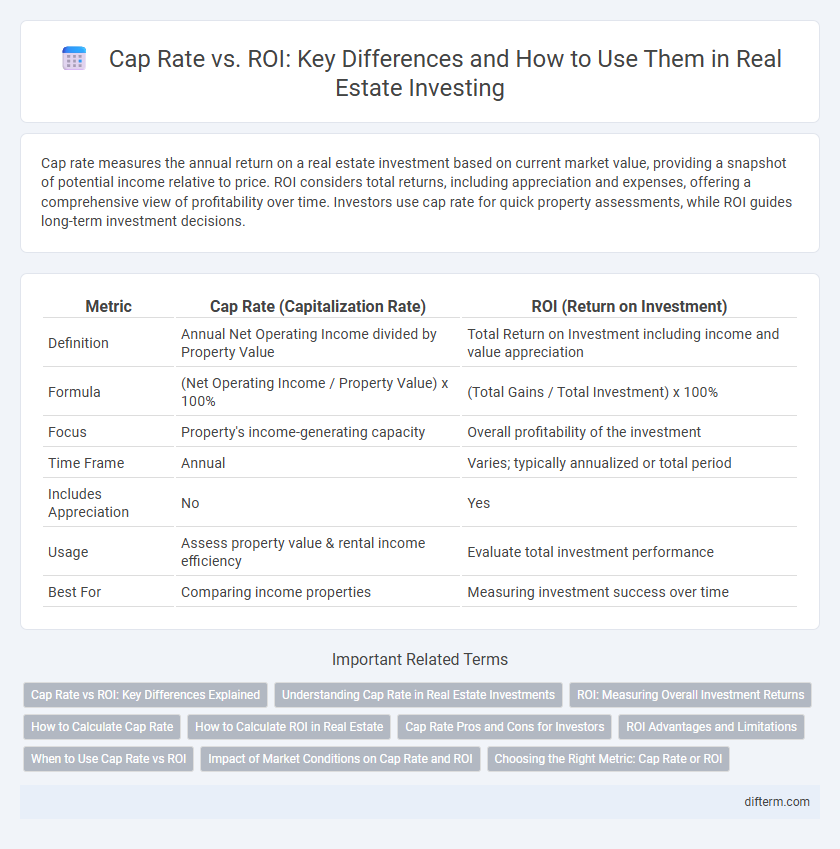

Cap rate measures the annual return on a real estate investment based on current market value, providing a snapshot of potential income relative to price. ROI considers total returns, including appreciation and expenses, offering a comprehensive view of profitability over time. Investors use cap rate for quick property assessments, while ROI guides long-term investment decisions.

Table of Comparison

| Metric | Cap Rate (Capitalization Rate) | ROI (Return on Investment) |

|---|---|---|

| Definition | Annual Net Operating Income divided by Property Value | Total Return on Investment including income and value appreciation |

| Formula | (Net Operating Income / Property Value) x 100% | (Total Gains / Total Investment) x 100% |

| Focus | Property's income-generating capacity | Overall profitability of the investment |

| Time Frame | Annual | Varies; typically annualized or total period |

| Includes Appreciation | No | Yes |

| Usage | Assess property value & rental income efficiency | Evaluate total investment performance |

| Best For | Comparing income properties | Measuring investment success over time |

Cap Rate vs ROI: Key Differences Explained

Cap Rate measures the annual return on a real estate investment based on net operating income and property value, providing a snapshot of market value assessment. ROI evaluates the total return on investment considering all cash flow, appreciation, and expenses over time, giving a broader profitability perspective. Understanding Cap Rate vs ROI helps investors make informed decisions by balancing immediate income potential against overall investment growth.

Understanding Cap Rate in Real Estate Investments

Cap rate, or capitalization rate, measures the annual net operating income (NOI) generated by a real estate property relative to its current market value, serving as a key indicator of investment risk and profitability. Unlike ROI, which accounts for total returns including financing and appreciation, cap rate focuses purely on income performance, offering investors a way to compare properties on an income basis without considering leverage or appreciation. Understanding cap rate helps investors assess potential cash flow, market trends, and property valuation to make informed decisions in real estate investment analysis.

ROI: Measuring Overall Investment Returns

Return on Investment (ROI) measures the overall profitability of a real estate investment by comparing net gains to the initial capital outlay. Unlike Cap Rate, which focuses solely on property income relative to value, ROI accounts for factors such as financing costs, appreciation, and operating expenses to provide a comprehensive view of investment performance. Accurate ROI analysis helps investors evaluate total returns and make informed decisions about property acquisition and portfolio growth.

How to Calculate Cap Rate

Cap Rate, or Capitalization Rate, is calculated by dividing the property's Net Operating Income (NOI) by its current market value or purchase price. The formula is Cap Rate = NOI / Property Value, expressed as a percentage. This metric helps investors evaluate the potential return and risk of real estate investments by indicating the expected annual income relative to the asset's price.

How to Calculate ROI in Real Estate

Calculating ROI in real estate involves dividing the net profit from the property by the total investment cost and then multiplying by 100 to get a percentage. Net profit is determined by subtracting all expenses, including mortgage payments, property taxes, maintenance, and insurance, from the total rental income or sale proceeds. This metric offers a comprehensive view of the investment's profitability, distinct from the cap rate which only measures the net operating income relative to the property's value.

Cap Rate Pros and Cons for Investors

Cap Rate measures a property's annual net operating income relative to its purchase price, providing investors with a quick snapshot of potential return and risk. High Cap Rates often indicate higher risk and potential for greater income, while low Cap Rates suggest stability but lower immediate returns. However, Cap Rate ignores financing costs and cash flow variations, making it less comprehensive than ROI for evaluating overall investment performance.

ROI Advantages and Limitations

Return on Investment (ROI) measures the overall profitability of a real estate investment by comparing net gains to the initial cost, providing a comprehensive view of long-term performance. ROI advantages include its ability to incorporate all income sources and expenses, offering investors a holistic assessment beyond just property value appreciation. Limitations involve its sensitivity to the holding period and potential exclusion of time value of money, which can distort comparisons across different investments.

When to Use Cap Rate vs ROI

Cap Rate is ideal for evaluating the potential profitability of income-generating properties by measuring the net operating income relative to the property's current market value. ROI provides a comprehensive view by factoring in total returns, including cash flow, appreciation, and financing costs, making it useful for assessing overall investment performance over time. Use Cap Rate for quick comparisons of property income potential and ROI for detailed analysis of investment growth and cash flow impact.

Impact of Market Conditions on Cap Rate and ROI

Market fluctuations directly influence capitalization rates (cap rates) and return on investment (ROI) in real estate by altering property values and rental income potential. Rising interest rates typically push cap rates higher, reflecting increased risk and reduced property prices, which can compress ROI despite stable cash flow. Conversely, in a strong market with growing demand and low vacancy rates, cap rates often decrease, boosting property valuations and enhancing ROI through both income appreciation and potential resale gains.

Choosing the Right Metric: Cap Rate or ROI

Cap Rate measures the property's net operating income relative to its current market value, providing insights into immediate investment profitability. ROI accounts for total returns including appreciation and financing costs over time, offering a comprehensive view of overall investment performance. Selecting between Cap Rate and ROI depends on investment goals, with Cap Rate favored for cash flow analysis and ROI preferred for assessing long-term wealth growth.

Cap Rate vs ROI Infographic

difterm.com

difterm.com