unlike conventional lenders, they focus less on credit scores and more on property value and potential resale, enabling faster approval and funding. These lenders typically charge higher interest rates and fees but offer flexible terms tailored to real estate investors and fix-and-flip projects.

What Are Conventional Lenders?

Conventional lenders are traditional financial institutions such as banks and credit unions that provide mortgage loans based on strict underwriting criteria including credit score, income, and debt-to-income ratio. They typically offer lower interest rates and longer repayment terms compared to hard money lenders but require thorough documentation and qualification. These lenders follow federal and state regulations to ensure loan compliance and borrower eligibility.

Key Differences Between Hard Money and Conventional Loans

Hard money lenders provide short-term, asset-based loans primarily used for real estate investments, often with higher interest rates and faster approval processes compared to conventional lenders. Conventional loans typically require extensive credit checks, lower loan-to-value ratios, and longer approval times but offer lower interest rates and more favorable terms for owner-occupied properties. Key differences include loan purpose, approval criteria, interest rates, and funding speed, making hard money loans suitable for investors needing quick capital and conventional loans ideal for traditional homebuyers.

Qualification Requirements Compared

Hard money lenders primarily assess the value of the collateral property and typically impose less stringent credit score requirements compared to conventional lenders. Conventional lenders require higher credit scores, detailed income verification, and a stable financial history to qualify for loans. The qualification process for hard money loans is faster but often involves higher interest rates due to increased risk tolerance.

Speed of Approval and Funding

Hard money lenders typically approve and fund loans within days, leveraging asset-based criteria rather than credit scores, which significantly accelerates the financing process for real estate investors. Conventional lenders require extensive documentation and thorough credit evaluations, often resulting in approval and funding times of 30 to 60 days. This speed difference makes hard money loans ideal for time-sensitive real estate transactions or fix-and-flip projects.

Loan Terms: Rates, Fees, and Repayment

Hard money lenders typically offer higher interest rates, averaging 8-15%, compared to conventional lenders whose rates often range from 3-7%, reflecting the increased risk and shorter loan terms. Fees associated with hard money loans, such as origination and underwriting fees, can be significantly higher, sometimes reaching 3-6% of the loan amount, whereas conventional loans usually have lower and more standardized fees. Repayment schedules for hard money loans are generally shorter, often 6 to 24 months, requiring quicker payoff, while conventional loans have longer terms ranging from 15 to 30 years, allowing for more manageable monthly payments.

Best Use Cases for Hard Money Loans

Hard money loans are best suited for real estate investors seeking quick financing for fix-and-flip projects or properties with poor credit history, as they offer faster approval and more flexible terms than conventional lenders. These loans are ideal when borrowers need to purchase or renovate a property quickly, often within days, bypassing the lengthy underwriting process of traditional mortgages. Hard money lending is advantageous for short-term investments and distressed properties where conventional financing options may be unavailable or impractical.

When to Choose Conventional Financing

Conventional financing is ideal when borrowers have strong credit scores, stable income, and can afford a lower loan-to-value ratio, resulting in better interest rates and longer repayment terms. This type of lender typically requires thorough documentation, making it suitable for those seeking lower overall costs and more predictable monthly payments. Borrowers planning to hold properties long-term or purchase primary residences generally benefit more from conventional loans compared to hard money financing options.

Risks and Benefits of Each Lending Option

Hard money lenders offer faster approval and more flexible terms, ideal for investors needing quick capital, but come with higher interest rates and shorter repayment periods, increasing financial risk. Conventional lenders provide lower interest rates and longer loan terms, reducing monthly payments and long-term costs, but strict credit requirements and slower processing can delay property acquisition. Evaluating the urgency of funding, creditworthiness, and project timeline helps determine whether hard money or conventional lending better suits real estate investment goals.

Which Lending Option Is Right for Your Real Estate Investment?

Hard money lenders offer fast approvals and flexible terms ideal for short-term real estate investments or projects requiring quick financing, often at higher interest rates and fees than conventional lenders. Conventional lenders provide lower interest rates and longer repayment periods but require strong credit scores, extensive documentation, and longer approval times, making them suitable for stable, long-term investments. Evaluating the urgency of funding, credit profile, project type, and investment timeline helps determine whether a hard money or conventional loan best aligns with your real estate investment goals.

Hard money lender vs Conventional lender Infographic

difterm.com

difterm.com