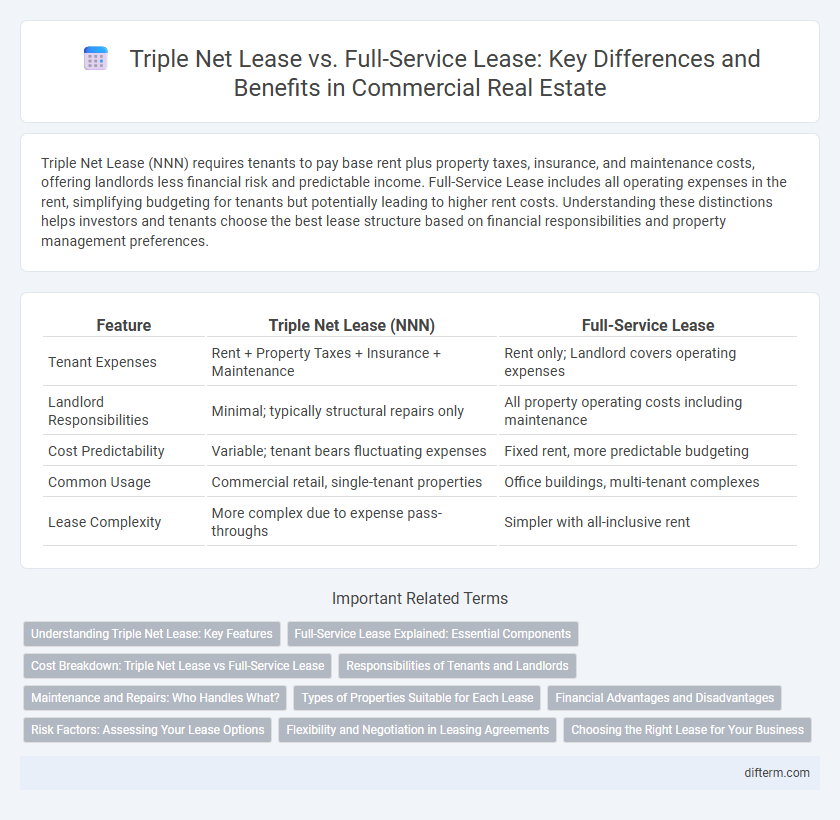

Triple Net Lease (NNN) requires tenants to pay base rent plus property taxes, insurance, and maintenance costs, offering landlords less financial risk and predictable income. Full-Service Lease includes all operating expenses in the rent, simplifying budgeting for tenants but potentially leading to higher rent costs. Understanding these distinctions helps investors and tenants choose the best lease structure based on financial responsibilities and property management preferences.

Table of Comparison

| Feature | Triple Net Lease (NNN) | Full-Service Lease |

|---|---|---|

| Tenant Expenses | Rent + Property Taxes + Insurance + Maintenance | Rent only; Landlord covers operating expenses |

| Landlord Responsibilities | Minimal; typically structural repairs only | All property operating costs including maintenance |

| Cost Predictability | Variable; tenant bears fluctuating expenses | Fixed rent, more predictable budgeting |

| Common Usage | Commercial retail, single-tenant properties | Office buildings, multi-tenant complexes |

| Lease Complexity | More complex due to expense pass-throughs | Simpler with all-inclusive rent |

Understanding Triple Net Lease: Key Features

A Triple Net Lease (NNN) requires tenants to pay property taxes, insurance, and maintenance costs in addition to base rent, shifting significant financial responsibilities from the landlord to the tenant. This lease structure offers predictable landlord expenses and lower base rent, making it popular in commercial real estate properties such as retail, industrial, and office spaces. Understanding the detailed obligations under a Triple Net Lease is crucial for tenants to accurately assess total occupancy costs and potential long-term financial commitments.

Full-Service Lease Explained: Essential Components

A Full-Service Lease includes rent, property taxes, insurance, maintenance, and utilities bundled into one predictable monthly payment, offering tenants convenience and simplified budgeting. Landlords manage all operational expenses, covering janitorial services, landscaping, and HVAC maintenance to ensure optimal property functioning. This lease type is common in office buildings, providing tenants with a comprehensive service package that minimizes administrative responsibilities.

Cost Breakdown: Triple Net Lease vs Full-Service Lease

Triple Net Lease (NNN) tenants pay base rent plus property taxes, insurance, and maintenance costs, resulting in variable expenses tied directly to the property's operating costs. Full-Service Lease tenants pay a single, all-inclusive rent that covers base rent, property taxes, maintenance, insurance, and often utilities, providing cost predictability but typically at a higher overall rent rate. Understanding these distinctions is crucial for budgeting, as NNN leases offer transparency in cost allocation, while full-service leases simplify expense management with fixed monthly payments.

Responsibilities of Tenants and Landlords

In a Triple Net Lease, tenants are responsible for property taxes, insurance, and maintenance costs, significantly reducing the landlord's financial obligations. Conversely, Full-Service Leases place most property expenses, including utilities, maintenance, and property management, on the landlord, offering tenants predictable monthly payments. This fundamental difference impacts cash flow stability for landlords and cost certainty for tenants in commercial real estate agreements.

Maintenance and Repairs: Who Handles What?

In a Triple Net Lease, tenants are responsible for all maintenance, repairs, property taxes, and insurance costs, ensuring full control and accountability over property upkeep. In contrast, a Full-Service Lease typically places the burden of maintenance and repairs on the landlord, who covers these expenses within the rent, offering tenants a hassle-free occupancy experience. Understanding these distinctions is crucial for commercial tenants and investors when negotiating lease terms and budgeting for property-related costs.

Types of Properties Suitable for Each Lease

Triple Net Lease agreements are commonly suited for single-tenant retail properties, industrial buildings, and standalone commercial spaces where tenants assume property expenses such as taxes, insurance, and maintenance. Full-Service Leases are ideal for multi-tenant office buildings, medical facilities, and commercial complexes where landlords cover operating expenses including utilities, janitorial services, and property maintenance. Selecting the appropriate lease type depends on property size, tenant responsibilities, and desired expense allocation.

Financial Advantages and Disadvantages

Triple net leases shift most property expenses, including taxes, insurance, and maintenance, to tenants, reducing landlords' operating costs and providing stable income, but increase financial responsibilities and unpredictability for tenants. Full-service leases offer tenants predictable, all-inclusive rent covering operating expenses, simplifying budgeting, but landlords bear fluctuating costs, potentially impacting net returns. Tenants seeking cost control often prefer triple net leases despite uncertainty, while those desiring expense certainty lean toward full-service leases despite higher base rents.

Risk Factors: Assessing Your Lease Options

Triple Net Lease transfers most property expenses such as taxes, insurance, and maintenance to the tenant, increasing financial risk and unpredictability. Full-Service Lease consolidates costs into a single rent payment, offering predictable expenses but potentially higher base rent. Evaluating risk tolerance and cash flow stability is crucial when choosing between these lease types for commercial real estate investments.

Flexibility and Negotiation in Leasing Agreements

Triple Net Lease agreements offer tenants greater flexibility by allowing direct control over property expenses such as taxes, insurance, and maintenance, enabling tailored cost management and operational adjustments. Full-Service Lease structures provide less negotiation room as landlords cover all expenses within a single rent, resulting in predictable monthly payments but limited tenant customization. Negotiation opportunities in Triple Net Leases often include specific terms on expense caps and maintenance responsibilities, while Full-Service Leases typically focus on rent amount and lease duration.

Choosing the Right Lease for Your Business

Choosing the right lease for your business depends largely on your financial flexibility and control preferences; Triple Net Leases require tenants to cover property taxes, insurance, and maintenance costs, offering lower base rent but higher variable expenses. In contrast, Full-Service Leases bundle these costs into a single rent payment, providing predictable monthly expenses but typically at a higher base rate. Evaluating your company's cash flow, risk tolerance, and long-term operational goals will help determine the optimal lease structure for commercial real estate occupancy.

Triple Net Lease vs Full-Service Lease Infographic

difterm.com

difterm.com