A Triple Net (NNN) lease requires tenants to pay base rent plus property taxes, insurance, and maintenance costs, providing landlords with predictable income and reduced financial risk. In contrast, a Gross lease bundles all expenses into a single rent payment, simplifying budgeting for tenants but increasing landlord responsibility for operational costs. Understanding the differences between NNN and Gross leases helps investors and tenants optimize financial planning and property management strategies.

Table of Comparison

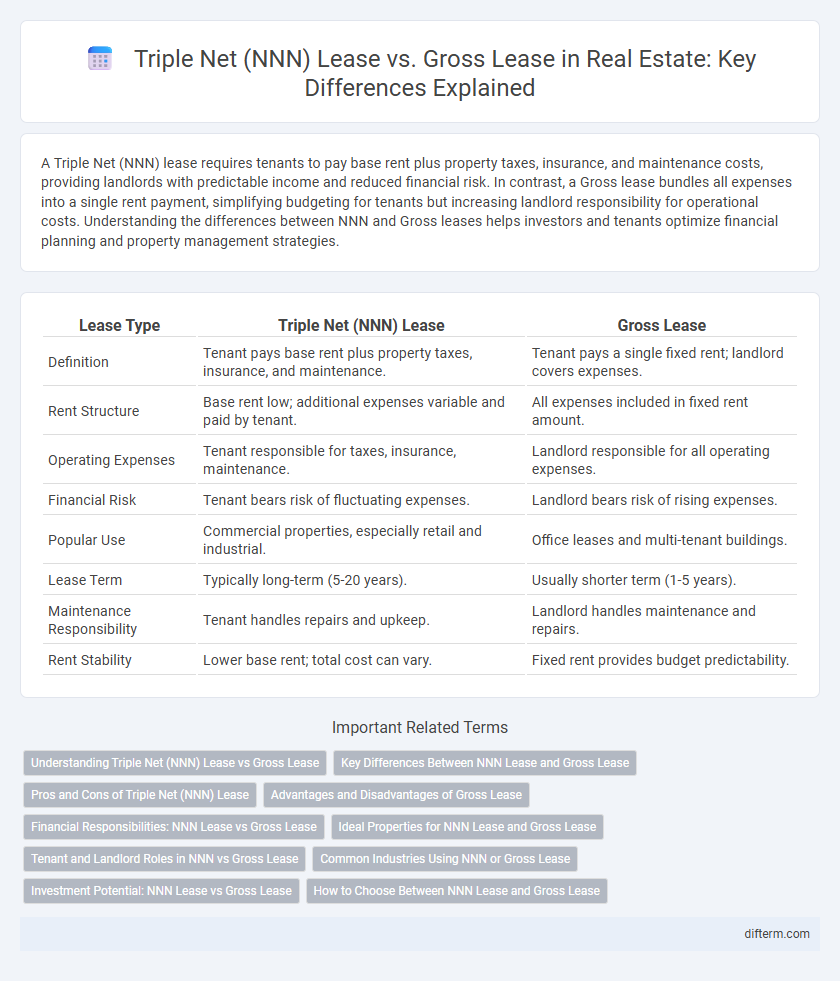

| Lease Type | Triple Net (NNN) Lease | Gross Lease |

|---|---|---|

| Definition | Tenant pays base rent plus property taxes, insurance, and maintenance. | Tenant pays a single fixed rent; landlord covers expenses. |

| Rent Structure | Base rent low; additional expenses variable and paid by tenant. | All expenses included in fixed rent amount. |

| Operating Expenses | Tenant responsible for taxes, insurance, maintenance. | Landlord responsible for all operating expenses. |

| Financial Risk | Tenant bears risk of fluctuating expenses. | Landlord bears risk of rising expenses. |

| Popular Use | Commercial properties, especially retail and industrial. | Office leases and multi-tenant buildings. |

| Lease Term | Typically long-term (5-20 years). | Usually shorter term (1-5 years). |

| Maintenance Responsibility | Tenant handles repairs and upkeep. | Landlord handles maintenance and repairs. |

| Rent Stability | Lower base rent; total cost can vary. | Fixed rent provides budget predictability. |

Understanding Triple Net (NNN) Lease vs Gross Lease

A triple net (NNN) lease requires the tenant to pay property taxes, insurance, and maintenance costs in addition to base rent, making it common in commercial real estate for predictable landlord expenses. In contrast, a gross lease bundles rent and operating expenses into a single fixed payment, shifting variable costs risk to the landlord but simplifying budgeting for tenants. Understanding the financial responsibilities and risk allocation in NNN versus gross leases helps investors and tenants make informed decisions aligned with their cash flow preferences and property management involvement.

Key Differences Between NNN Lease and Gross Lease

Triple net (NNN) leases require tenants to pay base rent plus property taxes, insurance, and maintenance costs, shifting most financial responsibilities to the tenant. Gross leases involve a single rent payment that covers rent and all operating expenses, which are borne by the landlord. Key differences include risk allocation, expense predictability, and tenant obligations, with NNN leases providing landlords more stable income and tenants greater control over property expenses.

Pros and Cons of Triple Net (NNN) Lease

A Triple Net (NNN) lease requires tenants to pay property taxes, insurance, and maintenance costs in addition to rent, reducing the landlord's financial risk and providing predictable income. Tenants benefit from lower base rent but face potentially high and variable additional expenses, complicating budgeting. This lease structure is ideal for investors seeking stable cash flow, while it may deter tenants sensitive to unpredictable operating costs.

Advantages and Disadvantages of Gross Lease

Gross leases offer simplicity by bundling rent and operating expenses into a single fixed payment, making budgeting easier for tenants. The landlord assumes responsibility for property taxes, insurance, and maintenance, which can lead to higher rent but less financial unpredictability for tenants. However, tenants may end up paying more overall, and landlords face greater risk if expenses rise unexpectedly.

Financial Responsibilities: NNN Lease vs Gross Lease

In a Triple Net (NNN) lease, tenants assume financial responsibility for property taxes, insurance, and maintenance costs, resulting in lower base rent but potentially higher variable expenses. Gross leases consolidate most expenses into a fixed rent, simplifying budgeting with the landlord covering operating costs but typically featuring higher monthly payments. Understanding these differing financial obligations is essential for landlords and tenants to accurately assess cash flow and risk allocation in commercial real estate agreements.

Ideal Properties for NNN Lease and Gross Lease

Ideal properties for a Triple Net (NNN) lease include retail centers, standalone commercial buildings, and industrial warehouses where tenants assume property taxes, insurance, and maintenance costs, ensuring predictable landlord expenses. Gross leases are best suited for office buildings and multifamily residential properties where landlords prefer to bundle all expenses into a single rent payment, simplifying budgeting for tenants. The choice between NNN and Gross leases depends on the tenant's willingness to manage operational costs and the landlord's preference for expense control and risk distribution.

Tenant and Landlord Roles in NNN vs Gross Lease

In a Triple Net (NNN) lease, tenants assume responsibility for property taxes, insurance, and maintenance costs, significantly reducing the landlord's operational expenses and financial risk. Conversely, under a Gross lease, landlords cover most or all property expenses, simplifying tenant obligations but increasing landlord's management duties and exposure to variable costs. This division of financial responsibilities impacts cash flow predictability for both parties, with tenants favoring transparency in NNN leases and landlords preferring the stability of Gross lease arrangements.

Common Industries Using NNN or Gross Lease

Commercial real estate sectors such as retail, industrial, and office spaces frequently utilize triple net (NNN) leases, where tenants bear property taxes, insurance, and maintenance costs, making it common in franchised chains and warehouse properties. In contrast, gross leases are prevalent in multi-tenant office buildings and residential complexes, where landlords cover expenses like utilities, maintenance, and property taxes, appealing to businesses seeking predictable monthly expenses. Understanding the industry-specific application of NNN and gross leases aids investors and tenants in selecting lease structures aligned with operational budgets and risk tolerance.

Investment Potential: NNN Lease vs Gross Lease

A Triple Net (NNN) lease transfers property expenses such as taxes, insurance, and maintenance to the tenant, enhancing predictability and reducing risk for investors. Gross leases require landlords to cover operating expenses, potentially lowering net returns but offering simplicity and stability in cash flow projections. Investors seeking long-term, low-risk income typically prefer NNN leases, while those favoring control and flexibility may opt for gross leases.

How to Choose Between NNN Lease and Gross Lease

Choosing between a Triple Net (NNN) lease and a Gross lease depends on the tenant's preference for responsibility over property expenses and risk tolerance. NNN leases require tenants to pay property taxes, insurance, and maintenance, offering potential lower base rent but higher variable costs, while Gross leases bundle all expenses into a fixed rent providing cost predictability. Evaluating financial stability and control preferences helps landlords and tenants align lease structures with investment goals and operational ease in commercial real estate.

Triple net (NNN) lease vs Gross lease Infographic

difterm.com

difterm.com