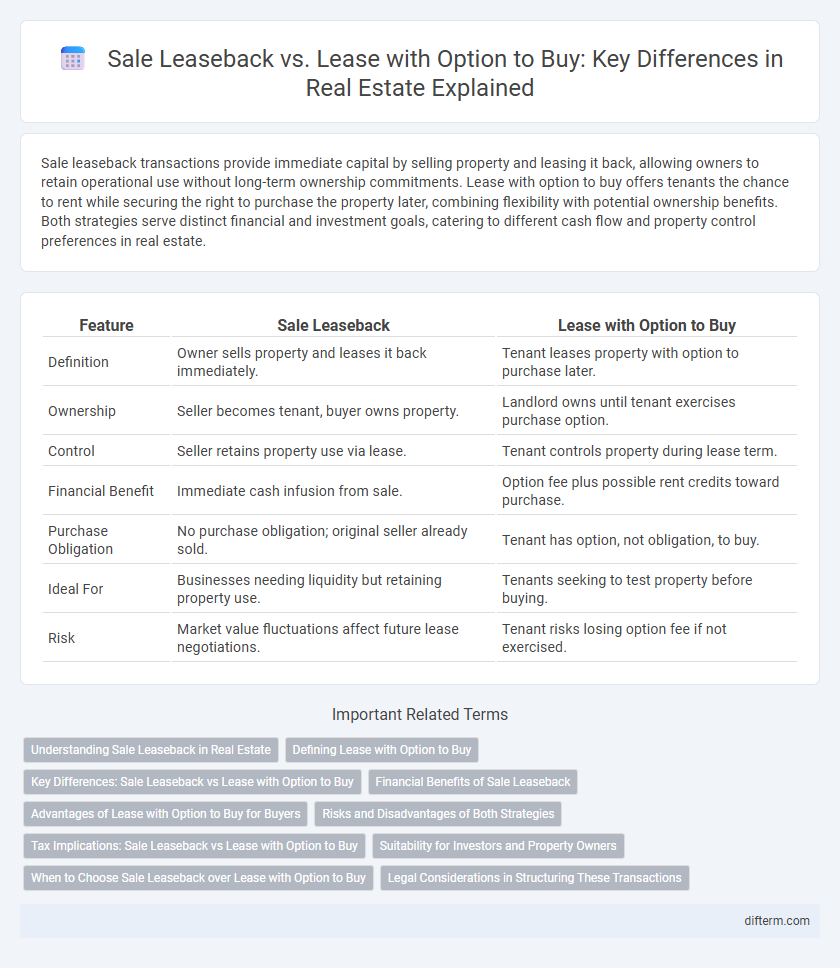

Sale leaseback transactions provide immediate capital by selling property and leasing it back, allowing owners to retain operational use without long-term ownership commitments. Lease with option to buy offers tenants the chance to rent while securing the right to purchase the property later, combining flexibility with potential ownership benefits. Both strategies serve distinct financial and investment goals, catering to different cash flow and property control preferences in real estate.

Table of Comparison

| Feature | Sale Leaseback | Lease with Option to Buy |

|---|---|---|

| Definition | Owner sells property and leases it back immediately. | Tenant leases property with option to purchase later. |

| Ownership | Seller becomes tenant, buyer owns property. | Landlord owns until tenant exercises purchase option. |

| Control | Seller retains property use via lease. | Tenant controls property during lease term. |

| Financial Benefit | Immediate cash infusion from sale. | Option fee plus possible rent credits toward purchase. |

| Purchase Obligation | No purchase obligation; original seller already sold. | Tenant has option, not obligation, to buy. |

| Ideal For | Businesses needing liquidity but retaining property use. | Tenants seeking to test property before buying. |

| Risk | Market value fluctuations affect future lease negotiations. | Tenant risks losing option fee if not exercised. |

Understanding Sale Leaseback in Real Estate

Sale leaseback in real estate involves the property owner selling the asset to an investor and simultaneously leasing it back, enabling continued use while freeing up capital. This arrangement offers sellers immediate liquidity without relocating, distinguishing it from lease with option to buy, which provides tenants the right but not obligation to purchase the property later. Sale leaseback agreements are commonly used for commercial properties to enhance cash flow and balance sheets.

Defining Lease with Option to Buy

A lease with option to buy is a contractual agreement allowing tenants to lease a property while securing the right to purchase it within a specified timeframe, typically capturing part of the rent as a credit toward the down payment. This arrangement benefits tenants seeking homeownership flexibility and provides sellers with steady rental income plus potential sale profits. Unlike sale-leaseback transactions, which involve owners selling the property and leasing it back immediately, the lease with option to buy centers on future purchasing rights without immediate transfer of ownership.

Key Differences: Sale Leaseback vs Lease with Option to Buy

Sale leaseback involves a property owner selling the asset and immediately leasing it back to retain operational use, providing immediate capital while maintaining occupancy. In contrast, a lease with option to buy grants the tenant the right to purchase the property at a predetermined price during or at the end of the lease term, combining rental payments with potential equity acquisition. Key differences include immediate ownership transfer in sale leaseback versus conditional future ownership in lease with option to buy, impacting cash flow, risk allocation, and investment strategy.

Financial Benefits of Sale Leaseback

Sale leaseback offers immediate liquidity by converting owned real estate into cash while retaining operational control through a long-term lease, enabling businesses to improve cash flow without increasing debt. Unlike a lease with option to buy, sale leaseback transactions provide predictable rental expenses and potential tax benefits from lease payments, enhancing financial stability and investment capacity. This structure also helps companies optimize balance sheets by removing real estate assets and liabilities, improving financial ratios for better borrowing terms.

Advantages of Lease with Option to Buy for Buyers

Lease with option to buy offers buyers the advantage of securing property control with lower initial costs compared to traditional purchases. This arrangement allows tenants to apply a portion of their lease payments toward the purchase price, providing financial flexibility and time to improve credit or save for a down payment. Buyers benefit from locking in a purchase price upfront, reducing market risk while enjoying the opportunity to test the property and neighborhood before committing to ownership.

Risks and Disadvantages of Both Strategies

Sale leaseback carries the risk of losing ownership control and potential property appreciation while remaining obligated to pay rent, which may increase over time. Lease with option to buy exposes tenants to the possibility of forfeiting option fees if unable to secure financing or decide against purchase, additionally risking rent premiums without long-term equity build-up. Both strategies require careful evaluation of market conditions and contract terms to mitigate financial losses and legal complications.

Tax Implications: Sale Leaseback vs Lease with Option to Buy

Sale leaseback transactions allow property owners to convert real estate equity into immediate cash while retaining operational control, offering potential tax deductions on lease payments as business expenses. Lease with option to buy agreements provide deferred property ownership, enabling lessees to apply a portion of lease payments toward the purchase price, which can impact capital gains and depreciation deductions differently compared to sale leasebacks. Understanding IRS regulations regarding property classification, timing of ownership transfer, and deductibility of payments is critical for optimizing tax benefits in both strategies.

Suitability for Investors and Property Owners

Sale leaseback offers immediate liquidity by allowing property owners to sell their asset and lease it back, making it highly suitable for owners seeking capital without losing operational control. Lease with option to buy provides potential investors flexibility to test property viability before committing to purchase, appealing to those looking for lower upfront risk and future acquisition opportunities. Both strategies cater to distinct investor profiles: sale leaseback favors cash flow-focused owners, while lease with option to buy targets investors prioritizing long-term ownership possibilities.

When to Choose Sale Leaseback over Lease with Option to Buy

Choose sale leaseback when immediate capital injection is essential without relinquishing operational control, typically for established businesses needing liquidity. This method suits companies aiming to unlock asset value while continuing to use the property, avoiding the uncertainties of future purchase commitments. In contrast, lease with option to buy is preferable when long-term ownership is a strategic goal but immediate purchase is financially unfeasible.

Legal Considerations in Structuring These Transactions

Sale leaseback transactions involve the immediate sale of real estate with a concurrent lease agreement, requiring careful drafting to address transfer of ownership, tenant rights, and tax implications under IRS rules. Lease with option to buy contracts must clearly define the purchase option terms, including option fee, exercise period, and property condition, ensuring compliance with state contract and real estate laws. Both structures necessitate thorough due diligence on title, zoning, and financing restrictions to mitigate legal risks and protect the interests of both parties.

Sale leaseback vs Lease with option to buy Infographic

difterm.com

difterm.com