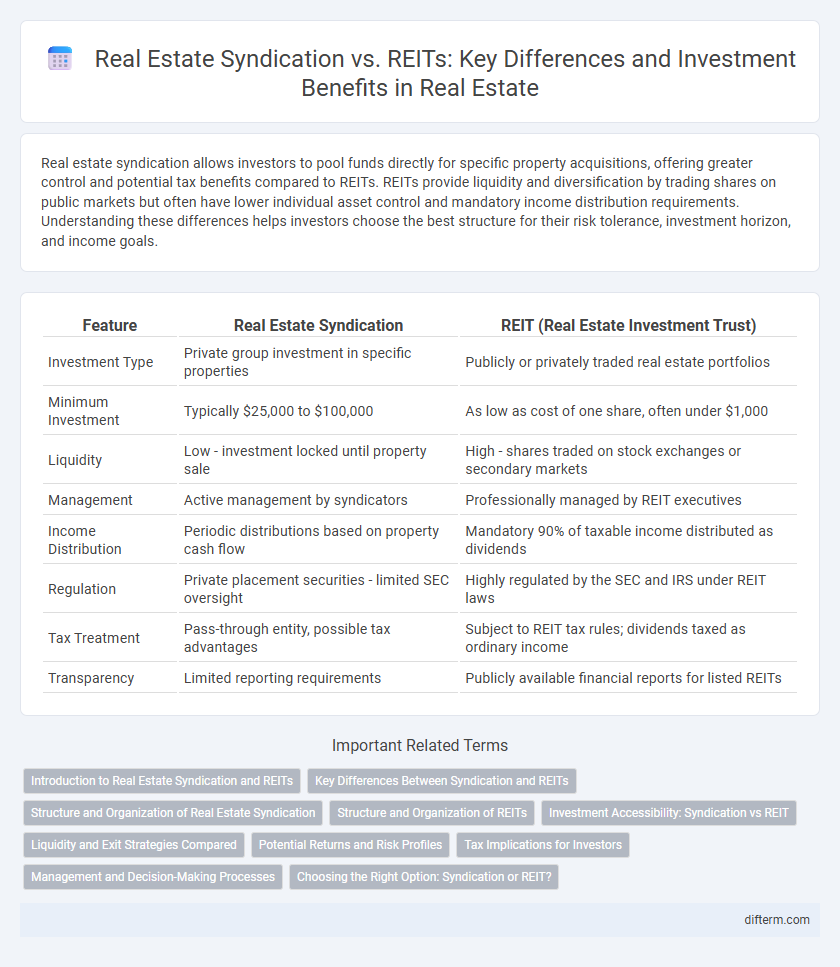

Real estate syndication allows investors to pool funds directly for specific property acquisitions, offering greater control and potential tax benefits compared to REITs. REITs provide liquidity and diversification by trading shares on public markets but often have lower individual asset control and mandatory income distribution requirements. Understanding these differences helps investors choose the best structure for their risk tolerance, investment horizon, and income goals.

Table of Comparison

| Feature | Real Estate Syndication | REIT (Real Estate Investment Trust) |

|---|---|---|

| Investment Type | Private group investment in specific properties | Publicly or privately traded real estate portfolios |

| Minimum Investment | Typically $25,000 to $100,000 | As low as cost of one share, often under $1,000 |

| Liquidity | Low - investment locked until property sale | High - shares traded on stock exchanges or secondary markets |

| Management | Active management by syndicators | Professionally managed by REIT executives |

| Income Distribution | Periodic distributions based on property cash flow | Mandatory 90% of taxable income distributed as dividends |

| Regulation | Private placement securities - limited SEC oversight | Highly regulated by the SEC and IRS under REIT laws |

| Tax Treatment | Pass-through entity, possible tax advantages | Subject to REIT tax rules; dividends taxed as ordinary income |

| Transparency | Limited reporting requirements | Publicly available financial reports for listed REITs |

Introduction to Real Estate Syndication and REITs

Real estate syndication involves a group of investors pooling funds to acquire or develop properties, typically managed by a syndicator or sponsor who oversees the investment operations. REITs (Real Estate Investment Trusts) are publicly or privately traded companies that own, operate, or finance income-producing real estate, offering investors liquidity and diversification through shares. Both syndications and REITs provide access to real estate markets but differ in structure, management involvement, and investment liquidity.

Key Differences Between Syndication and REITs

Real estate syndication involves pooling funds from multiple investors to directly purchase and manage specific properties, offering greater control and potential for higher returns but requiring active involvement. REITs, by contrast, provide investors with access to diversified real estate portfolios through publicly traded shares, emphasizing liquidity and passive income with lower minimum investments. Syndications typically have longer holding periods and less liquidity, while REITs offer daily market trading and regulatory transparency under SEC guidelines.

Structure and Organization of Real Estate Syndication

Real estate syndication involves a group of investors pooling funds to acquire properties, typically structured with a syndicator or general partner managing the investment and limited partners contributing capital. This structure allows for direct ownership of assets and greater control over property management decisions compared to REITs, which are publicly or privately traded corporations offering shares representing ownership in a diverse real estate portfolio. Syndications often require detailed operating agreements and legal frameworks to define profit distribution, decision-making authority, and investor responsibilities.

Structure and Organization of REITs

REITs (Real Estate Investment Trusts) are structured as corporations, trusts, or associations that pool capital from multiple investors to own, operate, or finance income-producing real estate. Unlike real estate syndications that are typically private partnerships with limited partners and general partners, REITs are publicly traded or non-traded entities regulated under the IRS code, requiring at least 75% of assets to be invested in real estate and paying out 90% of taxable income as dividends to shareholders. This organizational framework allows REITs to provide greater liquidity and diversification while adhering to strict regulatory and operational requirements.

Investment Accessibility: Syndication vs REIT

Real estate syndication offers investors access to individual properties through pooled capital, often requiring higher minimum investments and involving more active participation. REITs provide broader market accessibility by allowing investors to buy shares with lower entry costs on public exchanges, enabling easier diversification and liquidity. Both vehicles expand investment opportunities but differ significantly in minimum investment thresholds and investor involvement levels.

Liquidity and Exit Strategies Compared

Real estate syndication offers investors less liquidity as assets are typically held for longer periods with limited options for early exit, often requiring the sale of the entire property or buyout from partners. In contrast, REITs provide higher liquidity since shares trade on public exchanges, allowing investors to buy or sell shares easily and access capital quickly. Exit strategies in syndications usually depend on property disposition or refinancing, while REIT investors benefit from daily market liquidity and dividend payouts aligned with share ownership.

Potential Returns and Risk Profiles

Real estate syndication often offers higher potential returns due to direct ownership and active management but comes with increased risk and less liquidity compared to REITs. REITs provide more stable returns, diversified portfolios, and greater liquidity through publicly traded shares, making them suitable for risk-averse investors. Evaluating investor goals and risk tolerance is crucial when choosing between real estate syndication and REIT investments.

Tax Implications for Investors

Real estate syndication offers investors the advantage of pass-through taxation, allowing income and losses to be reported directly on individual tax returns, potentially reducing tax liabilities through depreciation and other deductions. REITs, however, are subject to corporate tax rules but distribute at least 90% of taxable income as dividends, which are typically taxed as ordinary income, leading to different tax treatment for investors. Understanding these distinct tax implications helps investors make informed decisions based on their income strategies and tax positions.

Management and Decision-Making Processes

Real estate syndication offers investors direct involvement with a small group of partners making collective decisions, allowing for greater control over property management and operational strategies. In contrast, REITs centralize management within a professional executive team and board of directors, making decisions on acquisitions, property management, and distributions without direct investor input. Syndications provide more hands-on management opportunities, while REITs emphasize passive investment with decisions driven by corporate governance.

Choosing the Right Option: Syndication or REIT?

Real estate syndication allows investors to pool resources for direct ownership in specific properties, offering greater control and potential tax benefits, whereas REITs provide liquidity and diversification through publicly traded shares with minimal management responsibilities. Investors seeking hands-on involvement and targeted asset selection may prefer syndication, while those valuing ease of entry and passive income often choose REITs. Assessing factors like investment horizon, risk tolerance, and desired level of control is crucial to selecting the optimal real estate investment vehicle.

Real Estate Syndication vs REIT (Real Estate Investment Trust) Infographic

difterm.com

difterm.com