A short sale allows homeowners to sell their property for less than the mortgage balance, often avoiding the severe credit impact of foreclosure. Foreclosure occurs when lenders repossess the property due to missed payments, leading to a more significant credit score drop and potential financial difficulties. Understanding the differences between short sales and foreclosures helps homeowners make informed decisions in distressed real estate markets.

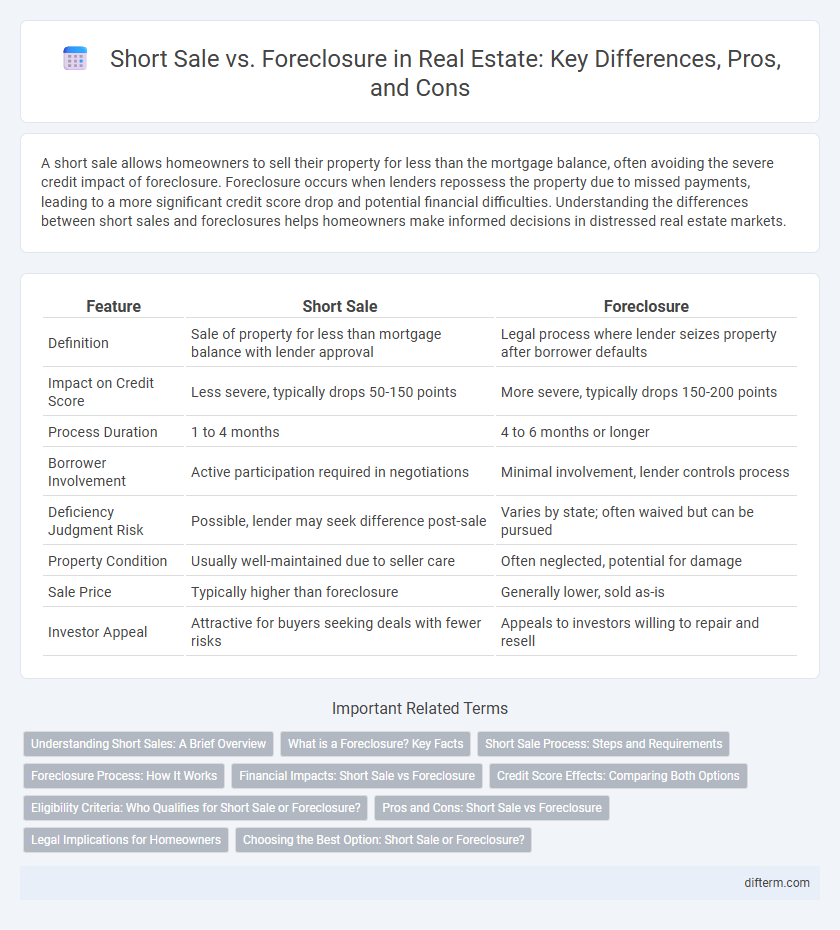

Table of Comparison

| Feature | Short Sale | Foreclosure |

|---|---|---|

| Definition | Sale of property for less than mortgage balance with lender approval | Legal process where lender seizes property after borrower defaults |

| Impact on Credit Score | Less severe, typically drops 50-150 points | More severe, typically drops 150-200 points |

| Process Duration | 1 to 4 months | 4 to 6 months or longer |

| Borrower Involvement | Active participation required in negotiations | Minimal involvement, lender controls process |

| Deficiency Judgment Risk | Possible, lender may seek difference post-sale | Varies by state; often waived but can be pursued |

| Property Condition | Usually well-maintained due to seller care | Often neglected, potential for damage |

| Sale Price | Typically higher than foreclosure | Generally lower, sold as-is |

| Investor Appeal | Attractive for buyers seeking deals with fewer risks | Appeals to investors willing to repair and resell |

Understanding Short Sales: A Brief Overview

Short sales occur when a homeowner sells their property for less than the outstanding mortgage balance, requiring lender approval to forgive the remaining debt. This option can mitigate credit damage compared to foreclosure and typically involves a lengthy approval process with multiple parties. Understanding the financial and legal implications helps sellers navigate potential tax consequences and buyers acquire properties below market value.

What is a Foreclosure? Key Facts

A foreclosure occurs when a homeowner fails to make mortgage payments, causing the lender to seize and sell the property to recover the loan balance. Key facts include the lender initiating a legal process, the property being sold at a public auction, and the foreclosure negatively impacting the homeowner's credit score for seven years. Foreclosure typically results in a lower market value sale compared to traditional transactions, affecting both buyers and sellers in the real estate market.

Short Sale Process: Steps and Requirements

The short sale process begins with the homeowner contacting the lender to request approval for selling the property below the outstanding mortgage balance, requiring documentation such as financial hardship proof and a market analysis. The lender must review and approve the short sale offer, which can take several weeks, while the homeowner negotiates with potential buyers and real estate agents to finalize the contract. Essential requirements include complete financial disclosure, a comparative market analysis, and often the homeowner must demonstrate that foreclosure is imminent and that a short sale is the best option for all parties involved.

Foreclosure Process: How It Works

The foreclosure process begins when a homeowner defaults on mortgage payments, prompting the lender to initiate legal action to reclaim the property. This typically involves a series of notices, court filings, and a public auction where the lender seeks to recover owed funds. Foreclosure impacts credit scores severely and can result in total loss of homeownership, distinguishing it from a short sale where the property is sold voluntarily to avoid foreclosure.

Financial Impacts: Short Sale vs Foreclosure

Short sales typically result in less severe credit score damage compared to foreclosures, often reducing the impact by 100 to 150 points versus 200 to 300 points for foreclosure. Homeowners pursuing a short sale may avoid deficiency judgments and incur lower legal fees, whereas foreclosures usually involve prolonged legal processes, higher costs, and potential deficiency liabilities. Lenders often prefer short sales as they minimize financial losses and speed up asset recovery, demonstrating a less damaging alternative for both parties compared to the foreclosure process.

Credit Score Effects: Comparing Both Options

Short sales typically have a less severe impact on credit scores compared to foreclosures, often reducing the score by 85 to 160 points versus 160 to 220 points for foreclosures. Recovery time after a short sale is usually shorter, with credit scores beginning to improve within 12 to 24 months, while foreclosures can cause negative credit effects lasting up to seven years. Mortgage lenders may view short sales more favorably than foreclosures when considering loan applications.

Eligibility Criteria: Who Qualifies for Short Sale or Foreclosure?

Eligibility for a short sale typically requires homeowners to demonstrate financial hardship and owe more on their mortgage than the current market value of the property, with lender approval needed to accept less than the owed amount. Foreclosure eligibility occurs when borrowers default on mortgage payments and fail to negotiate alternatives, leading the lender to initiate legal proceedings to repossess the property. Short sales often require proof of hardship such as job loss or medical expenses, while foreclosure is the lender's recourse after unsuccessful payment recovery efforts.

Pros and Cons: Short Sale vs Foreclosure

Short sales typically allow homeowners to avoid the severe credit damage associated with foreclosures, often resulting in a less negative impact on credit scores and faster recovery times for future loan approvals. Foreclosures can lead to longer-lasting credit damage and higher fines, but they allow lenders to repossess property quickly, sometimes resulting in faster resolution for all parties involved. While short sales involve lender approval and can be time-consuming, they offer more control and less financial stigma compared to the public and often more stressful process of foreclosure.

Legal Implications for Homeowners

Short sales allow homeowners to avoid foreclosure by negotiating with lenders to accept less than the owed mortgage balance, minimizing damage to credit scores and reducing the risk of deficiency judgments. Foreclosures involve a legal process where lenders repossess properties due to missed payments, often resulting in significant credit score drops and potential personal liability for unpaid mortgage debt. Understanding state-specific foreclosure laws and lender policies is crucial for homeowners to navigate these options and mitigate long-term financial consequences.

Choosing the Best Option: Short Sale or Foreclosure?

Choosing between a short sale and foreclosure depends on credit impact, timeline, and financial goals. A short sale usually results in less damage to credit scores and allows for more control over the selling process, often leading to a faster recovery post-sale. Foreclosure can take longer, severely affect credit, and may involve additional legal complexities, making short sales generally the preferable option for homeowners seeking to minimize long-term financial harm.

Short Sale vs Foreclosure Infographic

difterm.com

difterm.com