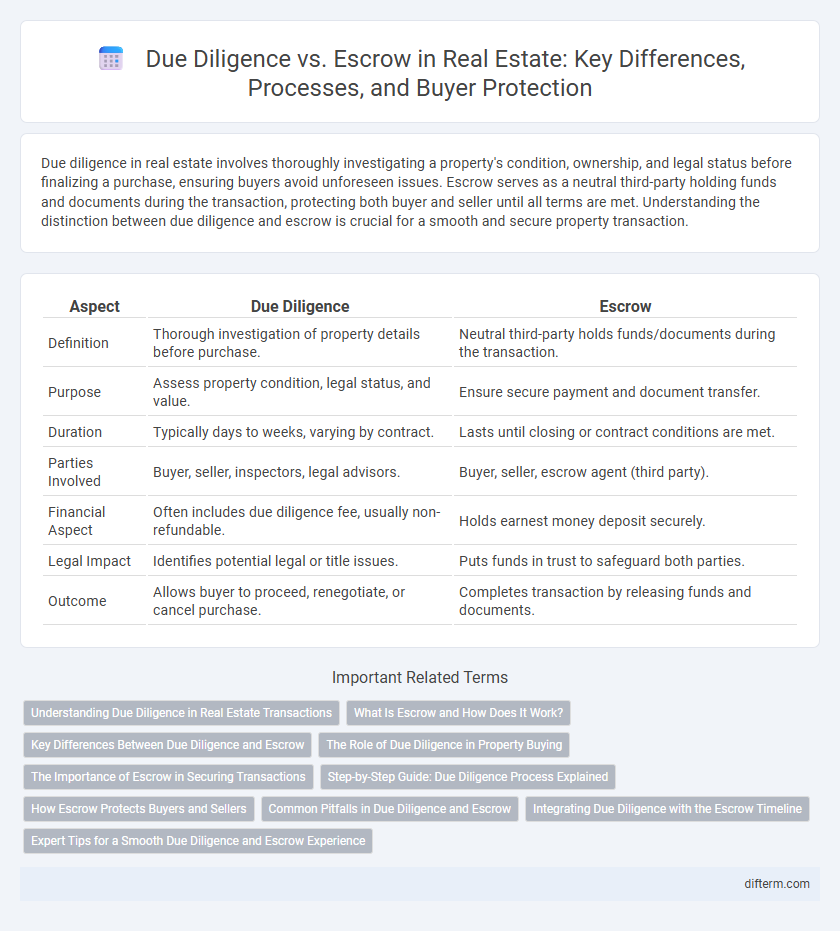

Due diligence in real estate involves thoroughly investigating a property's condition, ownership, and legal status before finalizing a purchase, ensuring buyers avoid unforeseen issues. Escrow serves as a neutral third-party holding funds and documents during the transaction, protecting both buyer and seller until all terms are met. Understanding the distinction between due diligence and escrow is crucial for a smooth and secure property transaction.

Table of Comparison

| Aspect | Due Diligence | Escrow |

|---|---|---|

| Definition | Thorough investigation of property details before purchase. | Neutral third-party holds funds/documents during the transaction. |

| Purpose | Assess property condition, legal status, and value. | Ensure secure payment and document transfer. |

| Duration | Typically days to weeks, varying by contract. | Lasts until closing or contract conditions are met. |

| Parties Involved | Buyer, seller, inspectors, legal advisors. | Buyer, seller, escrow agent (third party). |

| Financial Aspect | Often includes due diligence fee, usually non-refundable. | Holds earnest money deposit securely. |

| Legal Impact | Identifies potential legal or title issues. | Puts funds in trust to safeguard both parties. |

| Outcome | Allows buyer to proceed, renegotiate, or cancel purchase. | Completes transaction by releasing funds and documents. |

Understanding Due Diligence in Real Estate Transactions

Due diligence in real estate transactions involves thoroughly investigating a property's condition, legal status, and financial aspects before finalizing the purchase. This process includes reviewing inspection reports, title searches, zoning laws, and verifying seller disclosures to identify any potential risks or liabilities. Escrow serves as a neutral third-party holding funds during the transaction but does not replace the critical investigative role of due diligence for buyers and investors.

What Is Escrow and How Does It Work?

Escrow is a financial arrangement in real estate where a neutral third party holds funds and documents on behalf of the buyer and seller until all transaction conditions are met. This process ensures secure transfer of property by safeguarding earnest money, title documents, and loan funds, preventing fraud and protecting both parties. Escrow agents coordinate inspections, title searches, and contractual obligations, releasing funds only after confirming compliance with the purchase agreement.

Key Differences Between Due Diligence and Escrow

Due diligence in real estate involves a buyer's thorough investigation of a property's condition, legal status, and financial aspects before finalizing the purchase, while escrow is the third-party service that holds funds and documents securely until all terms of the transaction are met. Due diligence periods typically allow for inspections, title searches, and contract reviews, whereas escrow ensures the safe transfer of ownership and payment. Understanding these distinctions helps buyers manage risks and safeguards both parties during real estate transactions.

The Role of Due Diligence in Property Buying

Due diligence in property buying involves a comprehensive investigation of the real estate asset, including title verification, inspection reports, and zoning laws, to identify potential risks before finalizing the purchase. This process ensures transparency and legal compliance, safeguarding the buyer from hidden liabilities or financial loss. Escrow, by contrast, functions as a neutral holding account during the transaction, but due diligence remains the critical step for informed decision-making and risk mitigation.

The Importance of Escrow in Securing Transactions

Escrow plays a crucial role in real estate transactions by safeguarding the buyer's funds and ensuring all contractual obligations are met before the property title is transferred. It acts as a neutral third party holding money and documents, reducing risks associated with fraud or default. The escrow process enhances trust between buyers and sellers, facilitating a secure and transparent closing.

Step-by-Step Guide: Due Diligence Process Explained

The due diligence process in real estate involves a thorough investigation of the property's condition, legal status, and financial aspects before finalizing the transaction. Buyers typically review documents such as title reports, inspection reports, zoning regulations, and environmental assessments to identify any potential risks or liabilities. Completing due diligence ensures informed decision-making and safeguards against unforeseen issues prior to the escrow phase, where funds are securely held until all contractual conditions are met.

How Escrow Protects Buyers and Sellers

Escrow safeguards buyers and sellers by holding funds and documents securely until all contract conditions are met, ensuring a neutral third-party manages the transaction process. This protection minimizes risks such as fraud, title issues, or unmet contingencies, providing confidence that the property transfer only occurs upon mutual agreement. By facilitating transparent fund management and compliance verification, escrow enhances trust and reduces disputes in real estate transactions.

Common Pitfalls in Due Diligence and Escrow

Common pitfalls in due diligence include overlooking title defects, failing to verify zoning compliance, and neglecting property condition inspections, all of which can lead to costly surprises after closing. In escrow, common issues arise from mismanagement of funds, unclear instructions between parties, and missed deadlines, potentially delaying the transaction or causing legal disputes. Ensuring thorough due diligence and clear escrow agreements mitigates risks and safeguards the investment throughout the real estate closing process.

Integrating Due Diligence with the Escrow Timeline

Integrating due diligence with the escrow timeline streamlines the real estate transaction by aligning property inspections, title searches, and financial verifications within escrow's secure fund holding period. This synchronization ensures all contingencies are satisfactorily met before releasing funds, reducing risks for buyers and sellers. Efficient coordination between due diligence phases and escrow milestones enhances transparency and accelerates closing processes.

Expert Tips for a Smooth Due Diligence and Escrow Experience

Thorough due diligence in real estate involves verifying property titles, inspecting physical conditions, and reviewing zoning laws to avoid future disputes. Escrow experts recommend selecting a reputable escrow company to securely handle funds and documents, ensuring all parties meet contractual obligations. Clear communication between buyers, sellers, and agents throughout both processes significantly reduces delays and enhances transaction transparency.

Due Diligence vs Escrow Infographic

difterm.com

difterm.com