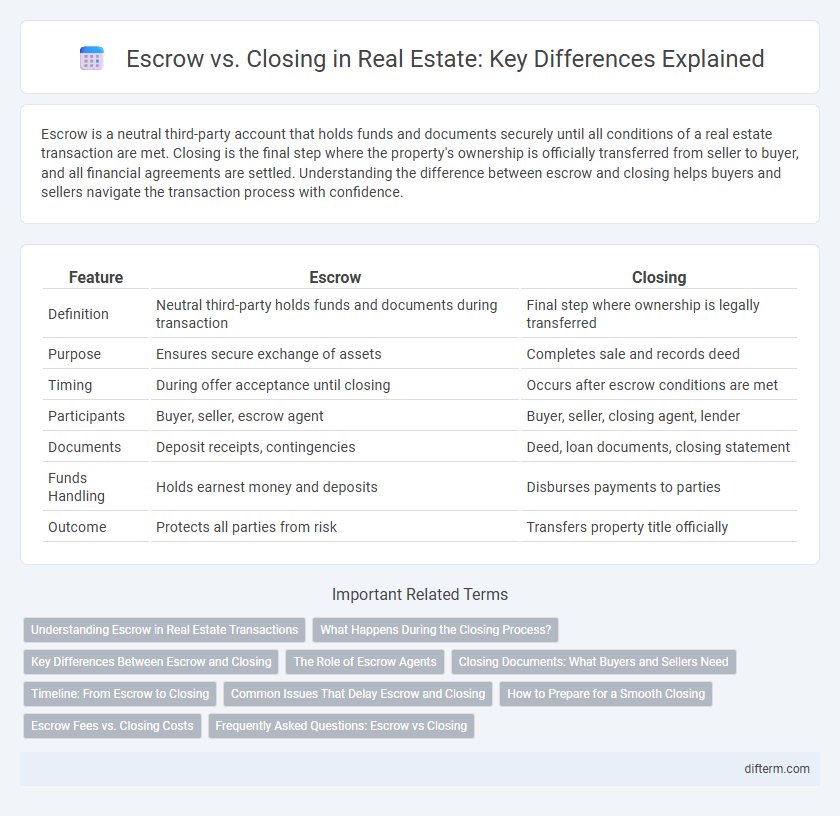

Escrow is a neutral third-party account that holds funds and documents securely until all conditions of a real estate transaction are met. Closing is the final step where the property's ownership is officially transferred from seller to buyer, and all financial agreements are settled. Understanding the difference between escrow and closing helps buyers and sellers navigate the transaction process with confidence.

Table of Comparison

| Feature | Escrow | Closing |

|---|---|---|

| Definition | Neutral third-party holds funds and documents during transaction | Final step where ownership is legally transferred |

| Purpose | Ensures secure exchange of assets | Completes sale and records deed |

| Timing | During offer acceptance until closing | Occurs after escrow conditions are met |

| Participants | Buyer, seller, escrow agent | Buyer, seller, closing agent, lender |

| Documents | Deposit receipts, contingencies | Deed, loan documents, closing statement |

| Funds Handling | Holds earnest money and deposits | Disburses payments to parties |

| Outcome | Protects all parties from risk | Transfers property title officially |

Understanding Escrow in Real Estate Transactions

Escrow in real estate transactions acts as a neutral third party that securely holds funds and documents until all conditions of the sale are met. This process ensures that the buyer's deposit and the seller's property title are protected and only transferred once both parties fulfill their contractual obligations. Understanding escrow is crucial for preventing fraud and facilitating a smooth, transparent closing process.

What Happens During the Closing Process?

During the closing process, all documents related to the real estate transaction are reviewed and signed by both the buyer and seller, including the deed, loan agreements, and settlement statements. The escrow agent facilitates the transfer of funds, ensuring that the buyer's payment is securely held until all conditions are met. Title transfer is finalized, and the buyer receives the keys to the property once the deed is recorded with the county.

Key Differences Between Escrow and Closing

Escrow involves a neutral third party holding funds and documents until all conditions of a real estate transaction are met, ensuring protection for both buyer and seller. Closing refers to the final step where ownership is officially transferred, documents are signed, and payments are completed. The key differences lie in escrow serving as a secure holding stage, while closing finalizes the deal and legally transfers property ownership.

The Role of Escrow Agents

Escrow agents serve as neutral third parties who hold funds and documents securely until all terms of a real estate transaction are fulfilled. They ensure that the buyer's deposit, seller's deed, and other critical elements are properly managed to prevent fraud and misunderstandings. Their role bridges the gap between escrow and closing by confirming that all contractual obligations are met before the final transfer of ownership.

Closing Documents: What Buyers and Sellers Need

Closing documents in real estate transactions include the deed, bill of sale, settlement statement, and loan payoff statements, essential for both buyers and sellers. Buyers need to review the title insurance policy, mortgage note, and closing disclosure to confirm terms and ownership transfer, while sellers must ensure the deed is properly signed and funds are accurately distributed. Understanding and verifying these documents prevent legal issues and facilitate a smooth transfer of property ownership.

Timeline: From Escrow to Closing

The timeline from escrow to closing typically spans 30 to 45 days, during which inspections, appraisals, and loan processing occur. Escrow holds funds and documents until all contractual obligations are met, ensuring a secure transaction before the official transfer of ownership at closing. Closing finalizes the sale with the signing of documents, payment of closing costs, and recording of the deed with local authorities.

Common Issues That Delay Escrow and Closing

Escrow delays often arise from incomplete documentation, unresolved title issues, or financing hold-ups, which directly impact the closing timeline. Common closing complications include last-minute appraisal discrepancies, unmet contingencies, and final walkthrough concerns that require resolution before transaction completion. Addressing these challenges proactively ensures smoother coordination between buyers, sellers, and lenders, reducing the risk of postponed property transfers.

How to Prepare for a Smooth Closing

To prepare for a smooth closing in real estate, ensure all escrow instructions are clearly understood and followed, including deposit deadlines and documentation requirements. Coordinate with your real estate agent, lender, and escrow officer to verify that all necessary contingencies are met, such as inspections and title searches, before the closing date. Having funds ready for closing costs and reviewing the final closing disclosure early helps prevent last-minute delays and facilitates a seamless transfer of ownership.

Escrow Fees vs. Closing Costs

Escrow fees are costs paid to a neutral third party that manages the transaction process, ensuring funds and documents are securely handled until all conditions are met. Closing costs encompass a broader range of expenses, including lender fees, title insurance, appraisal fees, and escrow fees, typically ranging from 2% to 5% of the property's purchase price. Understanding the distinction between escrow fees and overall closing costs helps buyers budget accurately during a real estate transaction.

Frequently Asked Questions: Escrow vs Closing

Escrow is a neutral third-party account that holds funds and documents until all conditions of a real estate transaction are met, while closing refers to the final step where ownership is legally transferred from seller to buyer. Buyers frequently ask about the time escrow takes, which typically ranges from 30 to 60 days, and the key difference that escrow protects the interests of both parties by ensuring terms are satisfied before funds release. Closing FAQs also focus on costs involved, with typical closing costs averaging 2% to 5% of the home's purchase price, including fees for title insurance, attorney services, and lender charges.

escrow vs closing Infographic

difterm.com

difterm.com