Off-plan properties offer buyers the chance to customize layouts and benefit from lower initial prices, while resale properties provide immediate availability and established neighborhood insights. Investing in off-plan properties can yield higher capital appreciation due to market growth during construction, whereas resale homes allow for immediate occupancy and potential renovation opportunities. Understanding the differences helps buyers align choices with their financial goals and lifestyle preferences in the real estate market.

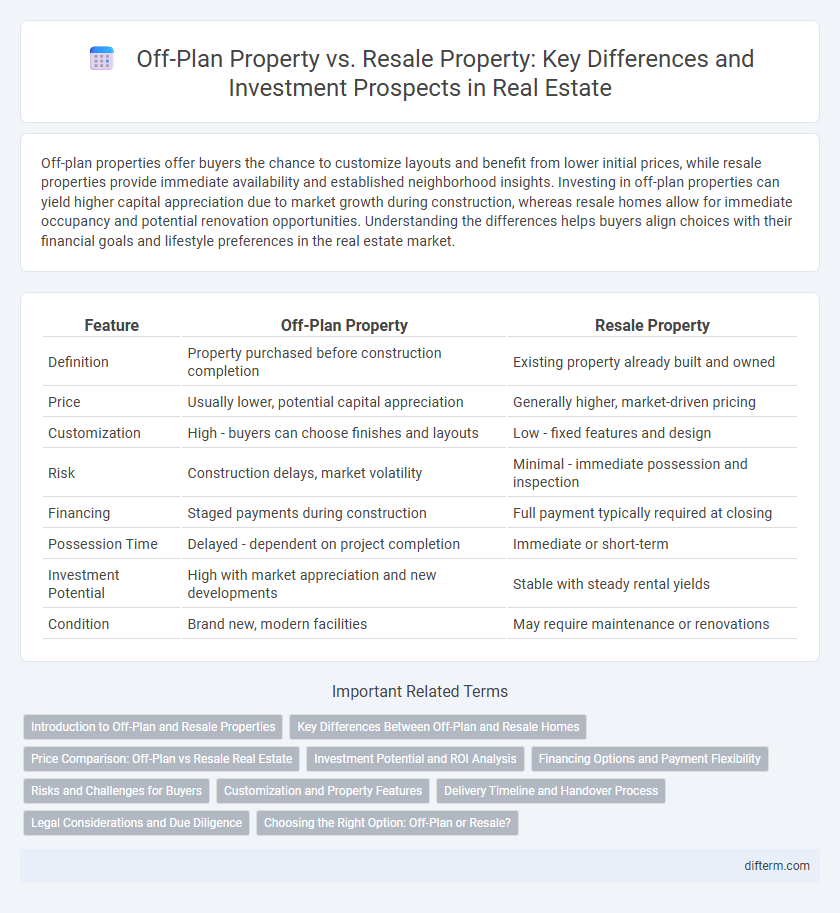

Table of Comparison

| Feature | Off-Plan Property | Resale Property |

|---|---|---|

| Definition | Property purchased before construction completion | Existing property already built and owned |

| Price | Usually lower, potential capital appreciation | Generally higher, market-driven pricing |

| Customization | High - buyers can choose finishes and layouts | Low - fixed features and design |

| Risk | Construction delays, market volatility | Minimal - immediate possession and inspection |

| Financing | Staged payments during construction | Full payment typically required at closing |

| Possession Time | Delayed - dependent on project completion | Immediate or short-term |

| Investment Potential | High with market appreciation and new developments | Stable with steady rental yields |

| Condition | Brand new, modern facilities | May require maintenance or renovations |

Introduction to Off-Plan and Resale Properties

Off-plan properties are real estate units purchased before construction completion, offering buyers the advantage of lower prices and customizable options. Resale properties are existing homes sold by current owners, providing immediate availability and established locations with existing market value insights. Understanding the differences helps investors and homebuyers make informed decisions based on timelines, budget, and property conditions.

Key Differences Between Off-Plan and Resale Homes

Off-plan properties are purchased before construction is completed, offering buyers customization options and often lower prices, while resale properties are existing homes available for immediate occupancy with established market values. Off-plan homes may involve longer waiting periods and higher investment risks due to construction delays or market fluctuations, whereas resale homes provide immediate access and a clearer understanding of property condition. Financing options and resale value stability differ significantly, with off-plan properties sometimes requiring staged payments and resale homes benefiting from proven market performance.

Price Comparison: Off-Plan vs Resale Real Estate

Off-plan properties typically offer lower prices compared to resale real estate, presenting an attractive entry point for investors and homebuyers seeking value appreciation. Resale properties often come with higher upfront costs but provide immediate availability and established neighborhood data to assess market value. Pricing dynamics between off-plan and resale properties vary based on market demand, location, and development stage, influencing overall investment potential.

Investment Potential and ROI Analysis

Off-plan properties often offer higher capital appreciation potential due to lower purchase prices and modern specifications, attracting investors seeking long-term gains. Resale properties provide immediate rental income streams and established market performance, enabling quicker ROI realization. Evaluating market trends, location growth forecasts, and property conditions is crucial to optimize investment returns in both off-plan and resale options.

Financing Options and Payment Flexibility

Off-plan properties often offer flexible payment plans with staged installments during construction, allowing buyers to spread costs over time and secure financing at potentially lower down payments. Resale properties typically require full financing upfront or a mortgage, with fewer payment flexibility options, impacting buyer cash flow management. Lenders may offer varied loan terms based on property age and market value, making financing off-plan developments more accessible for investors seeking gradual investment exposure.

Risks and Challenges for Buyers

Off-plan property buyers face risks such as construction delays, potential changes in market conditions, and uncertainty about the final quality and finishes, which can affect property value and investment returns. Resale property buyers encounter challenges like hidden structural issues, outdated designs requiring renovation, and limited negotiation power due to established market prices. Both options demand thorough due diligence, careful financial planning, and legal verification to mitigate risks and ensure a secure investment.

Customization and Property Features

Off-plan properties offer extensive customization options, allowing buyers to select layouts, finishes, and smart home technologies tailored to their preferences before construction is complete. Resale properties provide immediate access to established features like mature landscaping and developed infrastructure but often limit customization to renovations after purchase. Buyers prioritizing personalized design typically favor off-plan investments, while those seeking convenience and immediate occupancy lean towards resale properties.

Delivery Timeline and Handover Process

Off-plan properties typically have longer delivery timelines, ranging from several months to a few years, as construction must be completed before handover. The handover process for off-plan properties often includes final inspections, snagging lists, and phased possession, ensuring the property meets quality standards. In contrast, resale properties offer immediate possession with a straightforward handover, usually involving a title transfer and a final walkthrough.

Legal Considerations and Due Diligence

Conducting thorough due diligence is critical when comparing off-plan properties to resale properties, especially regarding title verification and compliance with local real estate laws. Off-plan properties often require scrutiny of developer licenses, construction permits, and contractual terms, while resale properties demand verification of clear ownership, absence of liens, and up-to-date registration records. Legal considerations must include reviewing purchase agreements, understanding cancellation policies, and ensuring transparency in disclosures to mitigate risks associated with property fraud or project delays.

Choosing the Right Option: Off-Plan or Resale?

Choosing between off-plan and resale properties depends on budget flexibility, timeline, and investment goals. Off-plan properties often offer lower prices and customization opportunities but carry risks related to construction delays and market fluctuations. Resale properties provide immediate availability and established neighborhood insights, making them suitable for buyers prioritizing quick occupancy and stability.

Off-Plan Property vs Resale Property Infographic

difterm.com

difterm.com