Assumable mortgages allow buyers to take over the seller's existing loan, often at a lower interest rate, which can result in significant savings and simpler financing. Non-assumable mortgages require buyers to obtain new financing, potentially facing higher rates and stricter qualification criteria. Choosing an assumable mortgage can streamline the home-buying process and provide financial advantages in a rising interest rate environment.

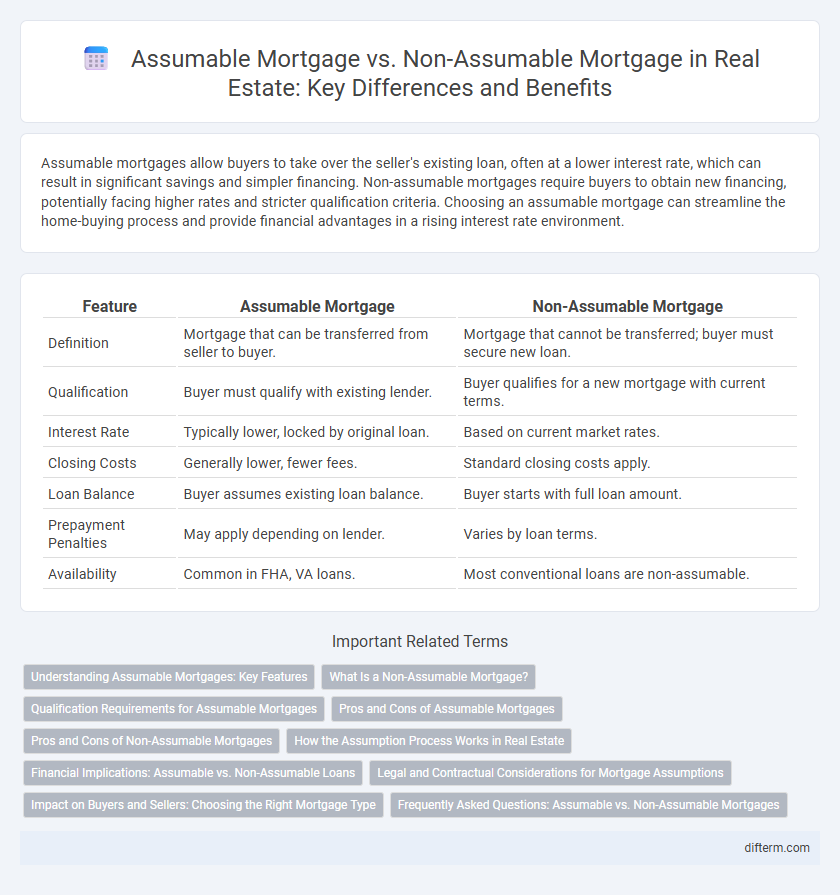

Table of Comparison

| Feature | Assumable Mortgage | Non-Assumable Mortgage |

|---|---|---|

| Definition | Mortgage that can be transferred from seller to buyer. | Mortgage that cannot be transferred; buyer must secure new loan. |

| Qualification | Buyer must qualify with existing lender. | Buyer qualifies for a new mortgage with current terms. |

| Interest Rate | Typically lower, locked by original loan. | Based on current market rates. |

| Closing Costs | Generally lower, fewer fees. | Standard closing costs apply. |

| Loan Balance | Buyer assumes existing loan balance. | Buyer starts with full loan amount. |

| Prepayment Penalties | May apply depending on lender. | Varies by loan terms. |

| Availability | Common in FHA, VA loans. | Most conventional loans are non-assumable. |

Understanding Assumable Mortgages: Key Features

Assumable mortgages allow buyers to take over the seller's existing loan with its current terms, often providing lower interest rates and reduced closing costs compared to obtaining a new mortgage. Key features include lender approval requirements, eligibility restrictions typically limited to government-backed loans such as FHA, VA, or USDA, and the potential for buyers to save money when interest rates have risen since the original loan was issued. Understanding the benefits and limitations of assumable mortgages is crucial for both buyers and sellers aiming to maximize financial advantages in real estate transactions.

What Is a Non-Assumable Mortgage?

A non-assumable mortgage is a loan that cannot be transferred from the current borrower to a new buyer without the lender's approval, requiring the new buyer to secure their own financing. This type of mortgage is common in conventional loans and limits the buyer's ability to take advantage of the seller's interest rate or loan terms. Understanding non-assumable mortgages is crucial for buyers and sellers in real estate transactions to manage financial expectations and loan eligibility.

Qualification Requirements for Assumable Mortgages

Assumable mortgages require the buyer to meet specific qualification criteria, including creditworthiness, income verification, and debt-to-income ratio assessments similar to traditional loan approvals. Lenders typically insist on a thorough financial evaluation to ensure the buyer can uphold the existing loan terms, which can expedite the loan process but demands stringent documentation. This qualification process contrasts with non-assumable mortgages, where the buyer must independently secure new financing without leveraging the seller's loan terms.

Pros and Cons of Assumable Mortgages

Assumable mortgages allow buyers to take over the seller's existing mortgage, often at a lower interest rate, resulting in potential savings and easier loan approval due to the lender's prior underwriting process. However, assumable loans may require lender approval and limit use to specific loan types like FHA, VA, or USDA loans, restricting buyer options. Sellers benefit from increased marketability, but buyers face risks if the mortgage balance is high, requiring significant down payment or additional financing.

Pros and Cons of Non-Assumable Mortgages

Non-assumable mortgages offer lenders greater control and typically include more stringent approval processes, minimizing risk of default. Borrowers cannot transfer the loan terms to a new buyer, which limits flexibility but ensures the mortgage remains under the original borrower's financial strength. Higher interest rates on non-assumable loans may increase monthly payments compared to assumable options, impacting overall affordability.

How the Assumption Process Works in Real Estate

The assumption process in real estate involves the buyer taking over the seller's existing mortgage loan under its current terms, subject to lender approval, which often includes a credit check and income verification. Assumable mortgages, commonly found in FHA, VA, and USDA loans, allow buyers to bypass new loan origination fees and potentially benefit from lower interest rates. This process increases transaction efficiency by simplifying financing, but non-assumable mortgages require buyers to secure new financing, leading to longer approval timelines and possibly higher borrowing costs.

Financial Implications: Assumable vs. Non-Assumable Loans

Assumable mortgages allow buyers to take over the seller's existing loan terms, often resulting in lower interest rates and reduced closing costs compared to obtaining new financing, which can make homeownership more affordable. Non-assumable mortgages require buyers to secure their own loans, potentially at higher interest rates and with additional fees, increasing the overall cost of purchasing the property. Understanding these financial implications helps buyers evaluate potential savings and the impact on long-term mortgage payments.

Legal and Contractual Considerations for Mortgage Assumptions

Assumable mortgages require explicit lender approval, with legal contracts specifying the transfer of liability from the seller to the buyer under existing loan terms. Non-assumable mortgages prohibit transfer, mandating full repayment upon sale, thus necessitating new financing for the buyer. Accurate review of contractual clauses and lender policies is critical to ensure compliance and avoid legal disputes in mortgage assumption processes.

Impact on Buyers and Sellers: Choosing the Right Mortgage Type

Assumable mortgages can significantly benefit buyers by allowing them to take over the seller's existing loan with its current interest rate, potentially saving thousands on financing costs and simplifying the approval process. Sellers gain a competitive edge by offering an assumable mortgage, attracting more qualified buyers in a market with rising interest rates. Non-assumable mortgages require buyers to secure new financing, which can increase costs and complicate transactions, often resulting in longer selling times and less attractive offers.

Frequently Asked Questions: Assumable vs. Non-Assumable Mortgages

An assumable mortgage allows a buyer to take over the seller's existing loan, often with the same interest rate and terms, which can be advantageous in a rising rate environment. Non-assumable mortgages require buyers to secure new financing, potentially at higher rates, and involve standard loan approval processes. Common questions focus on eligibility criteria, lender approval requirements, and differences in financial liability between assumable and non-assumable loans.

assumable mortgage vs non-assumable mortgage Infographic

difterm.com

difterm.com