A first position lien holds priority over all other liens, ensuring the lender's claim is paid first in the event of a property sale or foreclosure. A second position lien is subordinate, meaning it only receives payment after the first lien has been satisfied. Understanding the difference between these lien priorities is crucial for real estate investors and property buyers to assess risk and protect their interests.

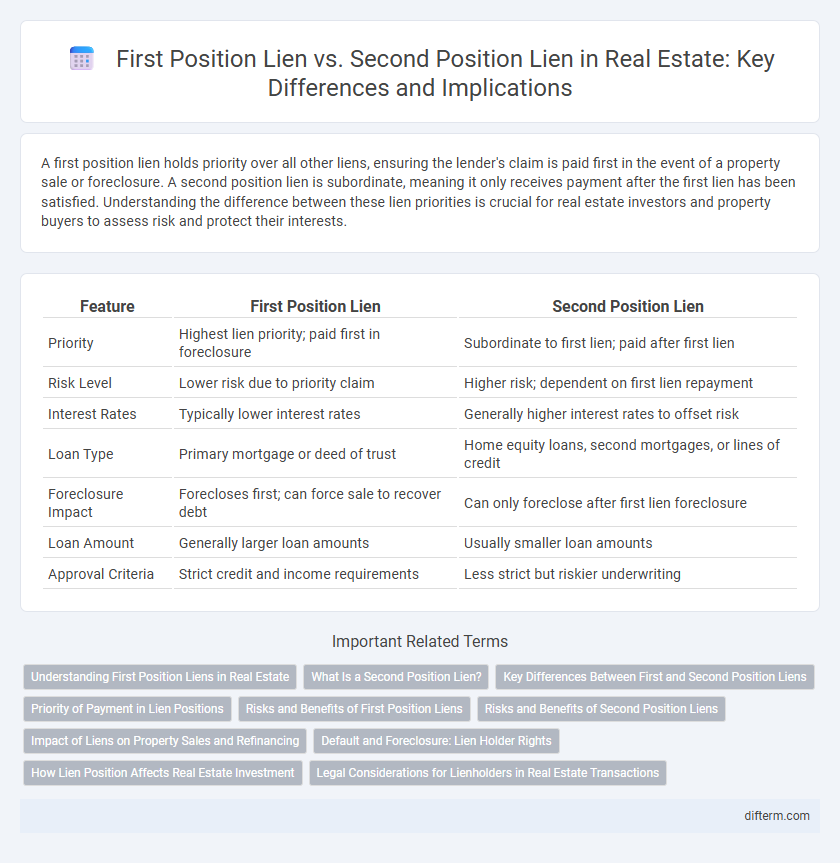

Table of Comparison

| Feature | First Position Lien | Second Position Lien |

|---|---|---|

| Priority | Highest lien priority; paid first in foreclosure | Subordinate to first lien; paid after first lien |

| Risk Level | Lower risk due to priority claim | Higher risk; dependent on first lien repayment |

| Interest Rates | Typically lower interest rates | Generally higher interest rates to offset risk |

| Loan Type | Primary mortgage or deed of trust | Home equity loans, second mortgages, or lines of credit |

| Foreclosure Impact | Forecloses first; can force sale to recover debt | Can only foreclose after first lien foreclosure |

| Loan Amount | Generally larger loan amounts | Usually smaller loan amounts |

| Approval Criteria | Strict credit and income requirements | Less strict but riskier underwriting |

Understanding First Position Liens in Real Estate

A first position lien in real estate holds the highest priority claim on a property, meaning it must be fully paid off before any other liens if the property is sold or foreclosed. This lien typically belongs to the primary mortgage lender, securing the original loan used to purchase the property. Understanding first position liens is crucial for buyers and investors, as they impact the risk and order of debt repayment in real estate transactions.

What Is a Second Position Lien?

A second position lien is a legal claim on a property that takes priority after the first position lien, typically the primary mortgage, has been satisfied. This lien holds a subordinate status in the event of foreclosure, meaning the second lienholder is paid only after the first lienholder receives full repayment. Common examples of second position liens include home equity loans and lines of credit, which often carry higher interest rates due to the increased risk.

Key Differences Between First and Second Position Liens

First position lien holds primary claim on a property's assets, ensuring the lender is paid first in case of foreclosure, while second position lien is subordinate and paid only after the first lien is satisfied. Interest rates on second position liens are typically higher due to increased risk, and their approval process involves more scrutiny from lenders. Understanding the priority, risk, and repayment order is crucial for borrowers and investors navigating real estate financing options.

Priority of Payment in Lien Positions

First position liens hold the highest priority in payment during a foreclosure or settlement, ensuring they are paid in full before any second position liens receive funds. Second position liens are subordinate and only receive payment after the first lien is fully satisfied, increasing the risk for lenders in this position. This priority system directly impacts the risk assessment and lending terms for mortgage and home equity loans.

Risks and Benefits of First Position Liens

First position liens offer superior security by granting the lender priority repayment rights in foreclosure, reducing the risk of loss compared to second position liens. They typically carry lower interest rates due to reduced risk exposure, attracting more conservative investors. However, borrowers may face stricter qualification criteria and limited refinancing flexibility under first position liens.

Risks and Benefits of Second Position Liens

Second position liens carry higher risk compared to first position liens due to their subordinate claim on property in case of foreclosure, which often leads to reduced recovery rates. However, second position liens can offer benefits such as higher interest rates and increased leverage opportunities for investors willing to accept the elevated risk. Borrowers may also benefit from accessing additional funding without refinancing the primary mortgage, although this comes with the caveat of potentially higher costs and stricter terms.

Impact of Liens on Property Sales and Refinancing

First position liens hold priority over second position liens in property sales and refinancing, meaning they are paid off first from the proceeds, which impacts the payoff hierarchy and lender risk. Second position liens often carry higher interest rates due to increased risk and can complicate refinancing, as lenders may require the first lien to be cleared or subordinated before approving new loans. Understanding lien positions is crucial for homeowners and investors to navigate property transactions and ensure successful refinancing outcomes.

Default and Foreclosure: Lien Holder Rights

First position lien holders have the primary right to repayment and are paid first from foreclosure proceeds, significantly reducing their risk of loss in default situations. Second position lien holders only receive payment after the first lien is fully satisfied, increasing their exposure to potential financial loss. In foreclosure, the first lien holder can initiate the process and enforce their claim, while second lien holders must wait and may ultimately recover less or nothing depending on remaining equity.

How Lien Position Affects Real Estate Investment

First position liens hold the primary claim on a property's assets, granting lenders priority to recoup their investment in case of foreclosure, which significantly lowers their risk and often results in better loan terms. Second position liens, positioned behind the first lien, carry higher risk due to the subordinate claim, usually leading to higher interest rates and stricter borrowing conditions. Real estate investors must carefully assess lien positions to manage financial exposure, determine leverage capacity, and forecast potential returns on investment properties.

Legal Considerations for Lienholders in Real Estate Transactions

First position lienholders have primary legal rights to claim the property in the event of borrower default, meaning their claims are satisfied before second position lienholders. Second position lienholders face greater risk as their claims are subordinate, often requiring careful evaluation of the borrower's equity and the first lien's terms. Legal considerations for lienholders include verifying the lien priority, ensuring proper recording of liens, and understanding state-specific foreclosure laws that impact the enforcement of lien rights.

First position lien vs Second position lien Infographic

difterm.com

difterm.com