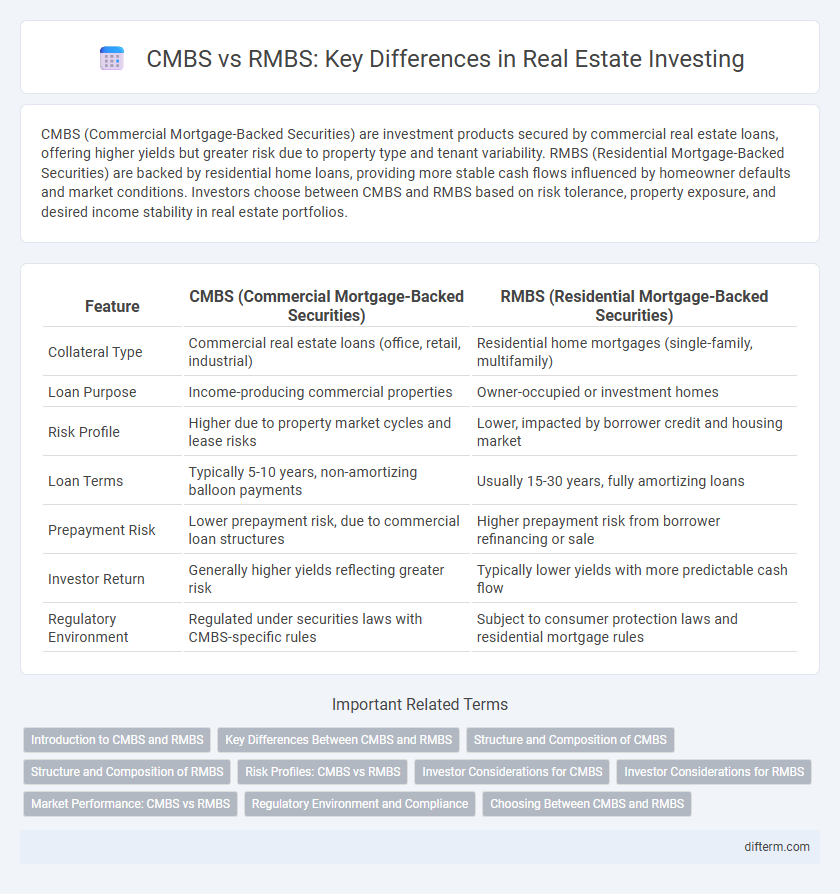

CMBS (Commercial Mortgage-Backed Securities) are investment products secured by commercial real estate loans, offering higher yields but greater risk due to property type and tenant variability. RMBS (Residential Mortgage-Backed Securities) are backed by residential home loans, providing more stable cash flows influenced by homeowner defaults and market conditions. Investors choose between CMBS and RMBS based on risk tolerance, property exposure, and desired income stability in real estate portfolios.

Table of Comparison

| Feature | CMBS (Commercial Mortgage-Backed Securities) | RMBS (Residential Mortgage-Backed Securities) |

|---|---|---|

| Collateral Type | Commercial real estate loans (office, retail, industrial) | Residential home mortgages (single-family, multifamily) |

| Loan Purpose | Income-producing commercial properties | Owner-occupied or investment homes |

| Risk Profile | Higher due to property market cycles and lease risks | Lower, impacted by borrower credit and housing market |

| Loan Terms | Typically 5-10 years, non-amortizing balloon payments | Usually 15-30 years, fully amortizing loans |

| Prepayment Risk | Lower prepayment risk, due to commercial loan structures | Higher prepayment risk from borrower refinancing or sale |

| Investor Return | Generally higher yields reflecting greater risk | Typically lower yields with more predictable cash flow |

| Regulatory Environment | Regulated under securities laws with CMBS-specific rules | Subject to consumer protection laws and residential mortgage rules |

Introduction to CMBS and RMBS

Commercial Mortgage-Backed Securities (CMBS) are investment products secured by commercial real estate loans, often involving office buildings, hotels, or shopping centers, offering predictable income streams through structured payments. Residential Mortgage-Backed Securities (RMBS) are backed by residential home loans, primarily composed of pools of single-family mortgages, providing exposure to the housing market and consumer mortgage performance. Both CMBS and RMBS play critical roles in mortgage finance, enabling lenders to free capital and investors to diversify portfolios with real estate-backed assets.

Key Differences Between CMBS and RMBS

CMBS (Commercial Mortgage-Backed Securities) are backed by commercial real estate loans, while RMBS (Residential Mortgage-Backed Securities) are backed by residential home loans. CMBS typically involve larger loan amounts with longer terms and more complex underwriting focused on commercial properties like office buildings and retail centers. RMBS generally consist of smaller, standardized single-family home loans with higher prepayment risks due to borrower refinancing or home sales.

Structure and Composition of CMBS

CMBS (Commercial Mortgage-Backed Securities) are structured through pooling commercial real estate loans, including office buildings, shopping centers, and multifamily properties, into a single trust that issues multiple tranches with varying risk levels and maturities. The composition typically features senior and mezzanine tranches, allowing investors to select exposure based on risk tolerance and yield requirements. Unlike RMBS (Residential Mortgage-Backed Securities), CMBS loans have larger balances and more complex underwriting due to the diverse property types and lease structures involved.

Structure and Composition of RMBS

Residential Mortgage-Backed Securities (RMBS) consist primarily of pools of residential mortgage loans, typically including prime and subprime home loans, structured into tranches based on credit risk and maturity. The structure of RMBS allows for the distribution of cash flows from mortgage payments, interest, and principal across different tranches, providing varied risk and return profiles to investors. Unlike Commercial Mortgage-Backed Securities (CMBS), RMBS focus exclusively on residential properties, which affects default risk, prepayment speeds, and overall portfolio composition.

Risk Profiles: CMBS vs RMBS

CMBS (Commercial Mortgage-Backed Securities) typically exhibit higher risk profiles due to their reliance on commercial property performance, which is more sensitive to economic cycles and market conditions compared to RMBS (Residential Mortgage-Backed Securities). RMBS generally benefit from more diversified borrower bases and government-sponsored entity guarantees, reducing default risk and enhancing credit stability. Investors often perceive CMBS as more volatile, reflecting increased exposure to property vacancies and lease rollovers, while RMBS risks are more tied to individual homeowner payment behaviors and regional housing market dynamics.

Investor Considerations for CMBS

Investors in CMBS (Commercial Mortgage-Backed Securities) must evaluate property type diversity, credit quality, and underlying loan pool performance, as these factors directly impact yield and risk. The relative illiquidity and prepayment unpredictability of CMBS compared to RMBS (Residential Mortgage-Backed Securities) require rigorous due diligence on loan covenants and borrower creditworthiness. CMBS also offer exposure to commercial real estate sectors such as office, retail, and industrial, which can provide higher returns but involve greater sensitivity to economic cycles and vacancy rates.

Investor Considerations for RMBS

Investors in RMBS prioritize stable cash flow through diversified pools of residential mortgages, which typically offer lower default risk compared to other asset-backed securities. Credit quality assessment focuses on borrower credit scores, loan-to-value ratios, and geographic concentration within the housing market. RMBS provide opportunities for yield enhancement and portfolio diversification, especially in environments with strong residential real estate fundamentals and low interest rates.

Market Performance: CMBS vs RMBS

Commercial Mortgage-Backed Securities (CMBS) typically exhibit higher yields compared to Residential Mortgage-Backed Securities (RMBS) due to increased risk from commercial property market fluctuations and tenant credit variability. RMBS often demonstrate lower default rates and greater stability because of diversified pools of residential loans backed by government-sponsored enterprises like Fannie Mae and Freddie Mac. Market performance for CMBS is more sensitive to economic cycles impacting commercial real estate, whereas RMBS benefits from a broader, more consistent housing demand driving steady cash flows.

Regulatory Environment and Compliance

CMBS (Commercial Mortgage-Backed Securities) and RMBS (Residential Mortgage-Backed Securities) operate under distinct regulatory frameworks with CMBS subject to oversight by agencies like the SEC and adherence to Dodd-Frank provisions, emphasizing commercial property risk assessments and loan performance standards. RMBS regulations prioritize consumer protection under the CFPB and the Truth in Lending Act, focusing on borrower eligibility, disclosure requirements, and anti-predatory lending laws. Compliance complexity increases for CMBS due to heterogeneous commercial real estate loans, while RMBS compliance frameworks heavily address residential mortgage underwriting and servicing standards.

Choosing Between CMBS and RMBS

Choosing between CMBS and RMBS depends on the investor's risk tolerance and asset preference, as CMBS are backed by commercial real estate loans while RMBS are secured by residential mortgages. CMBS typically offer higher yields due to their exposure to commercial property market cycles and tenant risks, whereas RMBS provide more stability through diversified pools of home loans. Understanding loan performance, prepayment speeds, and market conditions is essential for optimizing returns in either security type.

CMBS vs RMBS Infographic

difterm.com

difterm.com