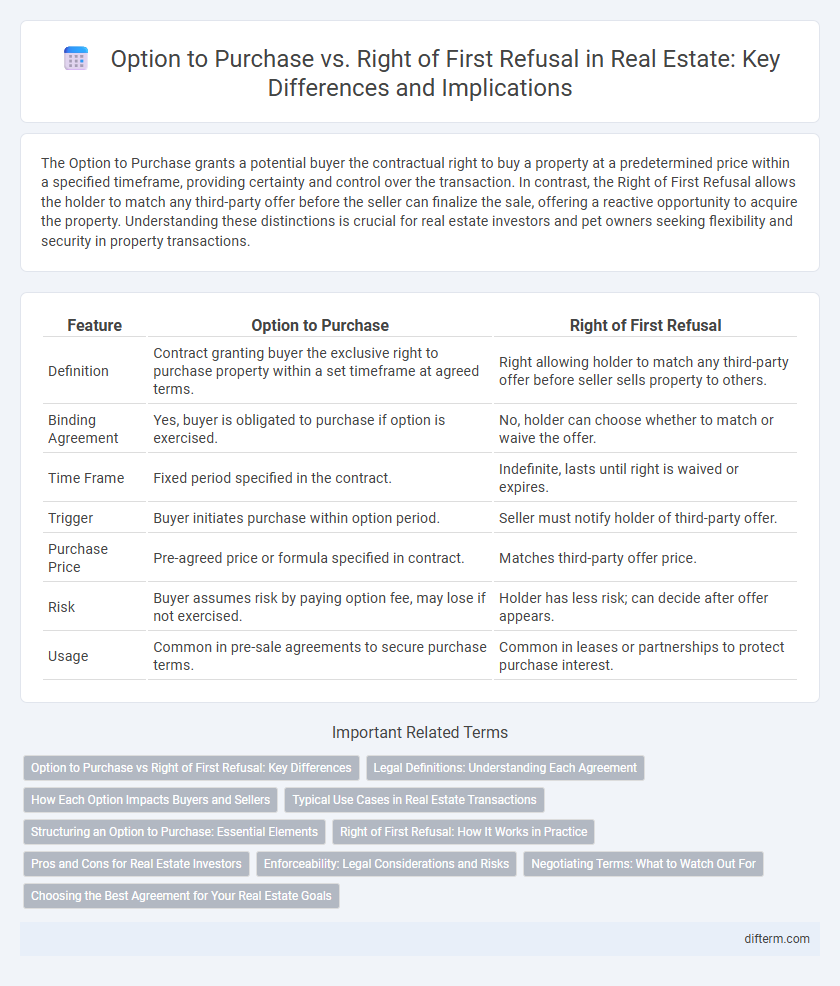

The Option to Purchase grants a potential buyer the contractual right to buy a property at a predetermined price within a specified timeframe, providing certainty and control over the transaction. In contrast, the Right of First Refusal allows the holder to match any third-party offer before the seller can finalize the sale, offering a reactive opportunity to acquire the property. Understanding these distinctions is crucial for real estate investors and pet owners seeking flexibility and security in property transactions.

Table of Comparison

| Feature | Option to Purchase | Right of First Refusal |

|---|---|---|

| Definition | Contract granting buyer the exclusive right to purchase property within a set timeframe at agreed terms. | Right allowing holder to match any third-party offer before seller sells property to others. |

| Binding Agreement | Yes, buyer is obligated to purchase if option is exercised. | No, holder can choose whether to match or waive the offer. |

| Time Frame | Fixed period specified in the contract. | Indefinite, lasts until right is waived or expires. |

| Trigger | Buyer initiates purchase within option period. | Seller must notify holder of third-party offer. |

| Purchase Price | Pre-agreed price or formula specified in contract. | Matches third-party offer price. |

| Risk | Buyer assumes risk by paying option fee, may lose if not exercised. | Holder has less risk; can decide after offer appears. |

| Usage | Common in pre-sale agreements to secure purchase terms. | Common in leases or partnerships to protect purchase interest. |

Option to Purchase vs Right of First Refusal: Key Differences

Option to Purchase grants a potential buyer the contractual right to buy a property at a predetermined price within a specific timeframe, providing certainty and exclusivity. Right of First Refusal allows the holder to match any third-party offer before the seller sells, giving them the chance but not the obligation to purchase. The key difference lies in the proactive nature of the Option to Purchase versus the reactive opportunity under the Right of First Refusal.

Legal Definitions: Understanding Each Agreement

An Option to Purchase is a legal agreement granting the buyer the exclusive right to buy a property at a predetermined price within a specified timeframe, creating a binding contract once exercised. The Right of First Refusal, by contrast, gives a prospective buyer the opportunity to match an offer the seller receives from a third party before the property can be sold elsewhere. Understanding the distinction lies in the timing and enforceability: an option secures a direct purchase right in advance, whereas a right of first refusal acts as a protective purchase opportunity triggered by external offers.

How Each Option Impacts Buyers and Sellers

An Option to Purchase grants the buyer the exclusive right to buy the property at a predetermined price within a specific timeframe, offering certainty and control but requiring upfront consideration fee, which sellers benefit from as immediate compensation. The Right of First Refusal allows the seller to receive offers from third parties first and gives the buyer a chance to match those offers, providing flexibility to sellers while creating uncertainty for buyers who may lose out if they cannot match the highest bid. Buyers prefer Options to Purchase for guaranteed purchase opportunities, whereas sellers favor Rights of First Refusal to maximize sale price potential through competitive bidding.

Typical Use Cases in Real Estate Transactions

Option to Purchase agreements are commonly used in real estate for securing the buyer's exclusive right to buy a property within a set period, often seen in off-market deals or pre-construction sales. Right of First Refusal is typically employed in situations where landlords or co-owners want the chance to match any third-party offer before the property is sold, frequently used in tenant purchase programs or co-ownership arrangements. Both mechanisms provide strategic control over future property transactions but differ in timing and contractual obligations, impacting negotiation leverage and market exposure.

Structuring an Option to Purchase: Essential Elements

An Option to Purchase in real estate requires a clear agreement specifying the property's description, option period, and fixed purchase price to ensure enforceability. Key elements include consideration paid by the optionee to secure exclusivity, clear terms outlining the exercise process, and detailed contingencies such as financing or inspections. Structuring these components precisely protects both buyer and seller by defining rights and obligations within the option timeframe.

Right of First Refusal: How It Works in Practice

The Right of First Refusal (ROFR) grants a potential buyer or tenant the opportunity to match any third-party offer before the property owner can finalize a sale or lease. In practice, the owner must notify the holder of ROFR with the exact terms of the external offer, allowing them a specified timeframe to accept or decline. This mechanism provides a strategic advantage by securing priority access without obligating the holder to purchase or lease immediately.

Pros and Cons for Real Estate Investors

Option to Purchase grants real estate investors a fixed price and timeframe to buy a property, providing certainty and control but potentially requiring upfront fees and binding commitments. Right of First Refusal allows investors to match offers before a property sells, offering flexibility and lower initial cost but risking losing the deal if outbid. Each method presents trade-offs in risk exposure, financial commitment, and negotiation leverage critical for strategic investment decisions.

Enforceability: Legal Considerations and Risks

The enforceability of an Option to Purchase hinges on a clear, binding agreement granting the buyer the unilateral right to buy the property within a specified timeframe, ensuring contractual certainty under property law. In contrast, the Right of First Refusal depends on the seller's obligation to offer the property to the holder before third parties, which can introduce ambiguity and potential disputes over notice requirements and acceptance terms. Both instruments carry legal risks including challenges to the clarity of terms, timing of exercise, and compliance with jurisdictional statutes, making precise drafting and legal counsel essential for enforceability.

Negotiating Terms: What to Watch Out For

When negotiating terms between an Option to Purchase and a Right of First Refusal, pay close attention to the duration and conditions under which each right can be exercised, as these directly affect timing and investment security for both parties. Ensure clarity on how the purchase price is determined--fixed in an Option to Purchase or contingent upon a third-party offer in a Right of First Refusal--to avoid future disputes. Also, scrutinize any contingencies related to transfer approvals, deposit requirements, and the potential for price renegotiation to protect your financial interests and contract enforceability.

Choosing the Best Agreement for Your Real Estate Goals

Choosing between an Option to Purchase and a Right of First Refusal depends on your specific real estate goals and risk tolerance. An Option to Purchase grants you exclusive rights to buy a property at predetermined terms within a set timeframe, providing certainty and control over the transaction. The Right of First Refusal offers the chance to match offers when the seller receives a third-party proposal, which may limit flexibility but can be less costly upfront.

Option to Purchase vs Right of First Refusal Infographic

difterm.com

difterm.com