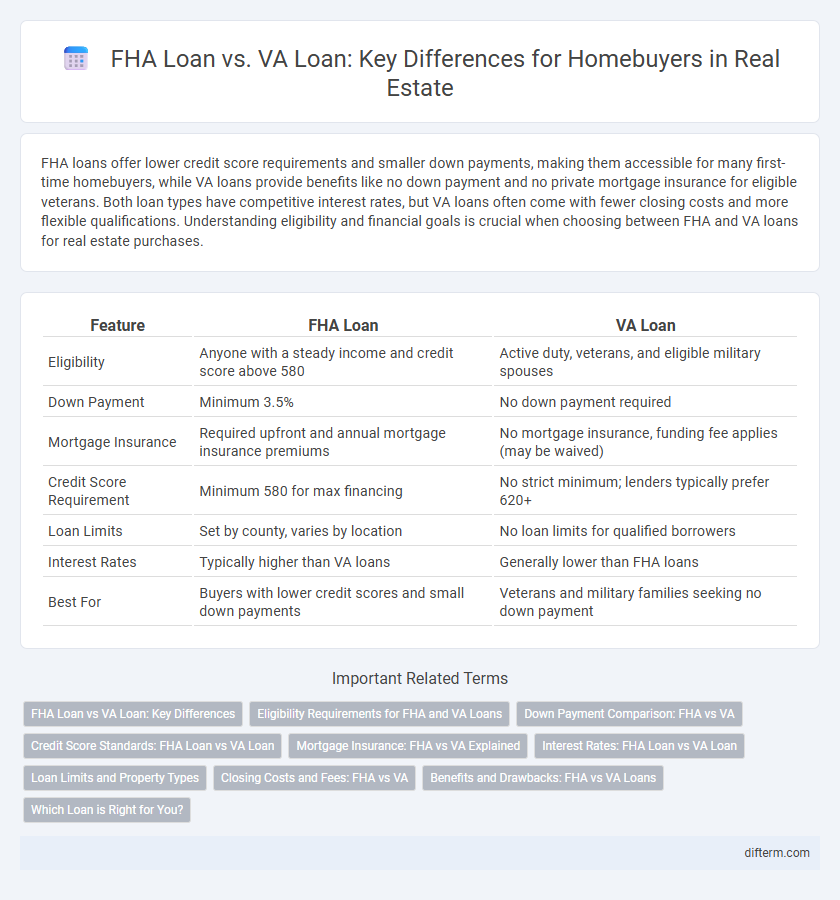

FHA loans offer lower credit score requirements and smaller down payments, making them accessible for many first-time homebuyers, while VA loans provide benefits like no down payment and no private mortgage insurance for eligible veterans. Both loan types have competitive interest rates, but VA loans often come with fewer closing costs and more flexible qualifications. Understanding eligibility and financial goals is crucial when choosing between FHA and VA loans for real estate purchases.

Table of Comparison

| Feature | FHA Loan | VA Loan |

|---|---|---|

| Eligibility | Anyone with a steady income and credit score above 580 | Active duty, veterans, and eligible military spouses |

| Down Payment | Minimum 3.5% | No down payment required |

| Mortgage Insurance | Required upfront and annual mortgage insurance premiums | No mortgage insurance, funding fee applies (may be waived) |

| Credit Score Requirement | Minimum 580 for max financing | No strict minimum; lenders typically prefer 620+ |

| Loan Limits | Set by county, varies by location | No loan limits for qualified borrowers |

| Interest Rates | Typically higher than VA loans | Generally lower than FHA loans |

| Best For | Buyers with lower credit scores and small down payments | Veterans and military families seeking no down payment |

FHA Loan vs VA Loan: Key Differences

FHA loans require a lower credit score and down payment, making them accessible for first-time buyers, while VA loans offer 100% financing with no down payment for eligible veterans and active-duty service members. FHA loans impose mortgage insurance premiums regardless of down payment size, whereas VA loans typically do not require mortgage insurance, reducing overall loan costs. Eligibility criteria differ significantly: FHA loans are available to any qualified borrower, whereas VA loans are restricted to those with military service history.

Eligibility Requirements for FHA and VA Loans

FHA loans require borrowers to have a minimum credit score of 580 and a steady income, with down payments as low as 3.5%, making them accessible to a broad range of homebuyers. VA loans are exclusively available to eligible veterans, active-duty service members, and certain members of the National Guard and Reserves, requiring no down payment or private mortgage insurance. Both loan types have specific documentation requirements, but VA loans generally offer more flexible credit standards and lower funding fees compared to FHA loans.

Down Payment Comparison: FHA vs VA

FHA loans require a minimum down payment of 3.5% of the purchase price, making them accessible for borrowers with lower credit scores or limited savings. VA loans often require no down payment at all, providing a significant financial advantage for eligible veterans and active-duty service members. The zero-down feature of VA loans can result in lower upfront costs compared to FHA loans, which may also involve mortgage insurance premiums regardless of down payment size.

Credit Score Standards: FHA Loan vs VA Loan

FHA loans typically require a minimum credit score of 580 for maximum financing with a 3.5% down payment, while borrowers with credit scores between 500 and 579 may still qualify with a 10% down payment. VA loans do not have a strict minimum credit score set by the VA, though lenders often require a score of 620 or higher to approve the loan. Comparing credit score standards, FHA loans offer more structured guidelines, whereas VA loans rely more on lender discretion and overall borrower creditworthiness.

Mortgage Insurance: FHA vs VA Explained

FHA loans require mortgage insurance premiums (MIP) for the life of the loan, typically starting at 1.75% upfront plus monthly payments ranging from 0.45% to 1.05% of the loan amount. VA loans do not require mortgage insurance but charge a one-time funding fee between 1.4% and 3.6% depending on service type and down payment size. The absence of ongoing mortgage insurance makes VA loans more cost-effective for eligible veterans compared to FHA loans.

Interest Rates: FHA Loan vs VA Loan

FHA loans typically have fixed interest rates ranging from 3% to 6%, influenced by credit scores and down payment size, while VA loans offer competitive, often lower interest rates averaging between 2.5% and 4.5%, benefiting from VA's backing and no private mortgage insurance requirement. The lower risk associated with VA loans allows lenders to provide reduced rates, making VA loans more cost-effective over the loan term compared to FHA loans. Borrowers with strong credit profiles frequently secure better deals with VA loans, whereas FHA loans serve buyers with lower credit scores, albeit at slightly higher interest expenses.

Loan Limits and Property Types

FHA loans have loan limits that vary by county, typically ranging from $472,030 to $1,089,300 in high-cost areas, while VA loans generally do not have a maximum loan limit but are subject to county-specific loan limit guidelines for guaranteeing portions of the loan. FHA loans allow financing of various property types including single-family homes, multi-family homes up to four units, and approved condos, whereas VA loans cover single-family homes, multi-family residences up to four units, and certain manufactured homes with stricter eligibility for property types. Understanding these distinctions in loan limits and eligible property types can significantly impact financing options for veterans and first-time homebuyers.

Closing Costs and Fees: FHA vs VA

FHA loans typically require borrowers to pay an upfront mortgage insurance premium (MIP) of 1.75% of the loan amount plus monthly insurance, increasing overall closing costs. VA loans eliminate private mortgage insurance (PMI) and generally have lower or no upfront funding fees for eligible veterans, resulting in reduced closing expenses. Both loan types can include other customary closing costs like appraisal and lender fees, but the VA loan's fee structure often offers significant savings at closing compared to FHA loans.

Benefits and Drawbacks: FHA vs VA Loans

FHA loans offer low down payments and easier credit requirements, making them accessible for first-time homebuyers but require mortgage insurance premiums that can increase overall costs. VA loans provide veterans and active-duty service members with no down payment and no private mortgage insurance, offering significant savings, though they have eligibility restrictions and may include a funding fee. Comparing FHA vs VA loans highlights that VA loans typically offer better value for qualified borrowers, while FHA loans remain a viable option for those with lower credit scores or who do not qualify for VA benefits.

Which Loan is Right for You?

FHA loans require a minimum credit score of 580 and a 3.5% down payment, making them ideal for first-time homebuyers or those with limited credit history. VA loans offer 0% down payment and no private mortgage insurance but are exclusively available to eligible veterans and active-duty service members. Assess eligibility, credit profile, and upfront costs to determine whether an FHA loan or VA loan best fits your financial situation and homeownership goals.

FHA Loan vs VA Loan Infographic

difterm.com

difterm.com