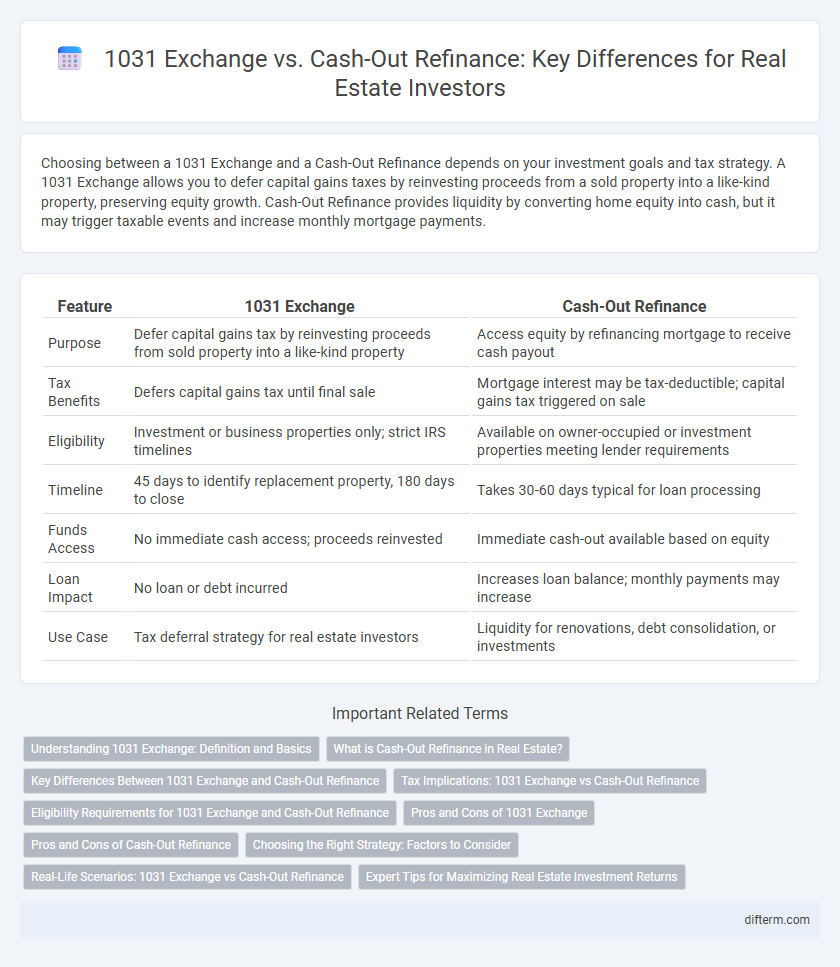

Choosing between a 1031 Exchange and a Cash-Out Refinance depends on your investment goals and tax strategy. A 1031 Exchange allows you to defer capital gains taxes by reinvesting proceeds from a sold property into a like-kind property, preserving equity growth. Cash-Out Refinance provides liquidity by converting home equity into cash, but it may trigger taxable events and increase monthly mortgage payments.

Table of Comparison

| Feature | 1031 Exchange | Cash-Out Refinance |

|---|---|---|

| Purpose | Defer capital gains tax by reinvesting proceeds from sold property into a like-kind property | Access equity by refinancing mortgage to receive cash payout |

| Tax Benefits | Defers capital gains tax until final sale | Mortgage interest may be tax-deductible; capital gains tax triggered on sale |

| Eligibility | Investment or business properties only; strict IRS timelines | Available on owner-occupied or investment properties meeting lender requirements |

| Timeline | 45 days to identify replacement property, 180 days to close | Takes 30-60 days typical for loan processing |

| Funds Access | No immediate cash access; proceeds reinvested | Immediate cash-out available based on equity |

| Loan Impact | No loan or debt incurred | Increases loan balance; monthly payments may increase |

| Use Case | Tax deferral strategy for real estate investors | Liquidity for renovations, debt consolidation, or investments |

Understanding 1031 Exchange: Definition and Basics

A 1031 Exchange allows real estate investors to defer capital gains taxes by reinvesting proceeds from the sale of an investment property into a like-kind property within a specific timeframe. This tax-deferral strategy requires adherence to strict IRS rules, including identification and closing deadlines, ensuring the continuation of investment capital growth. Understanding the fundamentals of a 1031 Exchange is crucial for maximizing tax benefits and optimizing long-term portfolio value compared to alternatives like cash-out refinancing.

What is Cash-Out Refinance in Real Estate?

Cash-out refinance in real estate involves replacing an existing mortgage with a new loan that exceeds the current loan balance, allowing homeowners to access the difference as cash. This strategy is often used to tap into home equity for renovations, debt consolidation, or investment purposes while maintaining ownership of the property. Compared to a 1031 exchange, cash-out refinance offers liquidity without relinquishing the asset but may come with higher interest rates and closing costs.

Key Differences Between 1031 Exchange and Cash-Out Refinance

A 1031 Exchange allows real estate investors to defer capital gains taxes by reinvesting proceeds from the sale of a property into a like-kind property, while a Cash-Out Refinance provides liquidity by replacing an existing mortgage with a new, larger loan based on the property's current appraised value. Unlike cash-out refinancing, which increases debt and impacts cash flow through higher mortgage payments, a 1031 Exchange involves no new debt and focuses on property replacement for tax deferral purposes. Key differences include tax treatment, liquidity access, and impact on ownership structure, making each strategy suitable for distinct investment goals.

Tax Implications: 1031 Exchange vs Cash-Out Refinance

A 1031 exchange allows real estate investors to defer capital gains taxes by reinvesting proceeds into a like-kind property, preserving investment capital and enhancing portfolio growth. Cash-out refinancing triggers immediate taxable events on the withdrawn equity, as the loan amount is considered debt rather than deferred gain, resulting in potential tax liabilities. Understanding these tax implications is crucial for strategic decision-making in real estate investment and wealth management.

Eligibility Requirements for 1031 Exchange and Cash-Out Refinance

Eligibility requirements for a 1031 Exchange mandate that the property involved must be held for investment or business purposes, excluding primary residences, and replacement property must be identified within 45 days and acquired within 180 days. In contrast, cash-out refinance eligibility primarily depends on the borrower's creditworthiness, loan-to-value ratio, and equity in the property, with no restrictions on property use. Investors seeking tax deferral benefits through a 1031 Exchange must strictly adhere to IRS timelines and property type criteria, whereas cash-out refinance offers more flexibility but triggers immediate taxation on any gains.

Pros and Cons of 1031 Exchange

A 1031 Exchange allows real estate investors to defer capital gains taxes by reinvesting proceeds from a sold property into a like-kind property, preserving equity and enhancing portfolio growth. However, strict IRS timelines and property matching rules can limit flexibility, and delays can jeopardize the tax deferral benefits. Unlike cash-out refinancing, which provides immediate liquidity but triggers taxable events, a 1031 Exchange is ideal for long-term investment growth without immediate tax impact.

Pros and Cons of Cash-Out Refinance

Cash-out refinance allows homeowners to access the equity in their property by replacing their existing mortgage with a larger loan, providing immediate liquidity for investments or expenses. Pros include potentially lower interest rates compared to other loan types and the ability to consolidate debt, but cons involve higher monthly mortgage payments, longer loan terms, and the risk of losing the property if unable to keep up with payments. Unlike 1031 Exchange, cash-out refinance does not offer tax deferral benefits on capital gains, making it less advantageous for real estate investors focused on tax planning.

Choosing the Right Strategy: Factors to Consider

Choosing between a 1031 Exchange and a Cash-Out Refinance depends on your investment goals, tax implications, and liquidity needs. A 1031 Exchange allows deferral of capital gains taxes when reinvesting in like-kind properties, making it ideal for expanding or upgrading portfolios without immediate tax consequences. Conversely, Cash-Out Refinance provides access to cash by leveraging existing equity, suitable for funding new investments or expenses but triggers taxable events.

Real-Life Scenarios: 1031 Exchange vs Cash-Out Refinance

A 1031 Exchange provides real estate investors with a tax-deferred way to reinvest proceeds from the sale of investment property into a similar property, ideally used to upgrade or diversify holdings without immediate capital gains tax. In contrast, a Cash-Out Refinance allows homeowners or investors to tap into their property's equity by replacing an existing mortgage with a larger loan, converting equity into cash for expenses or new investments but typically triggering new debt obligations. Real-life scenarios favor a 1031 Exchange when prioritizing tax deferral and property portfolio growth, while Cash-Out Refinance suits those needing liquidity for repairs, personal use, or non-like-kind investments.

Expert Tips for Maximizing Real Estate Investment Returns

Maximizing real estate investment returns requires understanding the strategic benefits of a 1031 Exchange versus a Cash-Out Refinance. A 1031 Exchange defers capital gains taxes by reinvesting proceeds into like-kind properties, ideal for expanding or upgrading a portfolio without immediate tax impact. Conversely, Cash-Out Refinance unlocks equity to access liquid capital for renovations or additional acquisitions, but triggers tax obligations and may increase debt risk, so expert advice on timing and market conditions is critical.

1031 Exchange vs Cash-Out Refinance Infographic

difterm.com

difterm.com